Speak to a licensed agent (Monday-Saturday 8am - 8pm, Sunday 9am - 5pm)

(623) 223-8884 | TTY: 711

(623) 223-8884 | TTY: 711

Enrolled in Original Medicare in Texas? A Medicare Supplement plan, or Medigap, works with Original Medicare.

Original Medicare Part A and B don’t have a maximum cap on out-of-pocket expenses. As a result, these costs could add up to a shocking amount unless you have a Medicare Supplement plan in Texas. A Supplement plan pays for some or all out-of-pocket costs you incur while enrolled in Original Medicare.

40% of Medicare beneficiaries enrolled in fee-for-service coverage had a Medicare Supplement plan in 2021. That’s up from 38% in 2020 and 36% in 2019, according to The State of Medicare Supplement Coverage by AHIP.

There are ten types of Medicare Supplement plans available in Texas, which are standardized. This means that all the plans are the same, but each insurance company sets the cost. Each plan is labeled by the letters A – G and K – N. Every insurance company must offer at least Medicare Supplement plan A but can provide other options.

The five most popular Medicare Supplement plan types are:

However, only two of these plan types are taking new enrollments for those who became Medicare-eligible after January 1, 2020; Plan G and N. That’s why Plan G is the most popular option for new enrollees, followed by Plan N.

Plans that include the Part B deductible were phased out as of January 1, 2020. That included plans C, F, and J. This means that if you became eligible for Medicare on or after January 1, 2020, you will not be able to enroll in these plans. However, plans C, F, and J are still available to anyone enrolled in the plan previously and those who became eligible for Medicare on or before December 31, 1999.

Medicare Supplement Plan G most closely resembles Plan F. The only difference is that Plan G doesn’t cover the Part B deductible, and Plan F does. Overall, Plan G is the best value for a Medicare Supplement plan in Texas. It offers the highest level of coverage for new Medicare enrollees.

Medicare Supplement Plan G covered services:

Medigap Plan G offers a standard and a High-Deductible plan depending on your health insurance and budget needs.

Depending on your sex, age, and tobacco use, a standard Plan G premium could cost between $99 – $579 or more per month versus a Plan G High-Deductible plan’s premium costing $29 – $92, or more, per month. With a high-deductible plan, you must first pay for plan copayments, coinsurance, and deductibles before the policy pays anything.

Below is an example of the monthly premium cost for someone living in the 75001 zip code. Remember, Medicare is local to the county level. Your results may differ based on your zip code/county, your age, your sex, and whether you smoke.

Medicare Supplement Plan G and N are nearly identical, except that Plan N doesn’t cover Medicare Plan B excess charges. Plan N has $20 copayments for each physician visit and a $50 copay for each emergency room (ER) visit that does not result in hospitalization.

Medicare Supplement Plan N covers:

Plan N doesn’t offer a high-deductible plan option. The standard Plan N premium, depending on sex, age, and tobacco use, is between $77- $542, or more, a month in 2024. Plan N’s monthly premium can be lower than Medicare Supplement Plan G’s standard premium (not high-deductible), but it will have higher copays.

Below is an example of the monthly premium cost for someone living in the 75001 zip code. Remember, Medicare is local to the county level. Your results may differ based on your zip code/county, sex, age, and tobacco use.

Medicare Supplement plans (Medigap) are regulated by the government and sold by private insurance companies. These are the top five most popular Medicare Supplement insurance companies in Texas.

All Medicare Supplement (Medigap) policies are standardized; the same. When you choose amongst the companies that offer the plan, you are making a choice regarding service and additional Medicare benefits.

Below, you can find the standard Plan G monthly premium, the Plan G High-Deductible premium, and the Plan N premium for a 65-year-old, non-smoking woman in the 75001 zip code. Plan costs are based on the insurance carrier, age, sex, and tobacco use. Men tend to have higher monthly premiums than women.

Review below to compare monthly premiums amongst the three most popular Medigap plans in Texas.

