Trying to reduce your costs of Medicare in Texas? A Medicare Advantage plan could help. Learn about the types of plans available, how much they may cost, and when to enroll.

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies that have a contract with the Centers for Medicare & Medicaid Services (CMS). According to the Kaiser Family Foundation, approximately 52% of Texans were enrolled in a Medicare Advantage plan in 2022. This is higher than the national average of 48%.

To qualify for a Medicare Advantage (MA) plan, you must be eligible for Medicare Part A and enrolled in Medicare Part B, and live in the service area of the plan you wish to enroll in. Medicare Advantage plans are local—to the county level—and many options exist.

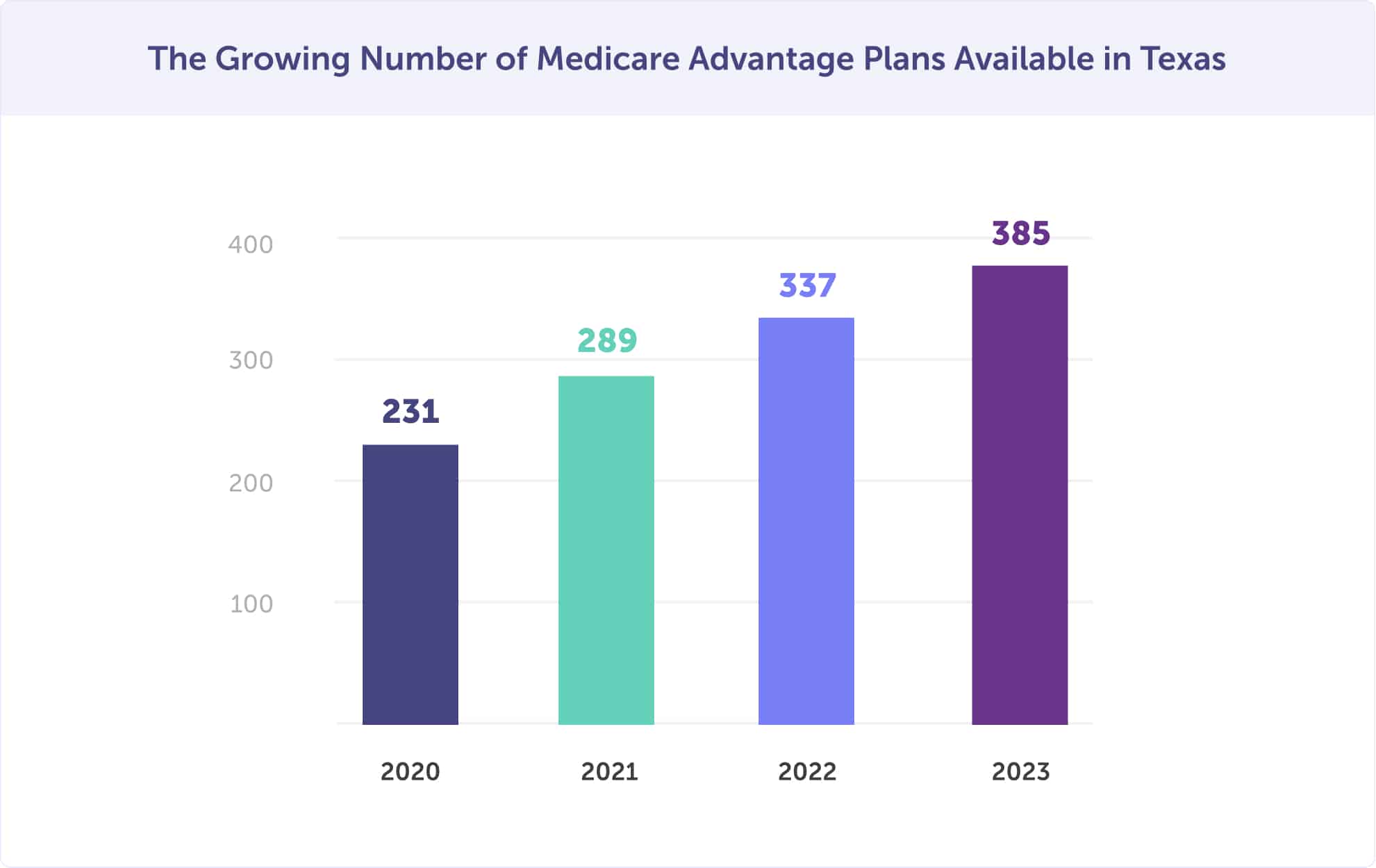

Within Texas, in 2025, 385 Medicare Advantage plans are available, compared to 337 plans in 2022, 289 plans in 2021 and 231 plans in 2020. Between 2022 and 2023, there was a 15% increase in Medicare Advantage plan options—and many more plans for you to potentially choose from.

In 2023, the 10 Texas counties with the highest Medicare Advantage enrollment are Starr County (71%), Hidalgo County (71%), El Paso County (70%), Willacy County (69%), Zavala County (66%), Cameron County (65%), Jim Wells County (65%), Maverick County (64%), San Patricio County (64%), and Kleberg County (63%).

Almost all of these counties were in the top 10 for Medicare Advantage enrollment in 2022 as well. The one difference is that Maverick County did not appear in 2022 and has replaced Nueces County, which was #10 last year.

Enrollment also increased by two percentage points. The highest penetration percentage was 69% in 2022, with the low being 61%. This shows that more people are choosing a Medicare Advantage plan in these counties, and emerging counties.

