Medicare plans in Texas include Parts A, B, C, D, and Medigap coverage. Learn the differences between the plans, plus essential deadlines and periods you don’t want to miss.

Medicare is a United States federal health insurance program. Medicare in Texas, as in the rest of the country, is designed to provide and reduce the cost of healthcare services for:

If you’re a Texan who meets any of the above criteria, you can apply for Medicare. Continue reading to learn about Medicare options in Texas, enrollment periods, and how to find the coverage that supports your health and fits your budget.

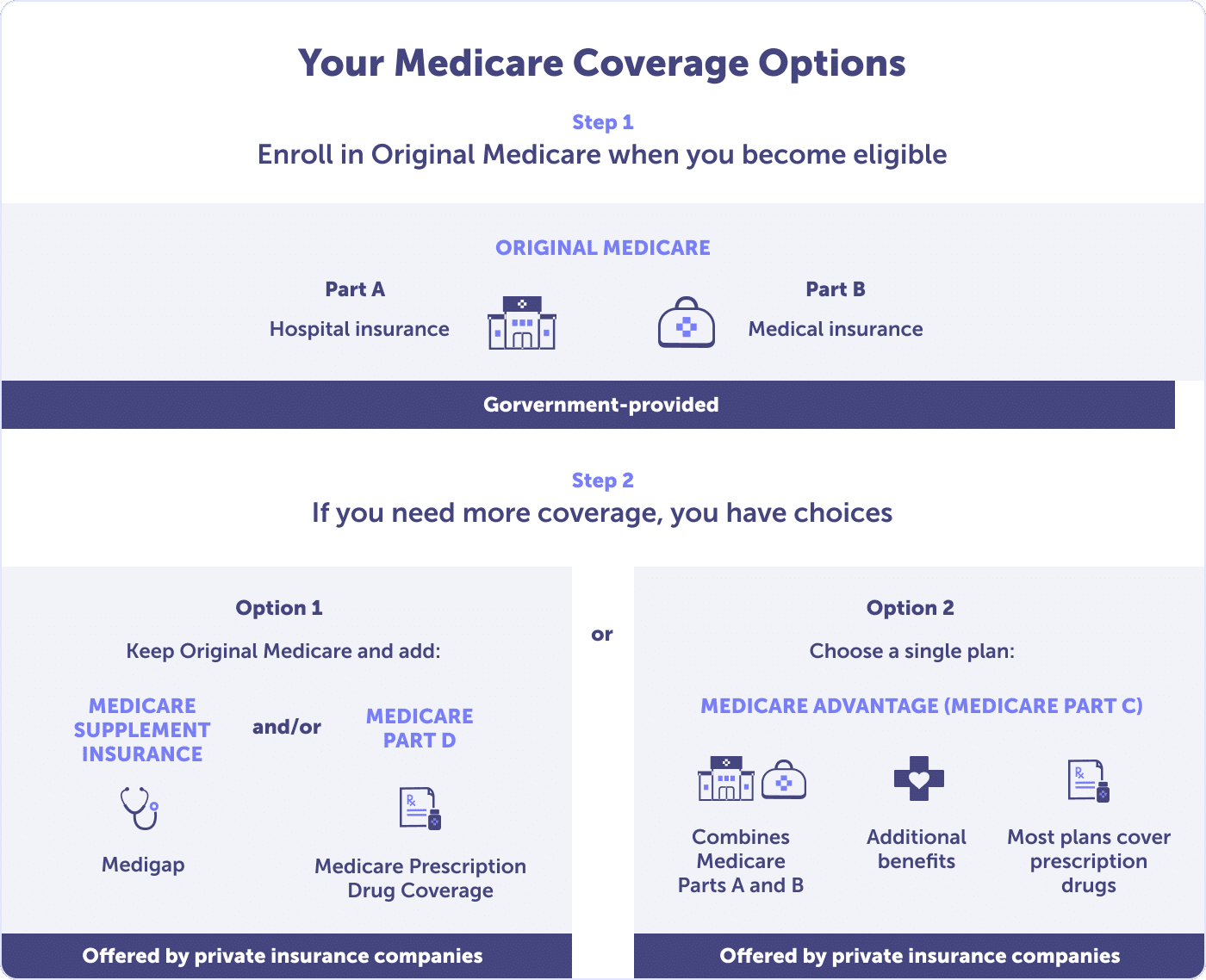

Texans have both public and private Medicare plan options. The public option is called Original Medicare and includes Part A (hospital insurance) and Part B (medical insurance).

You can also apply through a private health plan approved by Medicare, which includes Medicare Part C (Medicare Advantage), Medicare Part D (Prescription Drug Coverage), and Medicare Supplement (Medigap).

Original Medicare is the public option provided by the federal government and includes Medicare Part A (hospital insurance) and Part B (medical insurance).

