Medicare Supplement plans, also known as Medigap, help pay for some or all out-of-pocket costs that you would otherwise pay for with Original Medicare in Florida (Parts A and B). These plans work with Original Medicare and are not stand-alone plans.

Because Original Medicare does not include a maximum on out-of-pocket expenses, nearly 75% of Medicare beneficiaries have either a Medicare Supplement plan or a Medicare Advantage plan in Florida.

According to The State of Medicare Supplement Coverage by AHIP, there were 925,872 (19.3%) Florida Medicare enrollees with Medicare Supplement coverage in 2021. There were 913,759 with Medicare Supplement coverage in 2020 and 922,604 in 2019. Alternatively, approximately 55% of Floridians are enrolled in a Medicare Advantage plan in Florida in 2024.

You are eligible for a Medicare Supplement plan in Florida if you are enrolled in Medicare Part A and Medicare Part B and live in the plan’s service area.

Original Medicare Part A and B do not have a maximum for out-of-pocket costs. In addition to premiums and deductibles, you also pay 20% coinsurance for doctor bills and other medical expenses. These expenses really add up if you have a hospital stay over 60 days or receive care in a skilled nursing facility over 20 days. That’s where a Medicare Supplement plan can step in to help.

Medicare Supplement plan coverage varies but can include:

The Centers for Medicare & Medicaid Services (CMS) requires that you have creditable prescription drug coverage. Because Medicare Supplement plans do not include prescription drug coverage, you’ll need to sign up for a Medicare Part D plan if you don’t have creditable coverage from another source.

Agent tip:

“Avoid the lifetime Part D late enrollment penalty. Ensure that you have or sign-up for creditable prescription drug coverage when you enroll in your Medicare Supplement plan in Florida.“

If you choose not to enroll in a Medicare Part D standalone prescription drug plan when you enroll in a Medicare Supplement plan, you could face a Part D late enrollment penalty. The penalty is added to your standard Medicare Part D premium and increases every month you choose to wait to join. The longer you wait, the higher the penalty will become. And, unfortunately, it’s a penalty that must be paid for as long as you have a Medicare prescription drug plan.

Learn more about the types of Florida Medicare plans.

A Medicare Supplement plan in Florida can help reduce or eliminate out-of-pocket costs you would experience with only Original Medicare. This could significantly reduce your financial concerns.

Private insurance companies licensed by the Florida Office of Insurance Regulation are authorized to sell Medigap plans. And all plans are standardized, meaning each plan must include the same benefits another company offers. Plan benefits must be the same between providers, but the cost can vary because those are determined by each company.

In Florida, there are 10 types of Medicare Supplement plans (Medigap). Medicare Supplement plans are labeled A-G and K-N. Every insurance provider is required to offer at least Medicare Supplement Plan A but can offer other plans as well.

While 10 types of Medicare Supplement plans exist, you only have a portion to choose from. As of January 1, 2020, plans that include the Part B deductible were phased out. This means that if you turned 65 on or after January 1, 2020, you would not be able to enroll in Plan C or Plan F. However, if you turned 65 on December 31, 1999, or prior, you can still enroll in these plans.

The top five most popular Medicare Supplement plans in Florida are:

Of the plans available for new enrollment, Plan G is the closest to discontinued Plan F, which is likely why it has the second-highest enrollment of Medicare Supplement plans in Florida.

Wondering which Medicare Supplement plan is best for your health and budget? Use our online tool to review plan options, or call (623) 223-8884 to speak with a local licensed agent.

When you compare Medicare Supplement plans in Florida, it’s important to consider monthly premium costs and out-of-pocket expenses. Take note that some plans with lower premiums may have higher out-of-pocket expenses.

Among Medigap plans A through G, Medigap Plan G is the second most popular plan. It’s among the plans that provide basic benefits, plus 100% coinsurance coverage for Medicare Part B, Part A coinsurance or hospice copay paid at 100%, and three pints of blood per benefit calendar year. There are also additional benefits to choose from, including coverage of skilled nursing facility coinsurance, Part A deductibles, Part B excess costs, and foreign travel emergencies.

Plan N is the most popular amongst Medigap plans K through N. These plans don’t have uniform benefits like plans A – G. Each plan provides a unique level of coverage, and you should consult a local Medicare agent to discuss which plan option is best for your health and budget.

Call (623) 223-8884 or browse Medicare Supplement plans online.

The good news is that Medicare Supplement plan premiums don’t change based on age. If you buy your policy when you turn 65, you’ll continue paying the same rate as you get older – as long as you keep the same policy.

Your monthly premium depends on the plan you choose, your gender, and whether or not you’re a smoker. In 2023, you could expect a monthly premium of $61 to $431 for a 65-year-old non-smoking woman and between $70 and $495 for a smoking woman.

A 65-year-old non-smoking man could pay between $70 and $495 depending on plan choice and between $80 and $569 for a smoking man.

There are similarities to how you might choose between a Medigap and Medicare Advantage plan or a PPO and HMO plan – network flexibility and cost.

On the most basic level, Medicare Supplement plans are not limited to specific provider networks. In fact, you can go to any Medicare-approved provider in Florida. On the other hand, a Medicare Advantage plan traditionally has a more restrictive network but offers additional benefits such as dental, hearing, and vision.

