Wondering how a Medicare Supplement insurance plan could cover the out-of-pocket costs of Original Medicare, with access to any Medicare doctor or provider? Learn about the 10 types of plans for Medicare in Texas and the 6-month enrollment window.

Do you want Original Medicare and predictable costs? A Medicare Supplement plan might be your solution.

Medicare Supplement plans, also known as Medigap plans, assist you in paying for some or all of the out-of-pocket costs that you would otherwise have to pay for under Original Medicare (Parts A & B). Unlike a Medicare Advantage plan in Texas, with a Medicare Supplement plan you are not limited to specific provider networks—so these plans provide the flexibility of using Original Medicare, plus the coverage of some or all out-of-pocket expenses.

Medicare Supplement plans work in combination with Original Medicare and are not stand-alone plans. And because Original Medicare does not include a cap on out-of-pocket costs, many Medicare enrollees have some form of supplemental coverage.

According to The State of Medicare Supplement Coverage by AHIP, there were 931,380 Texas Medicare beneficiaries (40% of fee-for-service enrollees) with Medicare Supplement coverage in 2021. That’s up from 38% of fee-for-service enrollees in 2020 and 36% in 2019.

Original Medicare Part A covers some inpatient costs (hospital and skilled nursing facility care), while Medicare Part B covers 80% of outpatient costs (doctor bills and other medical expenses). Some out-of-pocket Part A and B expenses you may face include deductibles, copayments for hospital stays over 60 days, care in a skilled nursing facility after 20 days, a 20% coinsurance for doctor bills, and other medical expenses. The gap in coverage may cost you more than you anticipated.

Private insurance companies licensed by the Texas Department of Insurance are authorized to sell Medicare Supplement plans. And all plans are standardized. That means that each plan must include the same benefits offered by another company.

While the benefits must be the same, each company’s premium rates, reputation, member features, and service vary. Once you find the Medigap coverage available in your community and the plan that’s right for you, you’ll then need to determine which insurance carrier is best for your unique needs. Review your plan options with your local Medicare agent. Call (623) 223-8884 or review your Medicare plan options online.

When you choose a Medicare Supplement plan with Original Medicare, you should also enroll or maintain creditable prescription drug coverage to avoid the Part D late enrollment penalty. If you join a Medicare Supplement policy that doesn’t include creditable prescription drug coverage, and you decide to join a Medicare Prescription Drug Plan (Medicare Part D) later, you’ll pay a higher monthly premium than if you joined when you were first eligible.

The penalty added to your Medicare Prescription Drug Plan increases for each month you wait to join a Medicare Prescription Drug Plan. So, the longer you wait, the higher the penalty will become. And in general, it’s a penalty that must be paid for as long as you have a Medicare drug plan.

Learn more about the types of Medicare plans available to you in Texas.

Because Original Medicare lacks a limit on out-of-pocket medical expenses, a Medicare Supplement plan can ease your worries. In Texas, there are 10 types of Medicare Supplement plans available, lettered A – G and K – N. Each insurance company must offer at least Medicare Supplement Plan A but can offer any of the other plans as well. The costs of these plans are determined by the carrier.

The most popular Medicare Supplement plans in Texas are:

As of January 1, 2020, plans that include the Part B deductible were phased out. This means that if you became eligible for Medicare benefits on or after January 1, 2020, you would not be able to enroll in Medicare Supplement Plan C, Plan F, or Plan J. But if you became Medicare eligible on December 31, 1999, or before, you can still enroll in these plans.

Beneficiaries that are already enrolled in those plans will be able to keep their coverage. Plan G is the closest you can get to the discontinued Plan F, which is likely why Plan G has the second-highest enrollment of supplement plans in Texas. And why it’s gaining in the percentage of enrollment year-over-year.

Agent tip:

“Plan G and Plan N are gaining in popularity since plans with the Part B deductible were phased out. Plan G is the closest you can get to discontinued Plan F.“

When comparing Medicare supplement insurance plans in Texas, it’s important to weigh monthly premium costs with out-of-pocket expenses. Some plans with lower premiums may have higher out-of-pocket costs.

Let a local Medicare agent help you weigh your options and find a plan that meets your health needs and budget. Call (623) 223-8884 or review your Medicare plan options online.

Medicare Supplement plans A through G provide basic benefits plus 100% coinsurance coverage of Medicare Part B (Original Medicare), Part A coinsurance or hospice copay paid at 100%, and three pints of blood paid 100% in a benefit calendar year. Depending on the plan letter, additional benefits to choose from are coverage of skilled nursing facility coinsurance, Part A deductibles, Part B excess costs, and foreign travel emergencies.

Unlike Plans A through G, Plans K through N each offer varying benefits. There are no commonalities in the level of coverage between these plans, and you should consult a local Medicare agent to discuss which plan option is best for your health and budget. Call (623) 223-8884 or review your Medicare plan options online.

