Medicare Advantage plans (Medicare Part C) provide you the same benefits as Original Medicare Parts A and B, but with additional benefits. Private insurance companies that contract with the Centers for Medicare and Medicaid Services (CMS) offer these plans. As of December 2022, 48% of Arizonans were enrolled in a Medicare Advantage plan. Nearly half of all enrollees choose a Medicare Advantage plan because of its cost savings and extra benefits.

You must be eligible to enroll in a Medicare Advantage plan. To be eligible, you must be enrolled in Original Medicare Part A (hospital insurance) and Original Medicare Part B (medical insurance) and live in the Medicare Advantage plan’s service area. There are 157 Medicare Advantage plans available in Arizona; however, you’ll only have access to a portion of those because availability is based on the county that you live in.

Between 2022 and 2023, there was a slight change in plan options (155 in 2022). However, between 2021 and 2022, there was a 29.2% change in plan options (120 plans in 2021). With such an increase between 2021 and 2023, you have an even greater opportunity to find a suitable plan for your health and budget.

Most Medicare Advantage plans offer enrollees comprehensive and routine dental, hearing, and vision. Some plans provide wellness and healthcare planning, reduced cost-sharing, and rewards and incentives programs.

None of these benefits are offered by Original Medicare.

The five Arizona counties with the highest Medicare Advantage enrollment are Santa Cruz County (60%), Pima County (55%), Graham County (52%), Maricopa County (49%), and Pinal County (48%).

Medicare Advantage plans are required to provide the same coverage as Original Medicare Part A and Original Medicare Part B. The difference is that many of these plans offer an out-of-pocket maximum that Original Medicare doesn’t provide. This protects you from potential high and unexpected costs with Original Medicare alone.

Agent tip:

“Because Original Medicare doesn’t have a maximum out-of-pocket, enrolling in a Medicare Advantage plan can safeguard you against unknown out-of-pocket costs.“

Most Medicare Advantage plans also offer extra benefits that Original Medicare doesn’t: comprehensive dental, vision, and hearing coverage. Plus, you can usually find a Medicare Advantage plan that covers your prescription drug coverage (Part D). These plans are called Medicare Advantage Prescription Drug Plans (MAPD).

There are three primary reasons you may choose to enroll in a Medicare Advantage plan; 1) low or no-cost monthly premiums, 2) lower out-of-pocket costs, and 3) additional benefits such as comprehensive dental, vision, hearing, and more.

All individuals enrolled in Arizona Medicare have access to a $0 monthly premium Medicare Advantage plan. For those that pay a premium, the average monthly premium is $12.00. When you enroll in a Medicare Advantage plan in Arizona, you pay your Original Medicare premiums plus the Medicare Advantage monthly premium.

The bonus with Medicare Advantage is that most plans include prescription drug coverage, which cuts out an extra premium for Part D coverage. Also, Medicare Advantage plans have an out-of-pocket maximum, unlike Original Medicare.

When enrolled in Original Medicare alone, you don’t have a maximum for what you could spend on copayment or coinsurance. This is risky. One way to reduce your risk is with a Medicare Advantage plan.

Medicare Advantage plans set their deductibles, coinsurance, and copays within limits set by the federal government. These limits help you manage out-of-pocket costs and reduce exposure to unknown and unexpected medical bills.

Once your Medicare Advantage plan’s out-of-pocket maximum is reached, including the deductible, your plan pays 100% of covered medical expenses for the remainder of the plan year.

Original Medicare doesn’t offer comprehensive dental, vision, or hearing coverage. You’ll need to pay out-of-pocket for most services, including routine care. These are benefits that most Medicare Advantage plans offer. Most plans include reduced cost-sharing, over-the-counter and wellness products, transportation assistance, telemedicine, fitness programs, and other reward and incentive programs.

When choosing among your Medicare Advantage plan options, you should consider the extra benefits you would like to have and then work with a local licensed agent to help you locate the plan that suits your needs.

In 2023, the Centers for Medicare and Medicaid Services (CMS) Value-Based Insurance Design (VBDI) program offers Arizona enrollees unique programs.

Through the VBDI program, 33 Medicare Advantage plans provide enrollees:

There isn’t only one type of Medicare Advantage plan in Arizona. In fact, you’ll have four types to choose among.

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are the most popular types. There are also Special Needs Plans (SNPs) and Private Fee-for-Service (PFFS) plans. If you live somewhere rural, a PFFS may be available to you.

These four plan types have four things in common.

The differences between the plans are network flexibility and price. Keep reading to learn which plan is best for your health and budget.