According to Medicare beneficiary enrollment in Texas, the best Medicare Supplement plans in Texas are either standard Plan G, High-Deductible Plan G, or Plan N offered by one of the following three insurance companies:

Agent tip:

“Just because these plans and insurance companies are the most popular doesn’t mean they are right for you. To choose a Medicare Supplement plan tailored to your needs, you should consider the costs and coverage.“

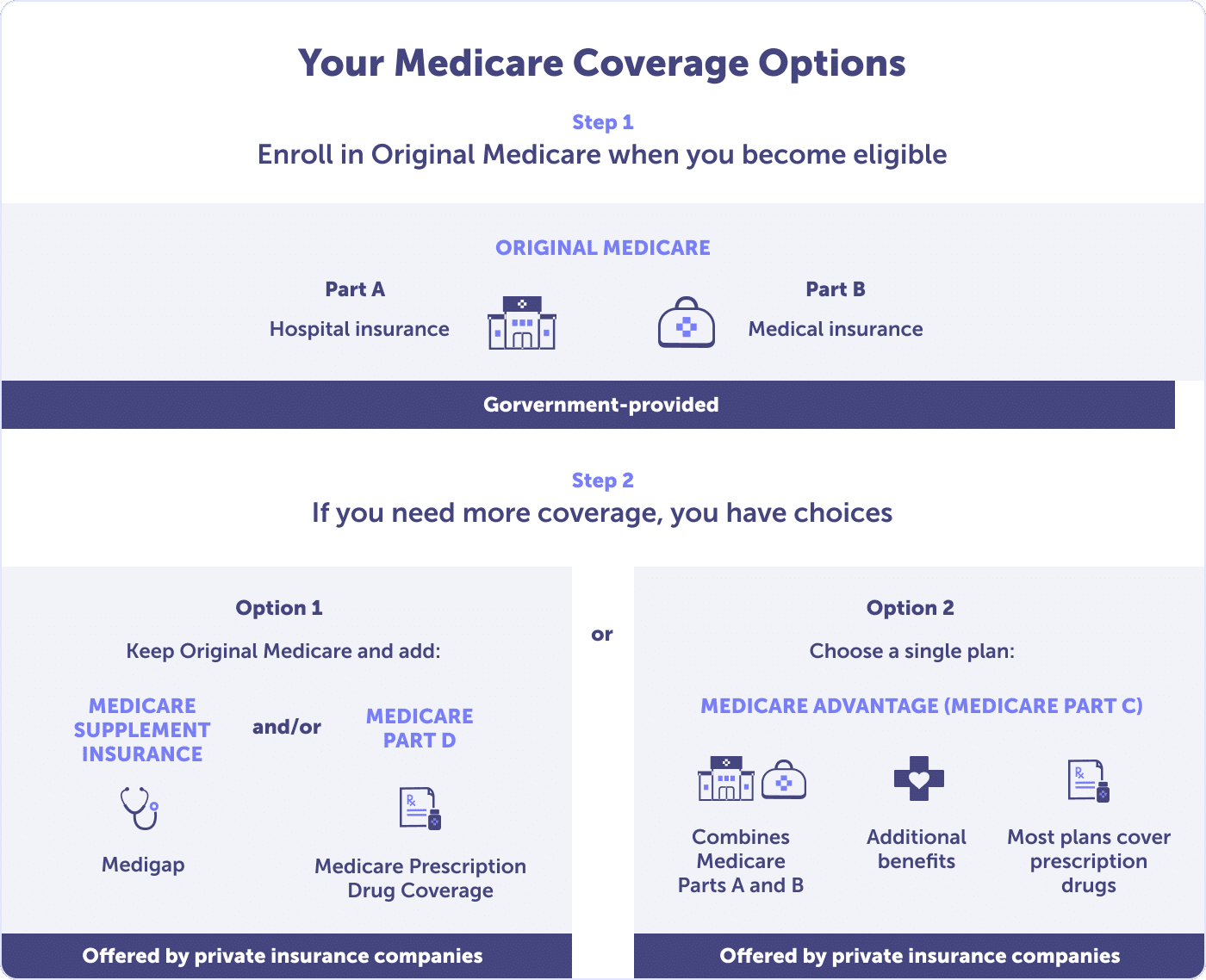

When you sign up for Medicare, you’re making a decision regarding coverage and cost.

Either Original Medicare with a Part D prescription drug plan and with or without a Medicare Supplement plan. Or a Medicare Advantage Plan with Prescription Drug coverage. These two methods are the most common way to get coverage suited to your health and budget needs.

Just because the plans and insurance companies mentioned above are the most popular doesn’t mean they are right for you. To choose a Medicare Supplement plan tailored to your needs, you should consider the costs and coverage. Choose a plan that includes the doctors and medications you want and need at a price you can afford.

Need help deciding which Medicare Supplement Plan is right for your health and budget? Speak with a local licensed agent who can guide you through your options. Call (623) 223-8884 or review your Medicare plan options online.

The alternative to a Medicare Supplement plan is a Medicare Advantage plan. Frequently, a Medicare Advantage plan in Texas could be a more budget-friendly alternative to a Medicare Supplement plan. This is because most Medicare Advantage plans also include prescription drug coverage.