Medicare Part A (hospital insurance) is part of Original Medicare and is usually premium-free. Plan A covers, but is not limited to, inpatient care in a hospital, skilled nursing facility care, short-term nursing home care, hospice care, and home health care. Private Medicare plans might have different rules, but private plans must provide at least the same coverage as Part A Original Medicare.

Medicare Part B (medical insurance) is part of Original Medicare. If you are eligible for Medicare Part A, then you can also enroll in Medicare Part B. However, Part B is not premium-free.

Your Medicare Part B costs include an annual deductible and a monthly or quarterly premium. If your income fluctuates or you make above a certain amount, your monthly premium may be higher.

Wondering what Part B will cost you? The premium for Part B Medicare in Texas is comparable to the rest of the country because it’s based on your or your spouse’s income history, not on your zip code or state.

Medicare Part B covers your basic medical needs, accounting for about 80% of costs, with the remaining 20% being your responsibility. Basic medical needs include doctor visits, lab tests, and medical equipment. You can also obtain second opinions about a medical issue.

Coverage for orthopedics, cardiology, radiology and any other specialist from A to Z is covered under Part B. You can also receive screenings for common medical conditions and a complete annual wellness checkup. Flu shots, pneumococcal shots, and Hepatitis B shots are covered with no copay.

Agent tip:

“To avoid the Medicare Part B late enrollment penalty, you should enroll during your Initial Enrollment Period. The Part B penalty is a lifetime penalty and gets added to your monthly Part B premium. The longer you wait to sign up for Part B, the higher that monthly penalty becomes.“

Approximately 52% of Texans are on a Medicare Advantage plan in 2022, also known as Medicare Part C. This is higher than the national average of 48%. Medicare Advantage (MA) plans are an alternative to Original Medicare (Parts A & B). MA plans are offered by private insurance companies that have a contract with the Centers for Medicare & Medicaid Services (CMS).

To qualify for a Medicare Advantage plan, you must enroll in Medicare Part A & B and live in the service area of the plan you wish to enroll in. Medicare Advantage plans are local—to the county level—and many options exist.