To qualify for a Medicare Supplement plan policy, you must be:

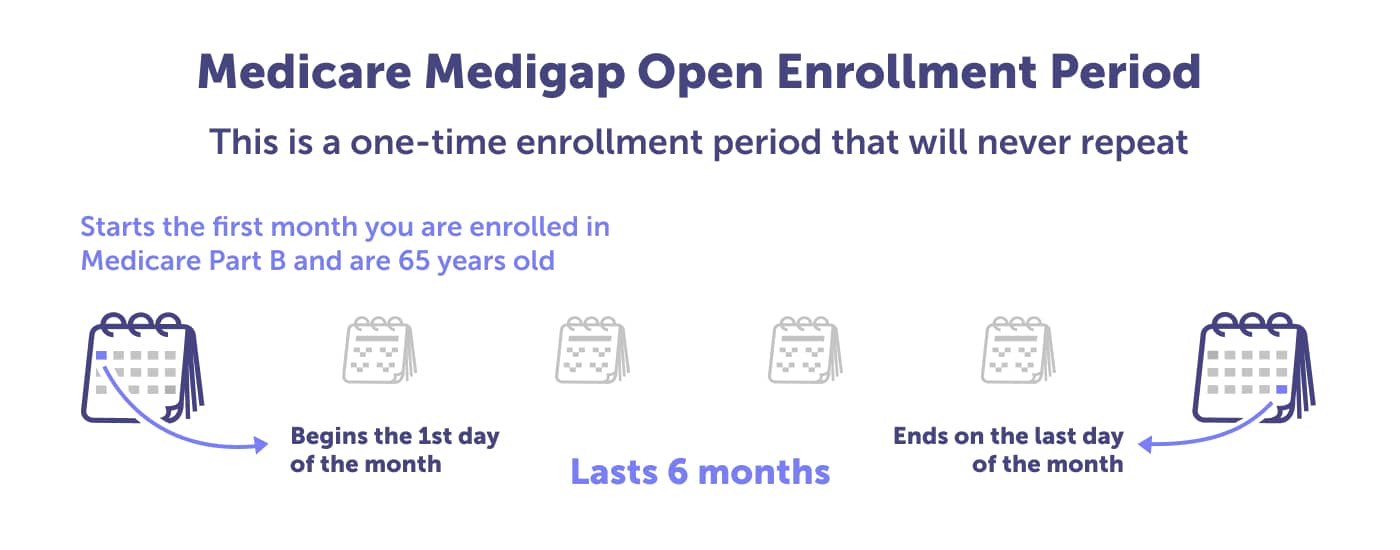

The best time to enroll in a Medicare Supplement plan in Texas is during your Medigap Open Enrollment Period. That’s because insurance carriers must sell you any plan they offer regardless of your pre-existing medical conditions.

Your Medigap Open Enrollment Period starts the first month you are enrolled in Medicare Part B, and you’re older than 65. The enrollment window lasts six months. This period only happens once and cannot be changed or repeated. If you miss your Medigap Open Enrollment period, you may still purchase a Medigap policy, but it may cost more due to past or present health problems.

Most carriers apply the pre-existing clause to newly issued Medicare Supplement plans if you enroll after your Medigap Open Enrollment Period. That’s why it’s essential you purchase a Medigap policy during your Medigap Open Enrollment Period—once you enroll in Part B and you’re older than 65.

You can purchase a Medigap plan outside of your Medigap Open Enrollment Period, but you may not be able to buy a policy at the same initial rate that you could have received during your Medigap Open Enrollment Period.

There is no guarantee that you can enroll in a Medicare Supplement plan outside of your Medigap Open Enrollment Period. That’s because there’s no guarantee that an insurance company will sell it to you—unless you meet certain medical underwriting requirements or situations.

Some of those situations include:

Generally, insurance companies use medical underwriting to decide whether to accept your application and how much to charge for the policy.

Need help deciding which of the Medicare Supplement plan is best for you? Speak with a local Medicare agent who can guide you through your options. Call (623) 223-8884 or review your Medicare plan options online.

10 Standard Medicare Supplement Insurance Plans.

Guaranteed issue rights.

How to compare Medigap policies.

The State of Medicare Supplement Coverage, 2023.

The State of Medicare Supplement Coverage, 2022.

The State of Medicare Supplement Coverage, 2019.

There isn’t a best Medicare Supplement plan in Texas. That’s because Medicare isn’t one-size-fits-all. Instead, it’s tailored to your unique health and budget needs. What is best for your neighbor or spouse is likely not what’s best for you.

However, in 2023, the most popular Medicare Supplement insurance providers in Texas are UnitedHealthcare and BlueCross BlueShield, with either Medicare Supplement Plan G (44.7%) or Medicare Supplement Plan N (8.2%). These are two plans you can consider as you weigh your Medigap options.

The monthly premium for Plan N and Plan G range between $29 and $579 depending on your age, sex, whether you smoke, and when you enroll in your plan. It’s best to consult with a local licensed agent to determine which plan is best for you.

Read more by Richard Torres

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2016. I am a U.S. Army Veteran and served under Operation Enduring Freedom. I enjoy spending time with my family and coaching youth soccer and basketball.