Looking for a way to reduce your costs for Medicare in Texas? A Medicare Advantage plan is an option. A Medicare Advantage plan provides all of the benefits of Original Medicare coverage offered in Texas, but often at a lower cost. And 100% of people with Medicare Part A and B have access to a Medicare Advantage plan.

Many Medicare Advantage plans have a $0 monthly premium. If you enroll in a Medicare Advantage plan that does charge a premium, you’ll pay the MA plan premium in addition to the monthly Part B premium. The bonus of Medicare Advantage? Most plans include prescription drug coverage.

Agent tip:

“Medicare Advantage Prescription Drug plans cover the creditable prescription drug coverage required by Medicare, without an extra prescription drug premium. You won’t need to enroll in a Medicare Part D plan when you enroll in a Medicare Advantage Prescription Drug plan.“

Medicare Advantage plans also limit the Medicare beneficiary’s out-of-pocket costs for services covered by Medicare Part A, and Part B. MA plans set their own deductibles, coinsurance, and copays within limits established by the federal government.

Once you reach your out-of-pocket maximum, including the deductible, your Medicare Advantage plan pays 100% of covered healthcare expenses for the remainder of the year. Unlike an MA plan, Original Medicare doesn’t have a maximum spending limit, and there is no cap on your annual out-of-pocket costs.

If you’d like to keep Original Medicare (Part A & B), but want more predictable, albeit potentially higher monthly premiums, a Medicare Supplement plan (Medigap Plans), is an alternative to Medicare Advantage.

Most Medicare Advantage plans in Texas offer benefits that Original Medicare doesn’t provide:

Not sure which is best for you? Have a local Medicare agent guide you to the optimal health insurance plan for your health needs and budget. Call (623) 223-8884.