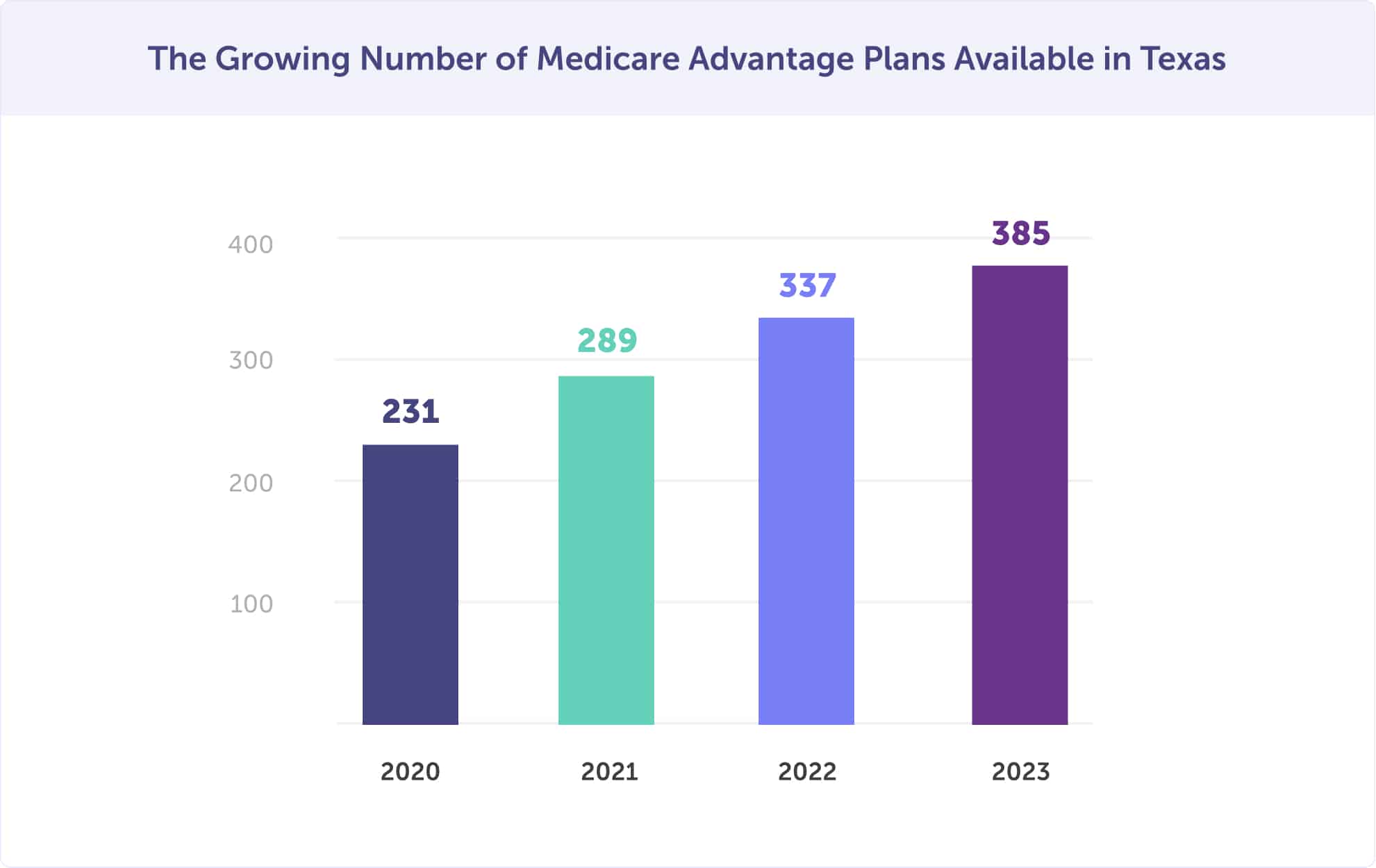

In 2024, there are 385 Medicare Advantage plans available in Texas. That is up from 385 plans in 2022, 289 plans in 2021, and 231 plans in 2020. Between 2022 and 2023, there are 15% more Medicare Advantage plans available in Texas.

Many of these plans offer Medicare Advantage enrollees innovative benefits such as wellness and healthcare planning, reduced cost-sharing, and rewards and incentives programs.

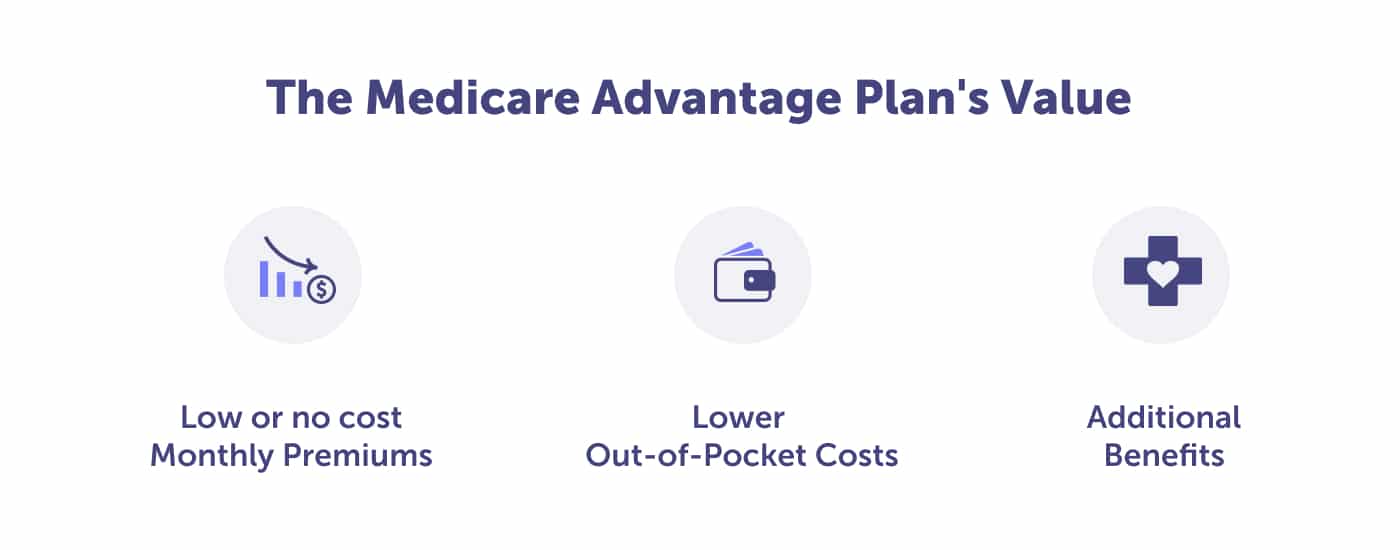

A Medicare Advantage (MA) plan provides all of the benefits of Original Medicare but with different cost-sharing. These plans have their own set deductibles, coinsurance, and copays within limits established by the federal government. Plus, they typically have additional coverage benefits for prescription drugs, wellness programs, and routine dental & vision.

Medicare Advantage plans limit the Medicare beneficiary’s out-of-pocket spending for services covered by Medicare Part A and Part B. Once your out-of-pocket costs reach their limit, including the deductible, your MA plan pays 100% of covered healthcare costs for the remainder of the year. In contrast, Original Medicare doesn’t have a maximum spending limit to cap your annual out-of-pocket costs.

