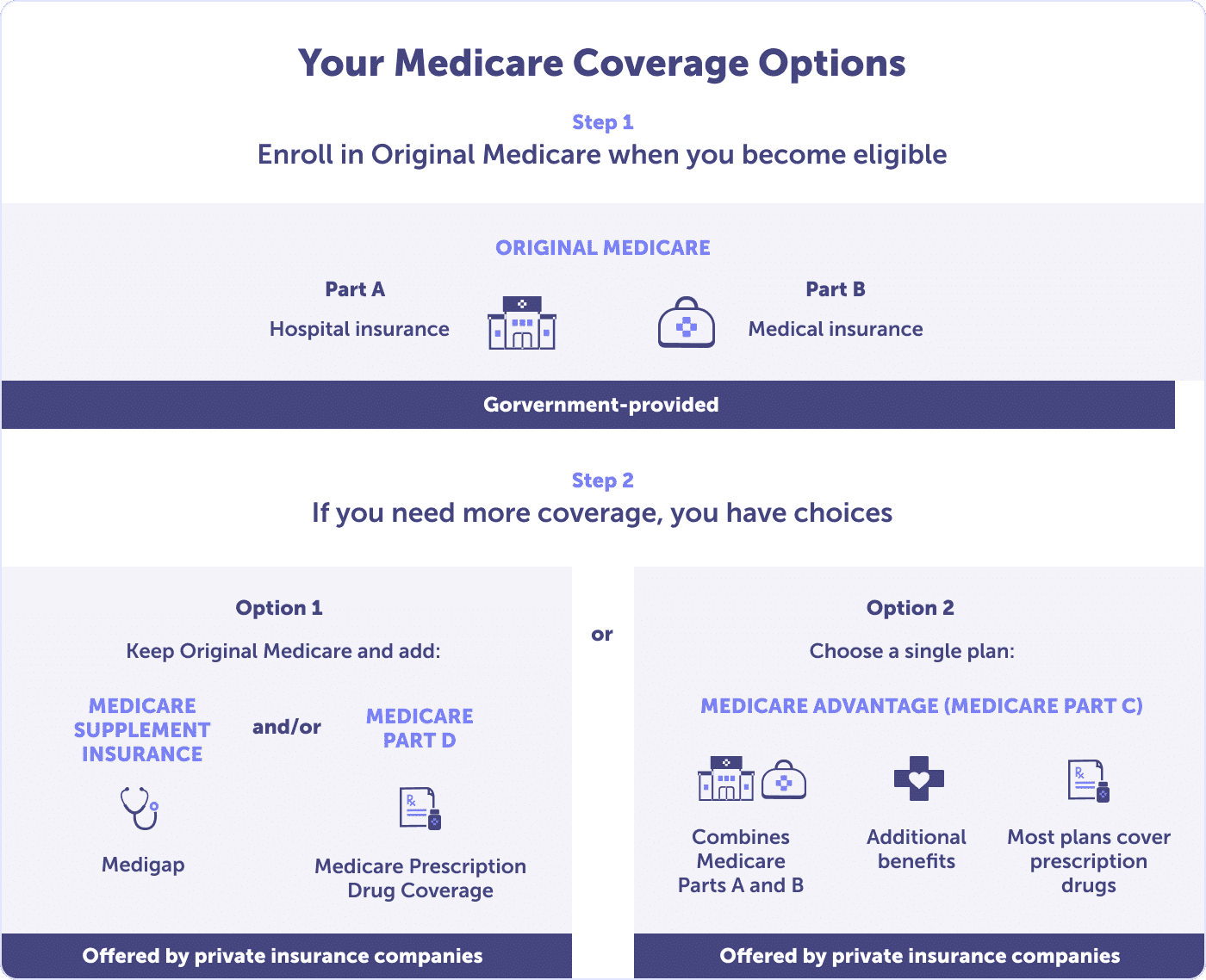

According to the Kaiser Family Foundation (KFF), Medicare is the federal health insurance program for Americans age 65 and older and for younger adults with permanent disabilities. Choosing Medicare coverage can feel confusing at first, but understanding your options can help you make confident decisions about your health and budget. When you first become eligible for Medicare, you’ll start with Original Medicare, the foundation of your coverage.