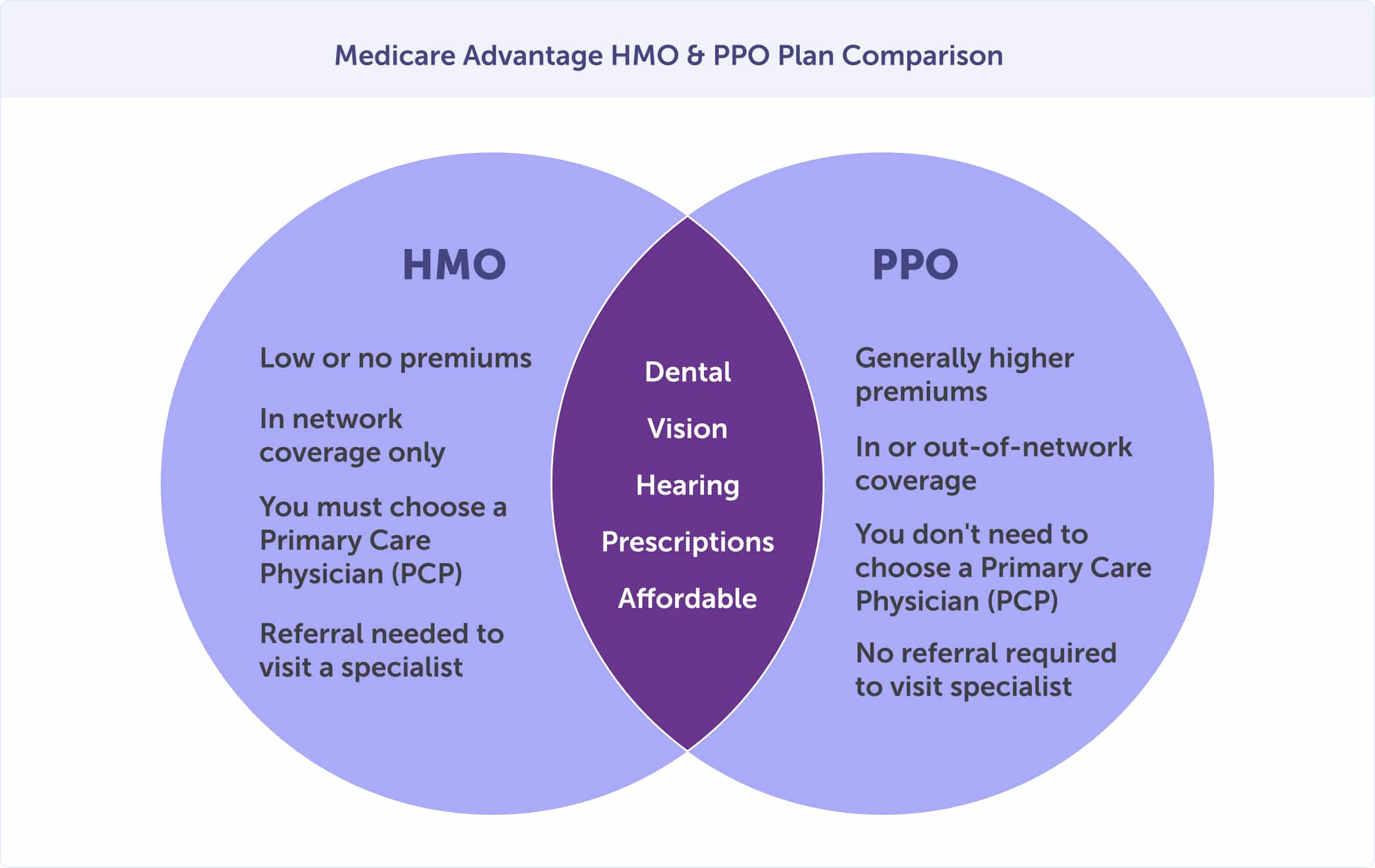

The most common Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs and PPOs have networks of participating hospitals, doctors, and other healthcare professionals.

How are Medicare Advantage HMOs and PPOs similar?

With a Medicare Advantage HMO, your costs are generally lower than a PPO. You’ll need to choose a primary care physician who provides or coordinates your care through referrals to other participating in-network providers. If you want to see a specialist with an HMO, you’ll need to receive a referral from your primary care physician. Outside of emergencies, out-of-network providers’ services are not covered unless approved in advance by the Medicare Advantage HMO plan.