Note: In addition to your Part B premium that’s paid to Medicare, an additional Medicare Advantage plan premium, if any, is paid directly to your plan.

Medicare Advantage plans that include prescription drug coverage are known as Medicare Advantage Prescription Drug (MA-PD) plans. These plans provide the convenience of having all your Medicare medical and prescription drug benefits through one plan. In 2020, 90% of Medicare Advantage plans offered prescription drug coverage (MA-PDs), and 89% of Medicare Advantage enrollees were in MA-PD plans.

In many cases, you’ll need to use health care providers who participate in the plan’s network and service area. Before you enroll, you may want to check with your providers and the plan you’re considering to make sure the providers you currently see or want to see in the future are in the plan’s network. Call Connie Health to find a Medicare plan that maintains your doctors and hospital relationships: (623) 223-8884

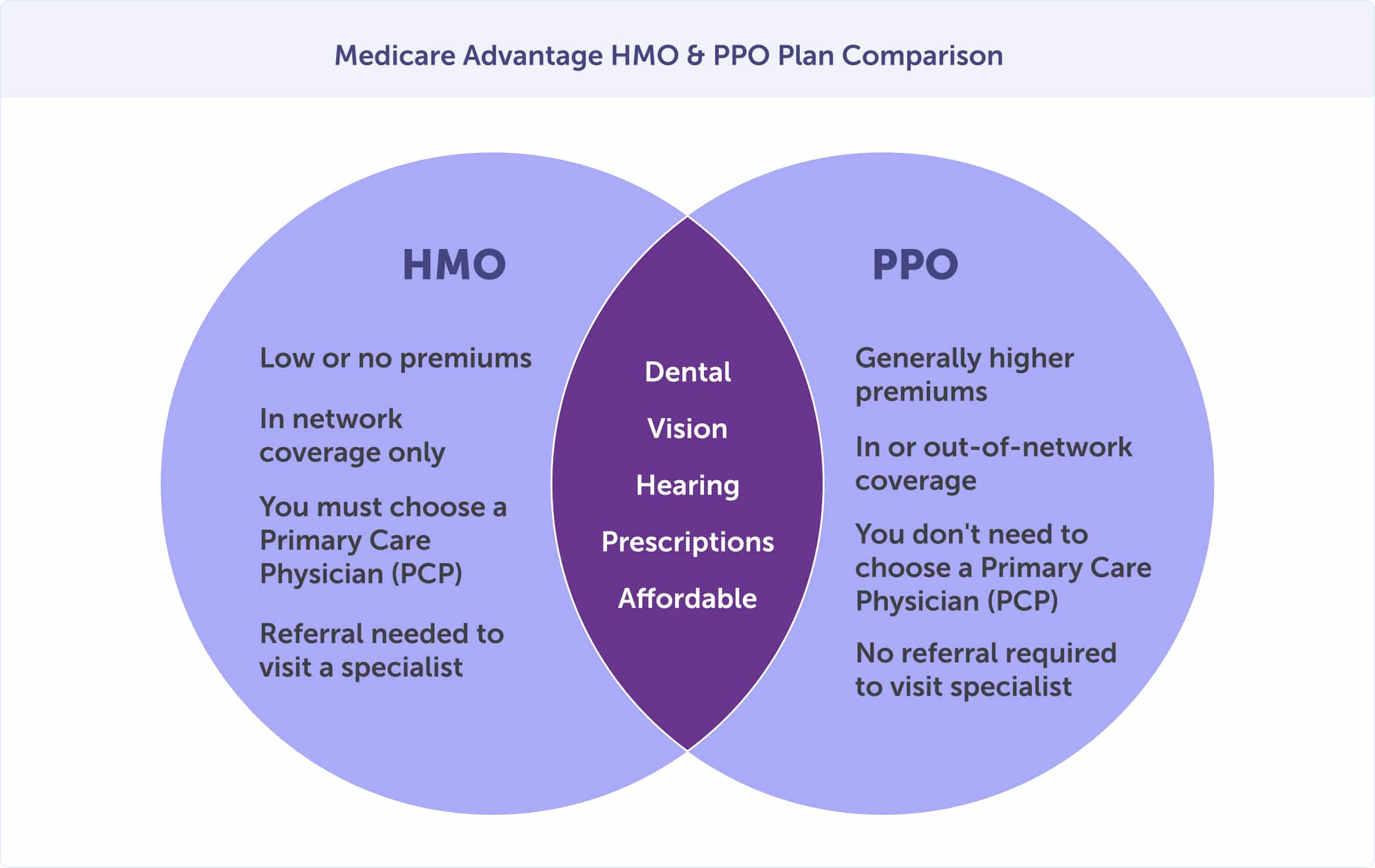

The most common Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs and PPOs have networks of participating hospitals, doctors, and other healthcare professionals.