From there, you can decide whether to add more protection, such as a Medicare Advantage plan (Part C), Medicare Drug Coverage (Part D), or a Medicare Supplement plan (Medigap) to help manage out-of-pocket costs.

This guide explains each type of Medicare plan in clear, simple terms so you can choose the coverage that best fits your needs.

Original Medicare includes:

Plan options that expand your Original Medicare coverage:

Continue reading to learn more about each of your Medicare health plan options.

Medicare Part A is hospital insurance and part of Original Medicare. It covers hospital stays and related services. Most people don’t pay a monthly or quarterly premium for Medicare Part A because they’ve worked and had Federal Insurance Contributions Act (FICA) taxes taken out of their paychecks.

If you or your spouse haven’t earned 40 credits of work and paid taxes for at least ten years, you could be required to pay a Part A premium.

Contact a local licensed insurance agent at (623) 223-8884 for detailed information on your Medicare Part A premium-free eligibility.

Part A covers, but is not limited to:

Most people don’t pay a premium for Medicare Part A.

However, it doesn’t cover all your medical costs. You’ll first need to pay a deductible of before coverage begins. After that, Medicare pays 80% of approved costs, and you’re responsible for the remaining 20% coinsurance, your share of the covered expenses during each benefit period.

Medicare Part B covers doctor visits and outpatient services. If you’re eligible for Part A, you can also enroll in Part B.

Part B covers, but is not limited to:

According to Medicare.gov, many tests, items, and services are not covered by Medicare Part B. These include routine dental, vision, and hearing care, such as check-ups, eyeglasses or contact lenses, hearing aids, dental extractions, and dentures.

For Medicare Part B, most people pay a premium. The Internal Revenue Service (IRS) sets the standard monthly premium annually. The Part B standard premium is $185.00 per month in 2025.

If your income is above a certain level, you’ll pay an extra charge called IRMAA (Income-Related Monthly Adjustment Amount) in addition to your standard premium. It’s based on your income from two years ago.

Your Part B premium is usually deducted from your Social Security benefits. If not, you’ll receive a bill.

Part B also includes an annual deductible of $257 in 2025. After meeting your deductible, you typically pay 20% of the Medicare-approved amount for most doctor visits, outpatient care, and medical equipment.

For help confirming your exact costs, contact a Connie Health licensed insurance agent at (623) 223-8884.

Original Medicare (Parts A and B) is the starting point for most people when they become eligible for Medicare. From there, you have additional Medicare coverage options that can help lower out-of-pocket costs and add benefits like prescription drug coverage, dental, vision, or hearing care. The graphic below illustrates the two primary ways people expand their Medicare coverage after enrolling in Original Medicare.

Medicare Part C, or Medicare Advantage, is an alternative to Original Medicare. These plans are offered by private insurance companies approved by the Centers for Medicare & Medicaid Services (CMS).

To join a Medicare Advantage plan, you must be enrolled in Part A and Part B and live in the plan’s service area. Plans are local, often offered by the county, and you may have several options to choose from.

Most Medicare Advantage plans include extra benefits that Original Medicare does not cover, such as:

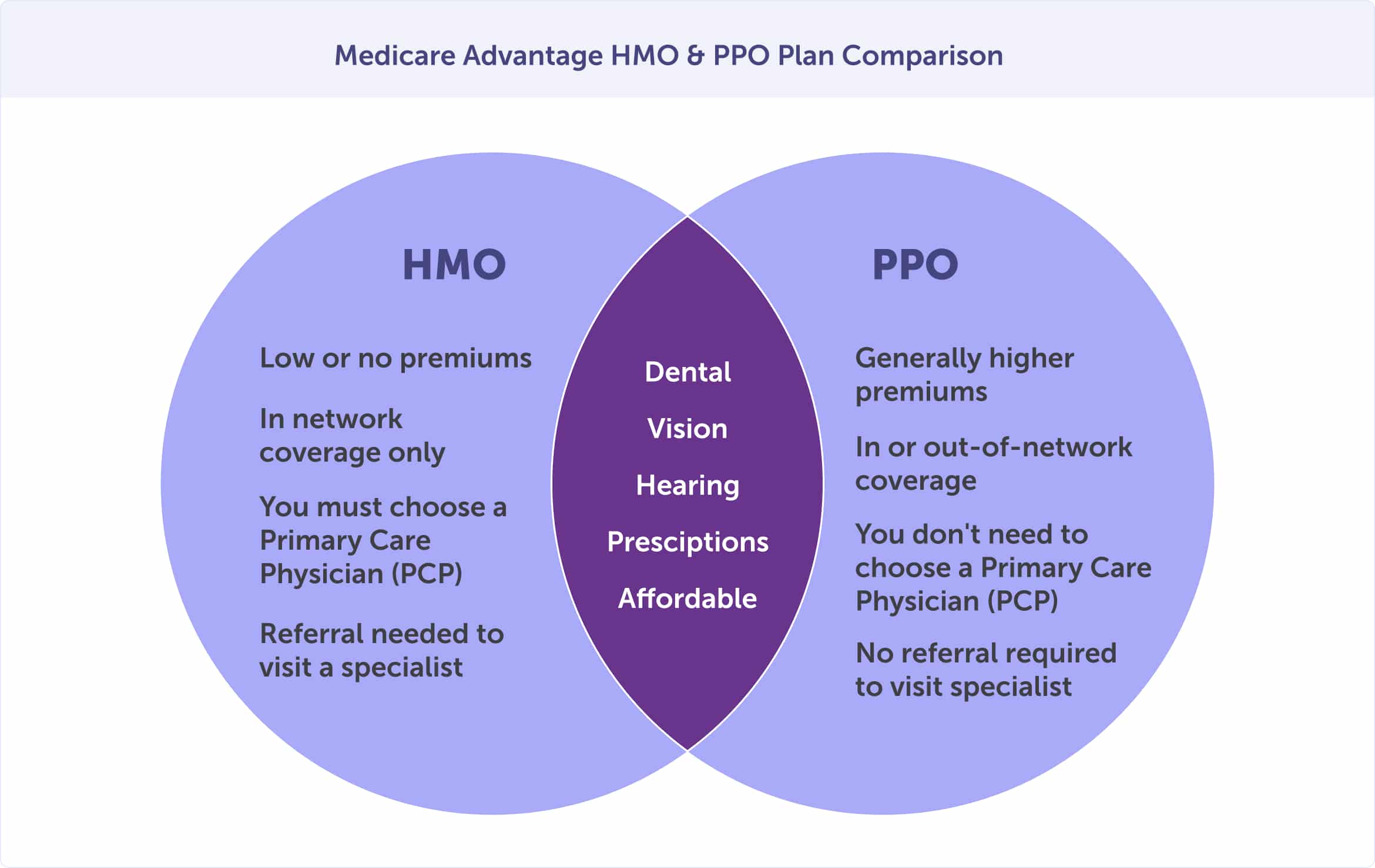

The most common Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Both use provider networks and often include prescription drug coverage.

HMO plans usually have lower costs. You choose a primary care doctor who coordinates your care. You’ll need referrals to see specialists, and out-of-network care is not covered except in emergencies or with prior approval.

PPO plans offer more flexibility. You can see doctors outside the plan’s network, but you’ll usually pay more. PPO members often need to keep good records and take a more active role in coordinating their care.

If keeping costs low is most important, an HMO may be the better choice. If flexibility matters more, a PPO might be a better fit.

Medicare Advantage plans cover everything Original Medicare covers, but they set their own deductibles, copays, and coinsurance within federal limits.

One major advantage:

Medicare Advantage plans have an annual out-of-pocket maximum. After you reach this limit, the plan pays 100% of covered services for the rest of the year. Original Medicare does not have this protection.

Some Medicare Advantage plans have $0 premiums, while others charge a monthly amount. Premiums may be deducted from Social Security or paid directly, depending on the plan.

Many Medicare Advantage plans include prescription drug coverage. These are called Medicare Advantage Prescription Drug (MAPD) plans. They combine your medical and drug benefits into one plan.

According to KFF, in 2025, Medicare Advantage enrollment reached a historic milestone: 34.1 million beneficiaries, representing 54% of eligible Medicare enrollees, chose MA plans. The vast majority of these plans (89%) include prescription drug coverage, demonstrating the continued popularity of integrated Medicare Advantage Prescription Drug (MA-PD) plans over traditional Medicare with stand-alone Part D coverage.