When comparing costs, the average monthly Medicare Advantage plan premium is $9.41 compared to a Medigap plan that ranges from $61 to $569 depending on plan choice, gender, and if you’re a non-smoker.

Both plans help cover some or all of the out-of-pocket expenses that you might encounter with Original Medicare.

Not sure whether a Medicare Supplement plan in Florida or a Medicare Advantage plan is right for you? Review plan options online or call (623) 223-8884 to speak with a local licensed agent to help you sort through your plan options.

Concerned about Original Medicare’s out-of-pocket expenses? You’re not alone. Many people enroll in a Medicare Supplement to control costs – with greater predictability.

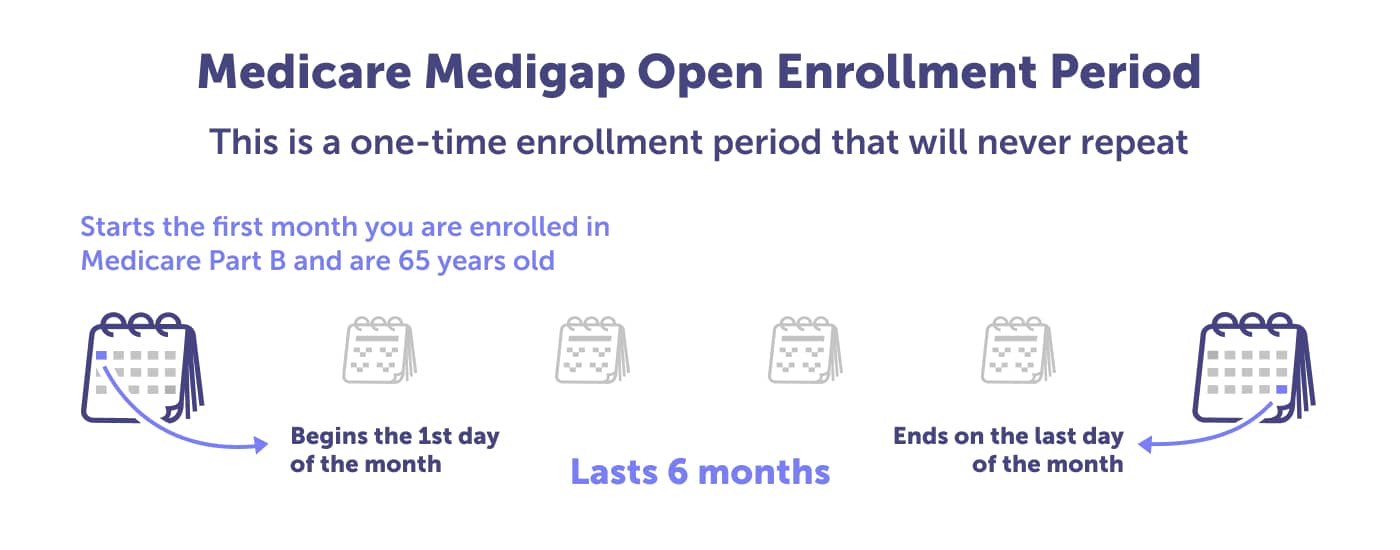

The ideal time to enroll in a Medicare Supplement plan in Florida is during your Medigap Open Enrollment Period. During this period, insurance companies must sell you any plan they offer regardless of your pre-existing medical conditions. It’s also when you can get the best pricing on a plan.

The Medigap Open Enrollment Period is unique to each person. It starts the first month you are enrolled in Medicare Part B, and you’re age 65. This enrollment period lasts only six months, happens only once, and cannot be changed or repeated. If you miss your Medigap Open Enrollment Period, you may be able to purchase a policy later, but it may cost more due to past or present health conditions.

Outside of the Medigap Open Enrollment Period, most insurance carriers apply the pre-existing clause to newly issued Medicare Supplement plans. This is why you must mark this critical window on your calendar.

If you miss your Medigap Open Enrollment Period, there is no guarantee that you can enroll in a Medigap plan. That’s because insurance companies are not required to sell you a plan – and you may be required to meet medical underwriting requirements. Insurance companies use medical underwriting to decide whether or not to accept your application and how much to charge for the policy. These steps are not required during your Medigap Open Enrollment Period.

Some situations exclude you from insurance companies requiring underwriting.

Not sure which Medicare Supplement plan is best for your health and budget? Review your plan options online or call (623) 223-8884 to speak with a local licensed agent who can guide you.

Guaranteed issue rights.

MA State/County Penetration, February 2023.

Medicare Enrollment.

Medicare Open Enrollment in Florida, 2023.

Supplement Insurance (Medigap) plans in Florida.

The State of Medicare Supplement Coverage, 2022.

The State of Medicare Supplement Coverage, 2021.

There isn’t a best Medicare Supplement plan in Florida; however, there are a couple of plans that most people are choosing. The most popular plans that are taking new enrollments in Florida (for those who became Medicare-eligible on or after January 1, 2020) are Medicare Supplement Plan G and Plan N.

Read more by William Revuelta

I am a Spanish-speaking Florida Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2009. I’m an avid sports fan and enjoy watching international soccer matches and college football. When not with my family, I listen to podcasts ranging from history to sports talk.