With a Medicare Advantage HMO, you’ll likely choose a primary care physician who provides or coordinates your care through referral to other participating providers. Outside of emergencies, out-of-network providers’ services are not covered unless approved in advance by the MA plan.

With a Medicare Advantage PPO in Texas, your out-of-pocket costs may be lower when you use hospitals, doctors, and other healthcare professionals in the PPO’s network versus non-participating healthcare providers.

To maintain your existing relationships with doctors, hospitals, or other care providers, check to see if your preferred healthcare providers are participating in the Medicare Advantage plan’s network.

Do you need help ensuring that you pick a plan that includes the doctors you value and the prescriptions you need? Call Connie Health to find a Medicare plan that maintains your doctors and hospital relationships: (623) 223-8884

When you sign up for Medicare Part A and B, you don’t automatically receive prescription drug benefits. And the Centers for Medicare & Medicaid Services require that you have creditable prescription drug coverage. If prescription drug coverage is needed, then Medicare Part D, also known as a Medicare Prescription Drug plan, fills that need.

Medicare Part D is a federal program designed to offer Medicare beneficiaries prescription drug coverage, whether you live in Texas or elsewhere. The plan is provided by private insurance companies that contract with the Centers for Medicare & Medicaid Services (CMS)—similar to Medicare Advantage plans.

Medicare Parts A and B work with Medicare Part D. However, if you have a Medicare Advantage plan, you’ll get this coverage through an MA-PD (Medicare Advantage Prescription Drug) plan. You cannot have a Medicare Prescription Drug Plan and a stand-alone Medicare Part D Prescription Drug Plan.

As a Medicare beneficiary in Texas, you can enroll in a stand-alone Medicare Part D Prescription Drug Plan. The cost and availability will vary by county, and most plans require you to pay a monthly premium, annual deductible, and copayment or coinsurance. You may qualify for financial assistance for prescription drug costs through a program called Extra Help. In 2022, 28% of people with a stand-alone Medicare prescription drug plan receive Extra Help.

To ensure your Medicare plan covers your prescription drugs, contact Connie Health for a no-obligation Medicare plan review. Call (623) 223-8884. One of our local agents can see if you qualify for Extra Help.

While Medicare Part D is an optional part of Medicare, if you don’t have another source of prescription coverage, you may incur a permanent late enrollment penalty when you decide to buy Medicare Part D. This penalty will be in place for the entire length of your coverage.

If you’re enrolled in Part A & B, be sure to enroll in Part D during your Initial Enrollment Period or General Enrollment Period if you miss your Initial Enrollment Period. This way, you can avoid those lifetime penalties. If you have creditable coverage through group health coverage that is ending, you must enroll in Medicare Part D within 63 days of losing your coverage.

Medigap, also known as Medicare Supplement plans, assists in paying for some of your out-of-pocket costs under Original Medicare, including cost-sharing expenses (copays, deductibles, and coinsurance). Some include emergencies during international travel.

Because Original Medicare (Parts A & B) does not include a cap on out-of-pocket costs, most enrollees have some form of supplemental coverage, and Medigap plans are one way to do this. Medigap plans can not be used with a Medicare Advantage plan.

Texas Medicare Supplement plans include plans F, Plan G, Plan K, Plan L, Plan M, and Plan N. Each plan may provide different levels of coverage. The cost of these plans is determined by the carrier. The most popular Medicare Supplement plan in Texas is Plan G. Medicare Supplement plans may offer additional benefits like a gym membership, hearing, and dental discounts.