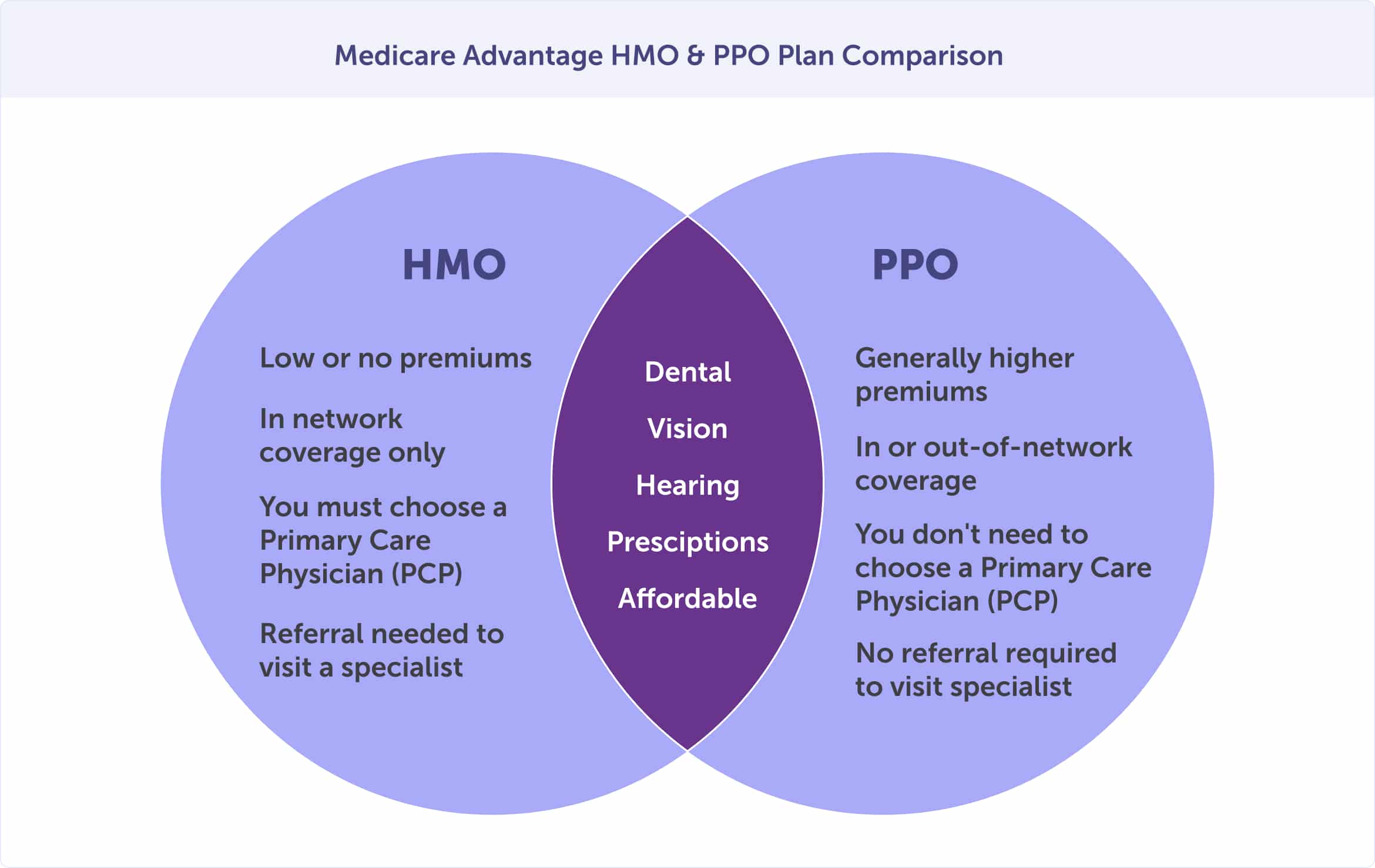

If you’re choosing between Medicare Advantage plans, most likely, it’s between a Health Maintenance Organization (HMO) and a Preferred Provider Organization (PPO) plan.

HMO plans are typically the most popular Medicare Advantage plan type. HMOs require that you receive most of your services in a network, except for emergency care.

Care through a Preferred Provider Organization (PPO) Medicare Advantage plan is slightly different. PPO plans have a network of preferred providers, but you can choose doctors or hospitals outside the network at a higher cost. PPO plans typically have regional or local PPO providers and provide greater flexibility.

Both HMO and PPO plans have four things in common.

Wondering whether an HMO or PPO Medicare Advantage plan is best for you? A local listened agent can help you find the plan that includes the doctors you value and the prescriptions you need. Call (623) 223-8884 to find a plan that maintains your doctors.

Medicare Advantage Special Needs Plans (SNPs) are limited to people with specific illnesses or characteristics. For example, if you have diabetes, End-Stage Renal Disease, HIV/AIDS, chronic heart failure, or dementia, you may qualify for a SNP plan. These plans are tailored to meet the needs of these illnesses, including provider choices and drug coverage.

If you have a chronic illness, you should speak with a local licensed agent who can help you find the right plan for your health and budget. Call (623) 223-8884 for a plan tailored to your health needs.

Medicare Advantage Private Fee-for-Service (PFFS) plans determine how much it will pay doctors, health care providers, and hospitals and how much you pay when you access care. With a PFFS, you pay any cost-sharing expenses at the time of service. Aftercare, the provider bills your plan for the remaining amount.