With a Medicare Advantage PPO in Texas, you’ll have more flexibility but potentially higher costs. For example, monthly premiums will generally be higher than an HMO. While you can see doctors outside the Medicare Advantage PPO plan network, you’ll also likely pay higher coinsurance or copayments for that care. And you’ll need to provide information about the medical care and prescription drugs you’ve received. This means you’ll need to keep excellent records and take a more active role in the coordination of your care.

To maintain your existing relationships with doctors, hospitals, or other care providers, check to see if your preferred healthcare providers are participating in a Medicare Advantage plan’s network.

Do you need help ensuring that you pick a plan that includes the doctors you value and the prescriptions you need? Call Connie Health for a Medicare plan that maintains your doctors and hospital relationships: (623) 223-8884.

Medicare Advantage plans that include prescription drug coverage are known as Medicare Advantage Prescription Drug (MAPD) plans. These plans provide the convenience of having all your Medicare medical and prescription drug benefits through one plan. In 2023, 89% of Medicare Advantage plans nationwide offered prescription drug coverage (MAPDs).

$0 is the lowest monthly premium for a Medicare Advantage plan. And 100 percent of people with Medicare Part A and B have access to a Medicare Advantage plan with a $0 monthly premium. The average monthly Medicare Advantage plan premium in 2025, for those with a premium, is $8.94. That’s down from $10.68 in 2022 and $11.11 in 2021.