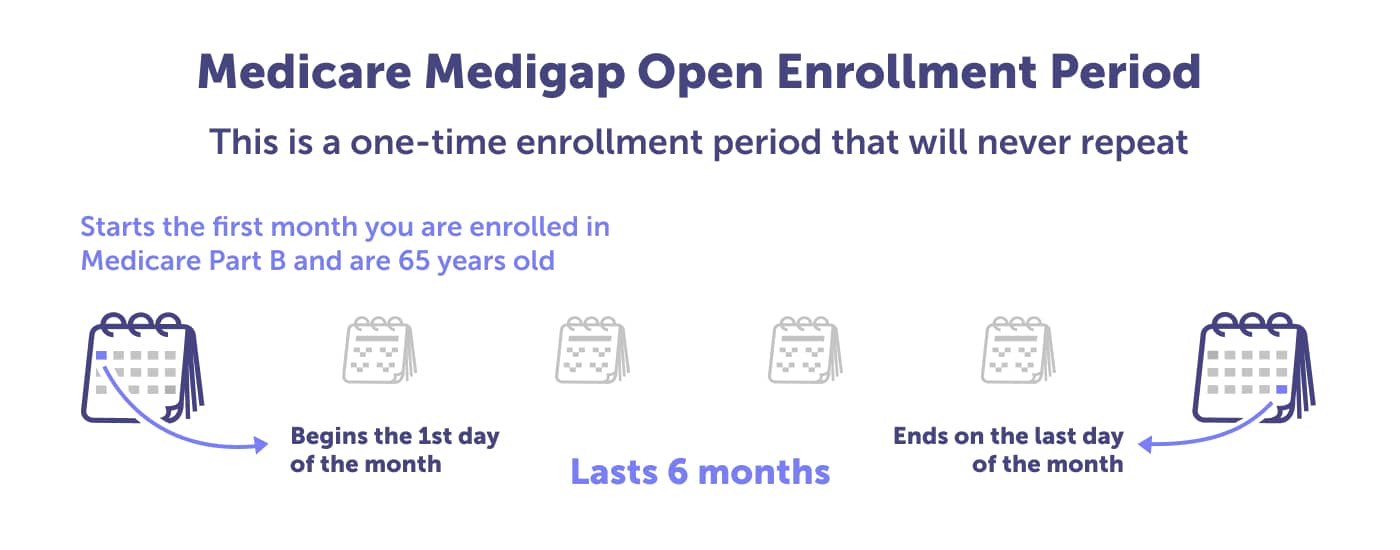

Medigap plans are provided by private insurance companies licensed by the Texas Department of Insurance and are authorized to sell Medigap plans. You can purchase a Medigap plan during your Medigap Open Enrollment Period. This is a one-time enrollment period that will never repeat. It starts the first month you are enrolled in Medicare Part B and are 65 years old, and lasts six months. If you miss your Medigap Open Enrollment Period, you may not be able to buy a Medigap policy at the same initial rate or at all.

There are four primary periods for enrolling, switching, or unenrolling in Medicare. Knowing when you need to enroll and when you can change can save you money. The best time to join a Medicare health or drug plan is when you first become Medicare eligible. Continue reading to learn about enrollment periods.

Most Texans get Medicare Part A & B when they become eligible for Medicare. The Initial Enrollment Period starts three months before you turn 65, includes your birth month, and ends three months after you turn 65. If you’re not yet collecting Social Security benefits before your Initial Enrollment Period starts, you’ll need to sign up for Medicare online or contact the Social Security Administration.

If you miss your Initial Enrollment Period, you may be able to enroll during the General Enrollment Period or a Special Enrollment Period. Read below to learn more.

Not sure if now is the right time to enroll in Part B? Speak with a local Medicare agent who can guide you through your options. Call (623) 223-8884 Or review your plan options online.

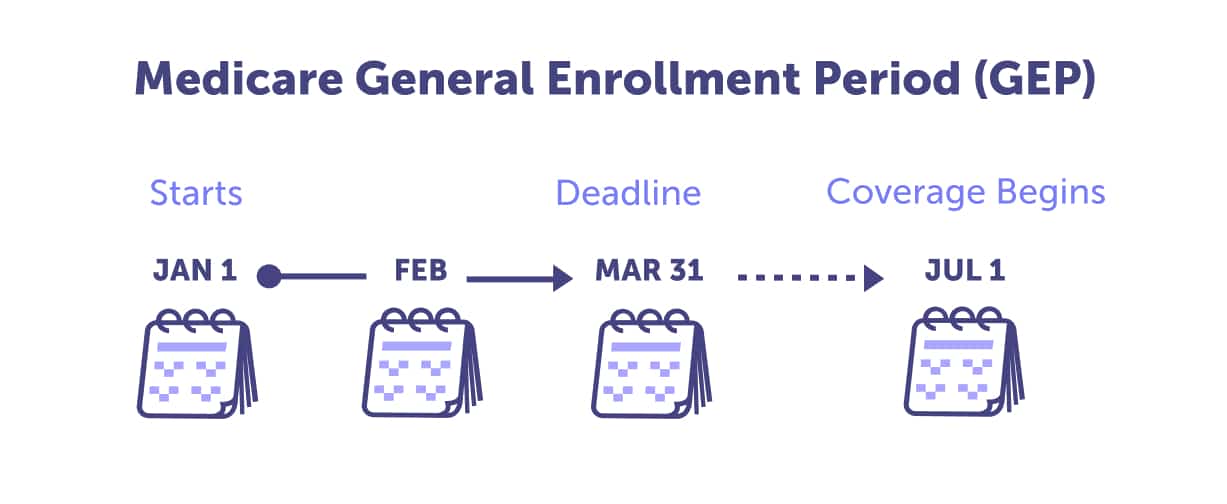

If you miss your Initial Enrollment Period, you can sign up during Medicare’s General Enrollment Period between January 1 to March 31, annually, and your coverage will begin on July 1st.