Instead of having Original Medicare, plus prescription drug coverage and a Medicare Supplement plan, you can have complete coverage with extra benefits with a Medicare Advantage Prescription Drug Plan. And with only one Medicare card.

Most Medicare Advantage plans also offer dental, vision, and hearing benefits. These are benefits that Original Medicare and Medicare Supplement plans don’t cover.

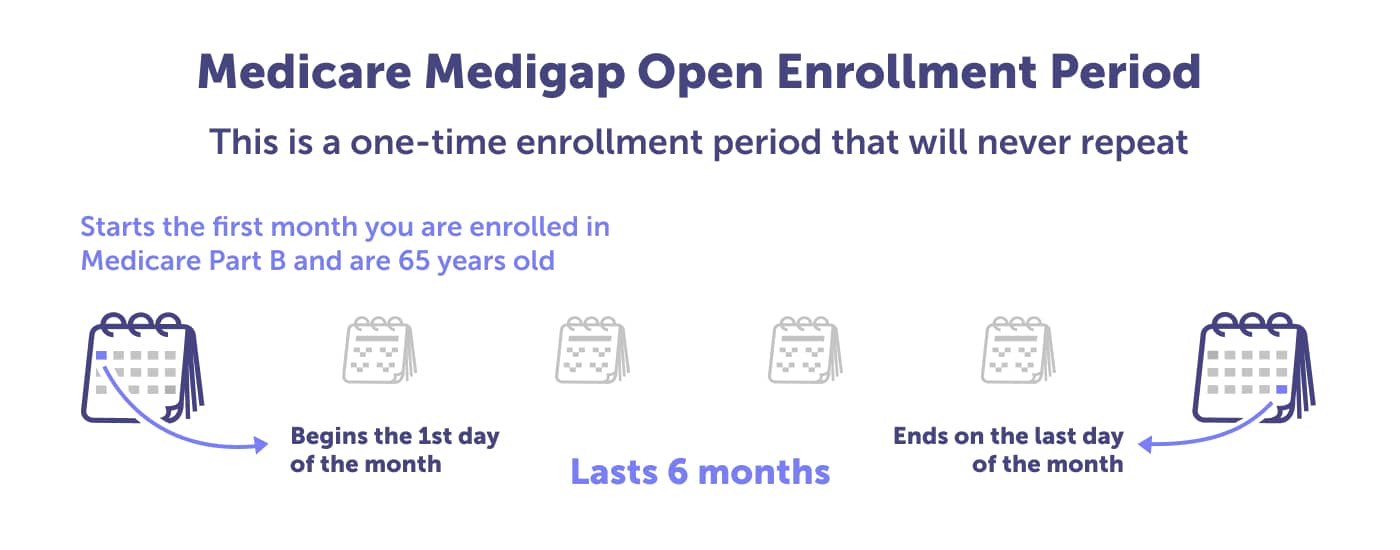

The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. During this time, insurance companies must sell you any plan they offer regardless of your pre-existing medical conditions. The Medigap Open Enrollment Period is also when you receive the best pricing.

Your Medigap Open Enrollment Period only happens once and cannot be changed or repeated. And its timing is also unique to you. This enrollment period begins the first month you are enrolled in Medicare Part B, and you’re 65 or older. The enrollment period lasts six months.

If you miss your Medigap Open Enrollment Period, you may not be eligible to enroll in the future. This is because insurance companies are not required to offer you a plan which could require underwriting unless you have a guaranteed issue right.

Need help understanding when your Medigap Open Enrollment Period is? Speak with a local licensed agent who can help. Call (623) 223-8884.

Supplement Insurance (Medigap) plans in Texas.

2021 Medicare Supplement Loss Ratios.

The State of Medicare Supplement Coverage, 2023.

The State of Medicare Supplement Coverage, 2022.

Want to know the best Medicare Supplement plan in Texas? There isn’t one. That’s because your Medicare choices should be tailored to your unique health and budget needs. What the best plan may mean to your neighbor or your spouse is different from you.

However, based on enrollment data, we’ve found that Standard Plan G, high-deductible Plan G, and Plan N are the three most popular plans to enroll in. UnitedHealthcare, BlueCross BlueShield, and Mutual of Omaha are the most popular insurance providers.

When you’re considering Medicare Supplement plans, you can consider the following:

We recommend you speak to a local licensed agent to determine the best plan for your health and budget needs.

Read more by Jasmine Alberto

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2007. I am on the the Advisory Committee for Foster Grandparents, Senior Companions, and RSVP Houston. I enjoy traveling, a backyard BBQ, and volunteering in my community.