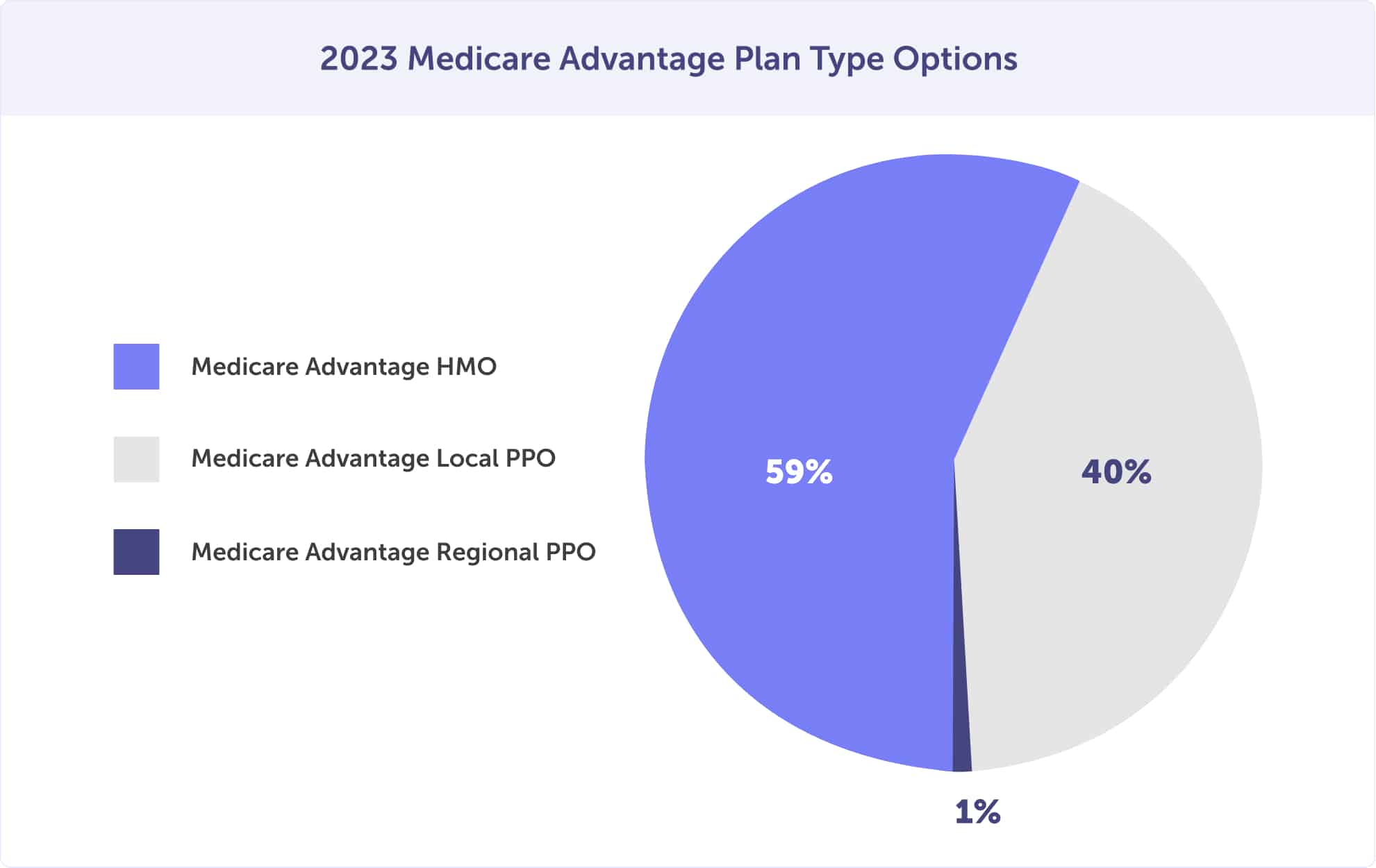

In 2025, Medicare-eligible people have far more HMO options (59%) than they do local PPO plan options (40%). Only 1% of Medicare Advantage plans available are regional PPOs and private fee-for-service plans. Between 2022 and 2023, there was a 7% increase in local PPO options and a 4% decrease in regional PPO plan availability.

The Medicare Advantage and MAPD premiums are paid directly to the plan provider. They are paid separately from the Part B premium paid to Medicare, which is usually paid by a monthly withdrawal from your Social Security benefit.

Speak with a local Medicare agent to see if you qualify for a $0 premium Medicare Advantage plan. Call (623) 223-8884 or find your plan online.

Want to enroll, switch, or unenroll in a Medicare Advantage plan? Knowing when you should—and can—may save you money. The best time to join a Medicare health or drug plan is during your Initial Enrollment Period. But continue reading to learn about the other times you can make a change.

Your Initial Enrollment Period is three months before you turn 65 plus the month you turn 65, and ends three months after you turn 65. You have a seven-month window. And that’s when most Texans enroll in Medicare Part A & Medicare Part B. If you’re not yet collecting Social Security benefits before your Initial Enrollment Period begins, you’ll need to sign up for Medicare – and Connie Health can help.

Note: If you don’t enroll in Medicare Part B during your Initial Enrollment Period, you could face a lifetime late enrollment penalty. This amount is added to your monthly Part B premium for your lifetime. And the longer you wait to sign up for Part B, the larger the monthly penalty becomes.