Most Medicare beneficiaries are weighing four things when choosing their plan. Here are the questions you want to ask to find the right plan for your health and budget.

A local licensed agent can help you discover which plan has the right mix. It’s a lot to consider, and you don’t have to do it alone. Call (623) 223-8884 to get help finding the right plan for your health and budget.

All Medicare beneficiaries in Arizona have access to a $0 premium Medicare Advantage plan. For those with a plan premium, the average this year is $12.00. Keep in mind that this amount changes every year.

Your Original Medicare Part B premium is paid directly to Medicare through your Social Security benefit or paid monthly or quarterly. Your Medicare Advantage or MAPD plan premium is paid directly to the plan provider and is in addition to your Original Medicare premiums.

While the plan premiums are stable, you should also consider out-of-pocket expenses such as deductibles, copay, and/or coinsurance. These costs depend on your chosen plan and should be factored into your budget.

Wondering if you qualify for a $0 premium Medicare Advantage plan? Call (623) 223-8884 to speak with a local licensed agent.

Knowing when to enroll can save money and ensure you don’t incur late enrollment penalties. Get ready to mark your calendars with these essential enrollment periods.

Most Arizonans will enroll in Medicare during their seven-month Initial Enrollment Period. This is a crucial enrollment period for you. You should enroll in Original Medicare Part A and B during this time. The enrollment period begins three months before you turn 65, the month you turn 65, and ends three months after you turn 65.

You may – or may not – need to sign up for Medicare. For those collecting Social Security benefits, you’ll likely be automatically enrolled.

You’ll want to mark this seven-month window on your calendar if you’re not. You could incur a lifetime late enrollment penalty if you don’t enroll in Medicare Part A and B during your Initial Enrollment Period. The penalty is added to your standard Part B premium, increases the longer you wait, and can never be removed.

Should you miss your Initial Enrollment Period, you may be able to enroll during the General Enrollment Period or a Special Enrollment Period if you qualify.

Want to be sure you don’t miss your Initial Enrollment Period? We’ve created a handy quiz for you to take. Take our Medicare eligibility quiz today to receive enrollment reminders.

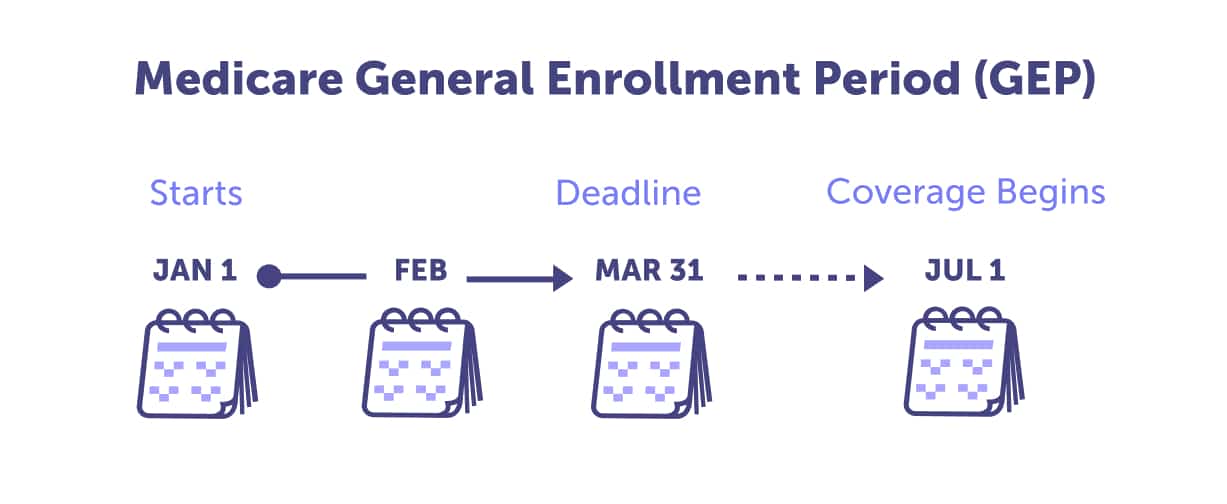

Should you miss your Initial Enrollment Period, you must mark Medicare’s General Enrollment Period in your calendar. From January 1 – March 31, annually, you can enroll in Medicare Part A and/or Part B or make a plan change that is effective July 1st. Note that if you’re enrolling in Medicare for the first time during the General Enrollment Period, that likely means that you’ll incur late enrollment penalties.

Knowing when to make a plan change can help you save money. There are three other enrollment periods that you should mark on your calendar.

A local licensed agent can help you review your plan options and enrollment periods in Arizona. Call (623) 223-8884 to speak with an agent or review plan options online.

Read more by Sammy Menton

I am an Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2009. I enjoy coaching youth and high school sports, watching sports, and spending time with family. I also like taking road trips and vacationing anywhere that has a beach.