Medicare Part D helps pay for prescription drugs. These plans are offered by private insurance companies approved by the Centers for Medicare & Medicaid Services (CMS).

If you have Original Medicare (Parts A and B), you can add a stand-alone Part D plan.

If you have a Medicare Advantage plan, your drug coverage usually comes through a MAPD (Medicare Advantage Prescription Drug) plan. In most cases, you can’t have both a MAPD plan and a stand-alone Part D plan at the same time.

Part D costs and plan options vary by county. Most plans have a monthly premium, an annual deductible, and either copayments or coinsurance for your medicines.

If you are receiving Medicare, have limited financial resources and income, and live in one of the 50 states or the District of Columbia, you may qualify for Medicare Part D Extra Help.

Extra help assists with paying your monthly premiums, annual deductibles, and co-payments for Medicare prescription drug coverage. If you qualify, you won’t pay a late enrollment penalty when you join a Medicare drug plan.

Although Medicare Part D is optional, you must maintain creditable drug coverage, coverage that is at least as good as Medicare’s standard drug benefit. If you go without creditable coverage for a period of time, Medicare will add a permanent late enrollment penalty to your Part D premium.

If your creditable coverage through an employer or group plan is ending, you must enroll in Medicare Part D within 63 days to avoid this penalty.

This penalty lasts for the entire time you have Medicare. If you’re enrolled in Original Medicare (Parts A and B), be sure to sign up for Part D during your Initial Enrollment Period or during the General Enrollment Period if you missed your first chance. Enrolling on time helps you avoid lifelong penalties.

Agent tip:

“You must have creditable prescription drug coverage, or you may incur a permanent late enrollment penalty.“

Medicare Supplement plans, or Medigap, help pay some of the out-of-pocket costs that Original Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. Some plans also include limited coverage for medical emergencies when traveling abroad.

Because Original Medicare has no annual out-of-pocket limit, many people choose a Medigap plan for added financial protection. You cannot have a Medigap plan and a Medicare Advantage plan at the same time.

Medigap does not include extra benefits like dental, vision, or hearing. If you choose Medigap, you’ll also need a stand-alone Part D plan for prescription drug coverage.

Most people choose between:

Need help deciding which option fits your needs? Call a local licensed Connie Health insurance agent at (623) 223-8884.

Choosing your Medicare coverage is an important decision that can impact both your health and your finances. Original Medicare (Parts A and B) is your foundation, but it doesn’t cover everything. Most people enhance their coverage with a Medicare Advantage (Part C), a stand-alone Prescription Drug Plan (Part D), or a Medigap (Medicare Supplement) plan.

Each option offers different costs, coverage levels, and benefits — and the best choice depends on your personal healthcare needs, budget, and preferred doctors.

If you’re unsure which plan is right for you, a Connie Health local licensed agent can walk you through your options and help you find a plan that fits your needs.

Call (623) 223-8884 today for your no-cost, no-obligation Medicare plan review.

The federal government provides Original Medicare, which includes Parts A and B. Medicare Advantage (Part C) plans are offered by private insurance companies approved by Medicare. They provide the same coverage as Original Medicare and often include additional benefits such as dental, vision, and hearing.

No. You can’t have both a Medigap plan and a Medicare Advantage plan at the same time. You’ll need to choose one or the other based on your healthcare needs and budget.

If you don’t have creditable prescription drug coverage and later decide to enroll in Medicare Part D, you may have to pay a permanent late enrollment penalty added to your premium for as long as you have coverage.

Yes, many Medicare Advantage plans have $0 monthly premiums. However, you’ll still need to pay your Medicare Part B premium and any copays, coinsurance, or deductibles your plan requires.

The best plan depends on your doctors, prescriptions, and budget. A Connie Health licensed insurance agent can compare plans available in your county and help you find one that fits your health needs. Call (623) 223-8884 to get personalized help at no cost.

Read more by David Luna

I am a Spanish-speaking Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2005. I am a Marine Corps Veteran & former police officer. I enjoy watching football and basketball but hold family time in the highest regard.