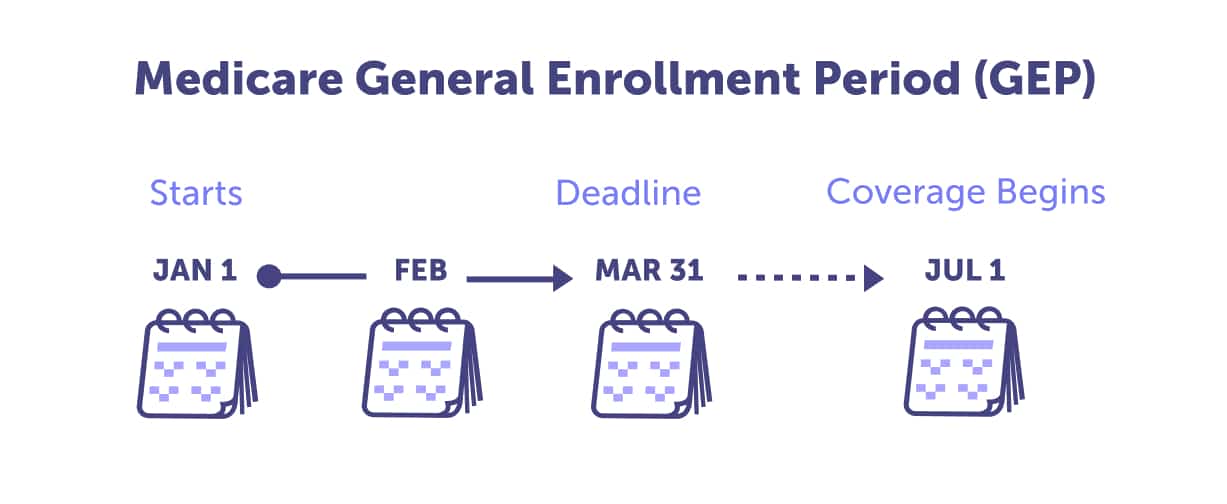

Should you miss your Initial Enrollment Period, you may be eligible to enroll during the General Enrollment Period or a Special Enrollment Period (SEP). If an election was made during the Annual Enrollment Period, you could make changes during the Medicare Advantage Open Enrollment Period. Keep reading to learn more.

Not sure if now is the right time to enroll in a Medicare Advantage plan? Speak with a local Medicare agent who can guide you through your options. Call (623) 223-8884 or find your plan online.

The General Enrollment Period is likely when you would enroll in a Medicare Advantage plan if you missed your Initial Enrollment Period. The General Enrollment Period runs from January 1 through March 31, with coverage beginning July 1st. Keep in mind that if you enroll during this time, you’ll likely face late enrollment penalties.

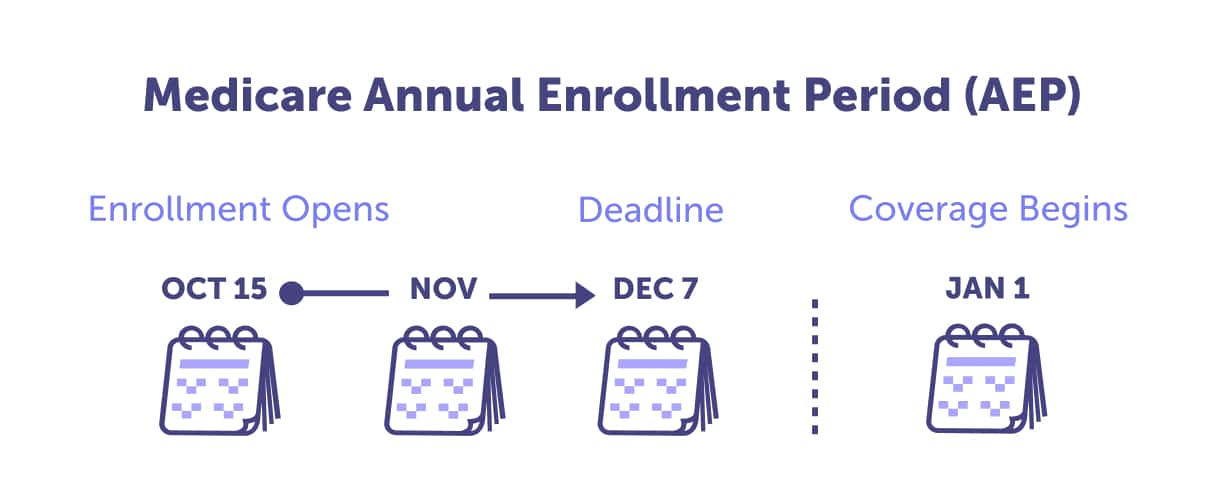

Want to join a Medicare Advantage plan? The Medicare Annual Enrollment Period, annually between October 15 and December 7, is your time to do the following:

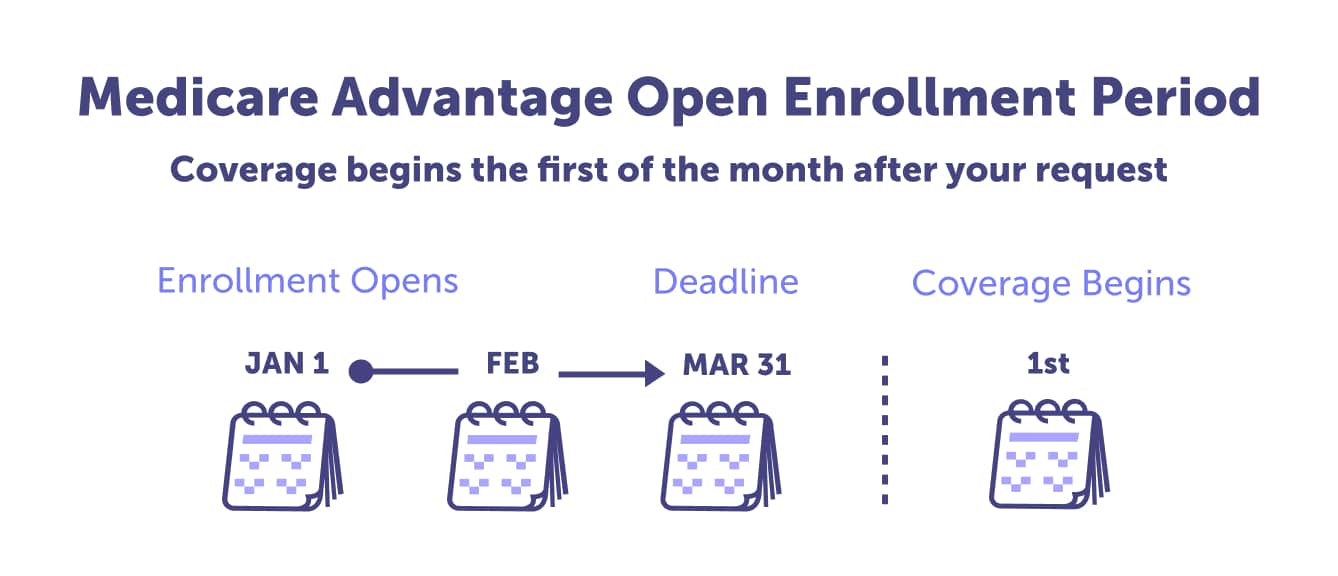

Annually, between January 1 through March 31, you have options to change your Medicare Advantage plan. Here are some of those options:

During the Medicare Advantage Open Enrollment Period, you cannot switch from Original Medicare to a MA plan, join a Medicare prescription drug plan if you’re in Original Medicare, or switch your Medicare Prescription Drug plan to another if you’re in Original Medicare.

If you move, lose your current coverage, have the chance to get other coverage, your plan changes its contract with Medicare, or other special circumstances—you qualify for a Medicare Advantage Special Enrollment Period. During this Special Enrollment Period, you can sign up for or make Medicare Advantage or Medicare Advantage Prescription Drug plan changes.

Medicare Advantage in 2022: Enrollment Update and key trends.

Ma State/County penetration 2023 01.

Last updated: February 2, 2023

The best Medicare Advantage plan in Texas is the plan that serves your health and budget needs best. It would be nice to have a one-size-fits-all plan, but Medicare doesn’t work like that. It’s tailored to your individual needs. That’s why the plan your neighbor or spouse is enrolled in likely won’t be the best plan for you. However, based on Medicare Advantage plan enrollment data, the most popular provider in Texas is UnitedHealthcare. Connie Health can help you find a plan suited to your unique needs.

Read more by Jasmine Alberto

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2007. I am on the the Advisory Committee for Foster Grandparents, Senior Companions, and RSVP Houston. I enjoy traveling, a backyard BBQ, and volunteering in my community.