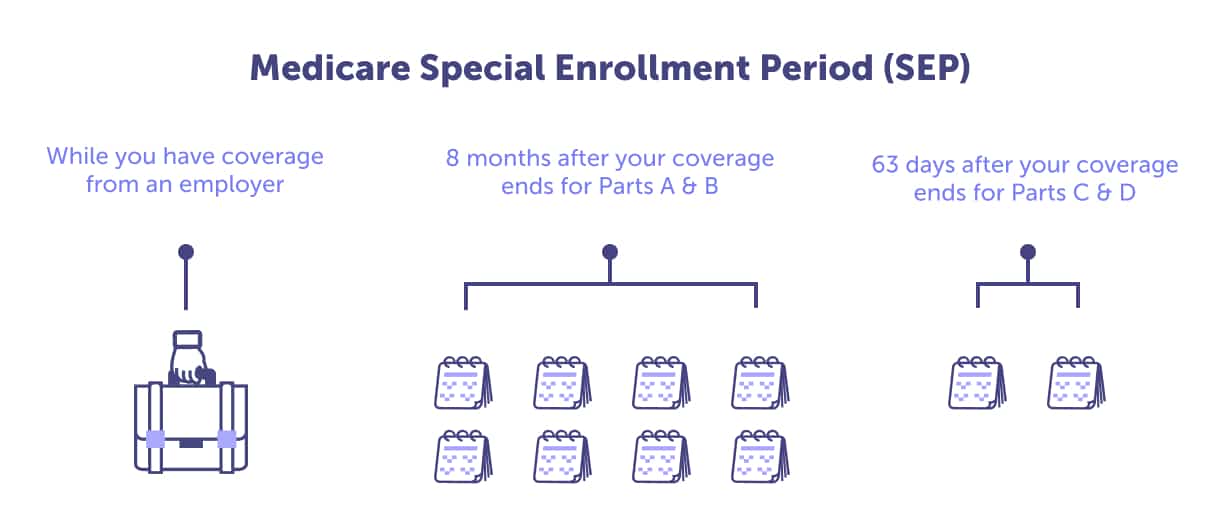

Once your Initial Enrollment Period ends, you’ll have the opportunity to sign up for Medicare during a Special Enrollment Period (SEP). You can sign up for Medicare Part A or B during a SEP if you change where you live, you lose your current coverage, you have a chance to get other coverage, your plan changes its contract with Medicare, become eligible for a 5-Star Medicare Advantage Special Enrollment Period, or other special circumstances.

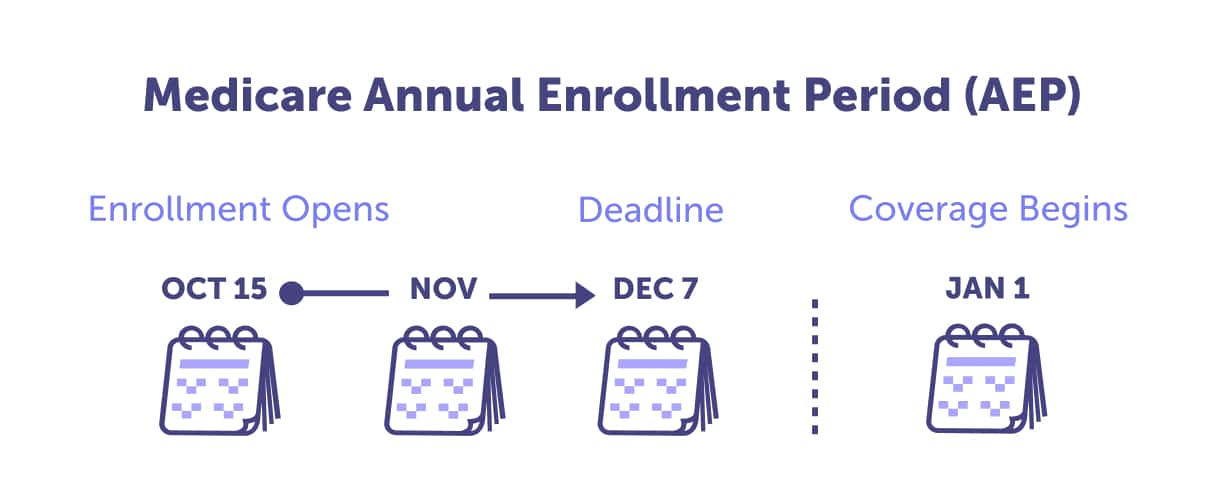

The Annual Enrollment Period is from October 15 to December 7, annually. This period is for people who are already enrolled in Medicare Parts A and B and want to make changes to their plan.

