Medicare is a federally funded health insurance program created in 1965 by President Lyndon Johnson’s Great Society initiative. In 2025, 62.8 million Medicare beneficiaries are about 18% of the United States’ 347 million population. If you’re Medicare-eligible, you’re in good company.

Medicare offers health insurance for individuals aged 65 and older, as well as some younger people with disabilities or specific conditions like End-Stage Renal Disease (ESRD). It helps cover doctor visits, hospital stays, and other treatments. Below, you’ll learn how Medicare works and who qualifies.

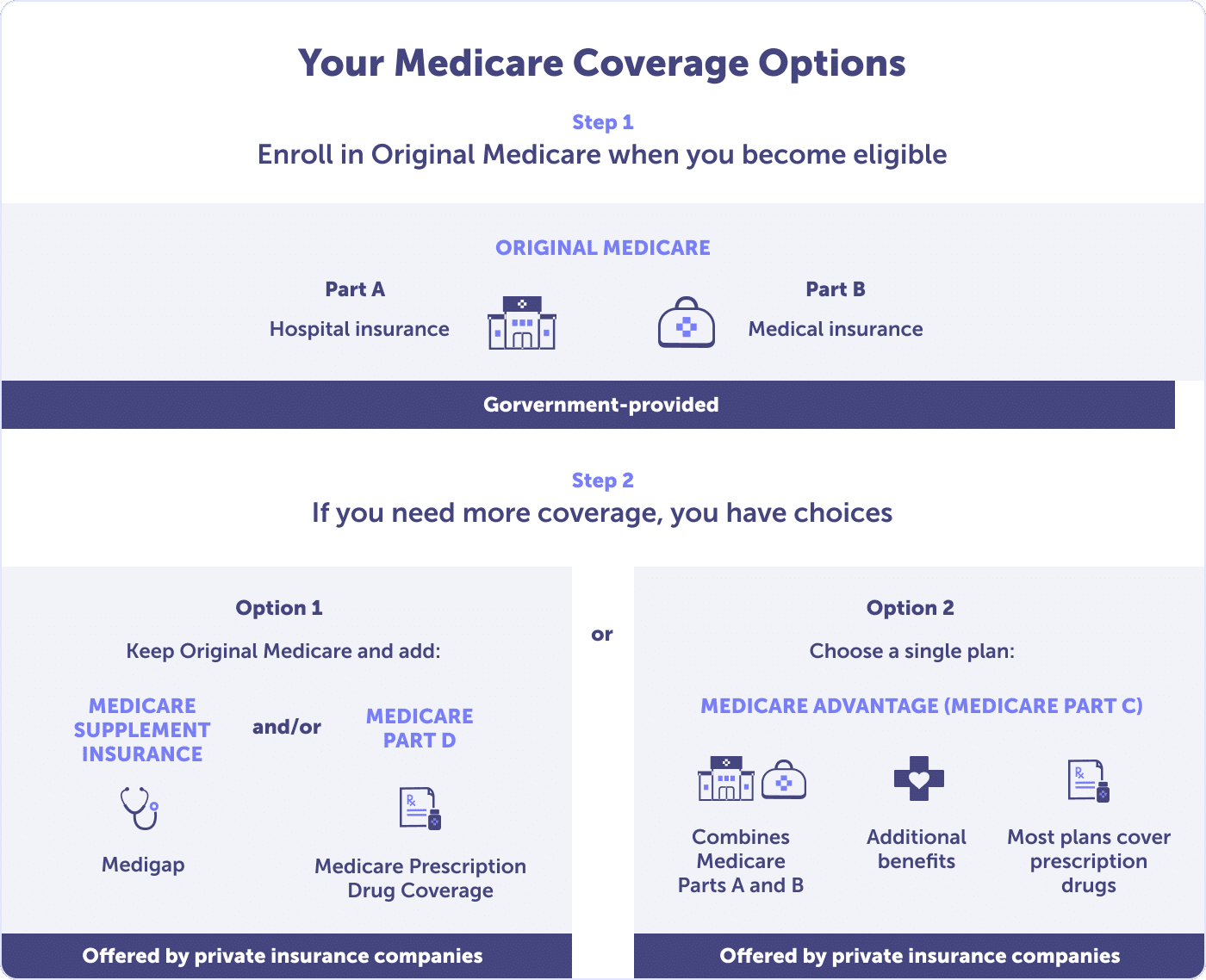

Medicare comprises several parts, combining public (government) coverage with optional private plans. Here’s a quick breakdown:

This chart outlines your Medicare coverage options in two steps. Step 1: Enroll in Original Medicare (Parts A and B) when you become eligible, which is government-provided. Step 2: If you need more coverage, choose between keeping Original Medicare and adding Medicare Supplement (Medigap) and/or Part D, or selecting a single Medicare Advantage (Part C) plan that bundles benefits and often includes prescription drugs.

Medicare covers hospital stays, doctor visits, lab tests, home health care, and prescription drugs. Coverage depends on your plan:

See our article ”Your Medicare Plan Options’’ for details.

A local licensed Connie Health agent can also walk you through enrolling in Medicare for the first time. Call (623) 223-8884 to speak with a local licensed agent.

According to Medicare.gov, you may be eligible for Medicare if you are:

Take the Connie Health Medicare eligibility quiz to check if you qualify.

Unsure if it’s time to enroll in Medicare? A local licensed Connie Health agent can help you navigate enrollment. Call (623) 223-8884 to speak with an agent.

When you become eligible, you may be automatically enrolled in Original Medicare Part A at age 65, but you must sign up for medical coverage for Part B. If you don’t qualify for premium-free Part A, you’ll need to pay a monthly premium for hospital coverage.

Agent tip:

“Already enrolled in Medicare Part A & B? Have your red-white-and-blue Medicare card ready when you speak with a Connie Health licensed insurance agent.“

Once you receive your red-white-and-blue Medicare card, you can decide whether to expand your Medicare coverage with private options like a Medicare Supplement (Medigap), Medicare Part D, or Medicare Advantage plan. These private plan options can lower your Medicare out-of-pocket costs.

Need help comparing plans? Call (623) 223-8884 to talk with a local licensed insurance agent who can help you choose a plan that may fit your health needs and budget.

While both are U.S. health insurance programs:

Key differences:

Medicare is a federal health insurance program for people age 65 and older, as well as younger individuals with certain disabilities or conditions like End-Stage Renal Disease (ESRD) or ALS. Most U.S. citizens and permanent residents qualify at age 65, while some qualify earlier due to disability or illness.

Medicare has different parts—A, B, C (Medicare Advantage), D, and Medigap—that help cover hospital stays, doctor visits, prescription drugs, and more. The right plan depends on your health needs and budget.

Understanding these differences can help you choose the right coverage.

Need assistance? Call (623) 223-8884 to speak with a licensed insurance agent today.

Need Help Deciding The Right Medicare Coverage For You?

Free, unbiased service

Compare all major plans and carriers

Local, licensed insurance agents with 25+ years of experience

Licensed Insurance Agent

You should enroll during your Initial Enrollment Period (IEP), which begins three months before the month you turn 65, includes your birthday month, and continues for three months afterward. Enrolling during this period helps ensure you have coverage when you become eligible and can help you avoid late enrollment penalties.

Original Medicare doesn’t, but many Medicare Advantage plans may include these benefits.

Yes, if you qualify. This is called being “dual eligible” and may provide extra benefits and cost savings.

You may face late enrollment penalties for Part B or Part D. Some Special Enrollment Periods may apply.

Costs vary by plan and income. Part A often has a $0 premium if you or your spouse paid Medicare taxes long enough; the monthly premium for Part B and D applies to most people.

Read more by David Luna

I am a Spanish-speaking Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2005. I am a Marine Corps Veteran & former police officer. I enjoy watching football and basketball but hold family time in the highest regard.