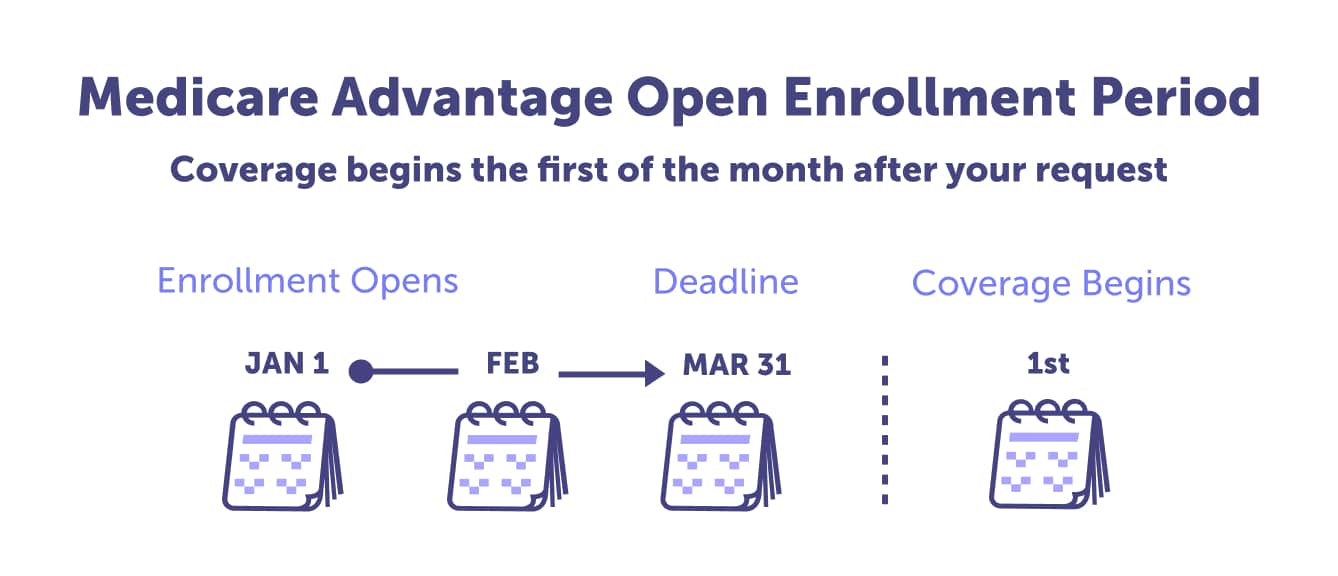

The Medicare Advantage Open Enrollment Period occurs between January 1 and March 31 annually. During this time, you can unenroll from a Medicare Advantage plan and go back to Original Medicare. You can also switch from one Medicare Advantage plan to another, with or without prescription drug coverage. Or, if you drop a Medicare Advantage plan, you can join a Medicare prescription drug plan (Part D) to go alongside your Original Medicare plan (Parts A & B).

10 Standard Medicare Supplement Insurance Plans.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

Medicare Open Enrollment in Texas, 2023.

What Medicare Part D drug plans cover.

Last updated: February 9, 2023

You have many choices regarding Medicare, but plan availability is based on your zip code. And there isn’t a “best” plan because your chosen plan should be suited to your unique health and budget needs.

If you’re looking for a Medicare Supplement plan, the most popular plans in Texas are UnitedHealthcare and BlueCross BlueShield, with either Medicare Supplement Plan G (40.85%) or Medicare Supplement Plan N (6.92%). These are two plans you can consider as you weigh your Medigap options.

If you’re looking for a Medicare Advantage plan, the best one in Texas suits your needs. You’ll have a lot to consider. An HMO or PPO Medicare Advantage plan? With or without prescription drug coverage? And with the benefits and providers, you’re looking for.

A local licensed agent can help find the best plan for your unique needs. Speak to an agent today.

There isn’t a best Medicare Supplement plan in Texas. That’s because Medicare isn’t one-size-fits-all. Instead, it’s tailored to your unique health and budget needs. What is best for your neighbor or spouse is likely not what’s best for you.

However, in 2023, the most popular Medicare Supplement insurance providers in Texas are UnitedHealthcare and BlueCross BlueShield, with either Medicare Supplement Plan G (40.85%) or Medicare Supplement Plan N (6.92%). These are two plans you can consider as you weigh your Medigap options.

The monthly premium for Plan N and Plan G ranges between $72 and $924 depending on your age, sex, whether you smoke, and when you enroll in your plan. It’s best to consult with a local licensed agent to determine which plan is best for you.

The best Medicare Advantage plan in Texas is the plan that serves your health and budget needs best. It would be nice to have a one-size-fits-all plan, but Medicare doesn’t work like that. It’s tailored to your individual needs. That’s why the plan your neighbor or spouse is enrolled in likely won’t be the best plan for you. However, based on Medicare Advantage plan enrollment data, the most popular provider in Texas is UnitedHealthcare. Connie Health can help you find a plan suited to your unique needs.

Read more by Sid Martinez

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2011. When not working, you can find me exploring new places in the Lone Star State, or watching movies and TV shows.