Speak to a licensed agent (Monday-Saturday 8am - 8pm, Sunday 9am - 5pm)

(623) 223-8884 | TTY: 711

(623) 223-8884 | TTY: 711

As we age, we’re more likely to get cancer. Among women over 70 years of age, breast cancer, colorectal (colon), gastric, and lung cancer are most common. For men age 70 or older, there is a higher prevalence of lung cancer, prostate cancer, bladder and colorectal cancer.

Knowing this, it’s sobering to consider that without supplemental insurance (Medicare Advantage, Medicare Supplement, or cancer care), cancer patients spend nearly 25% of their total annual household income on out-of-pocket medical expenses. We’re here to help you avoid that.

Whether you’re researching Medicare plans or have received a cancer diagnosis and are wondering what’s covered, we hope you’ll get the answers you need. Should you have any unresolved questions, please call and speak with one of our local licensed agents, who is always happy to help.

Catching cancer in an early stage can extend your life expectancy. That is why you must take advantage of Medicare’s preventative services and cancer screenings.

Thankfully, many preventative services and cancer screenings are covered through Original Medicare Part B. Because Medicare Advantage includes Part B coverage, these services are also covered by Medicare Advantage plans. Review the screenings and preventive services below, and if you haven’t received a due screening, schedule it today.

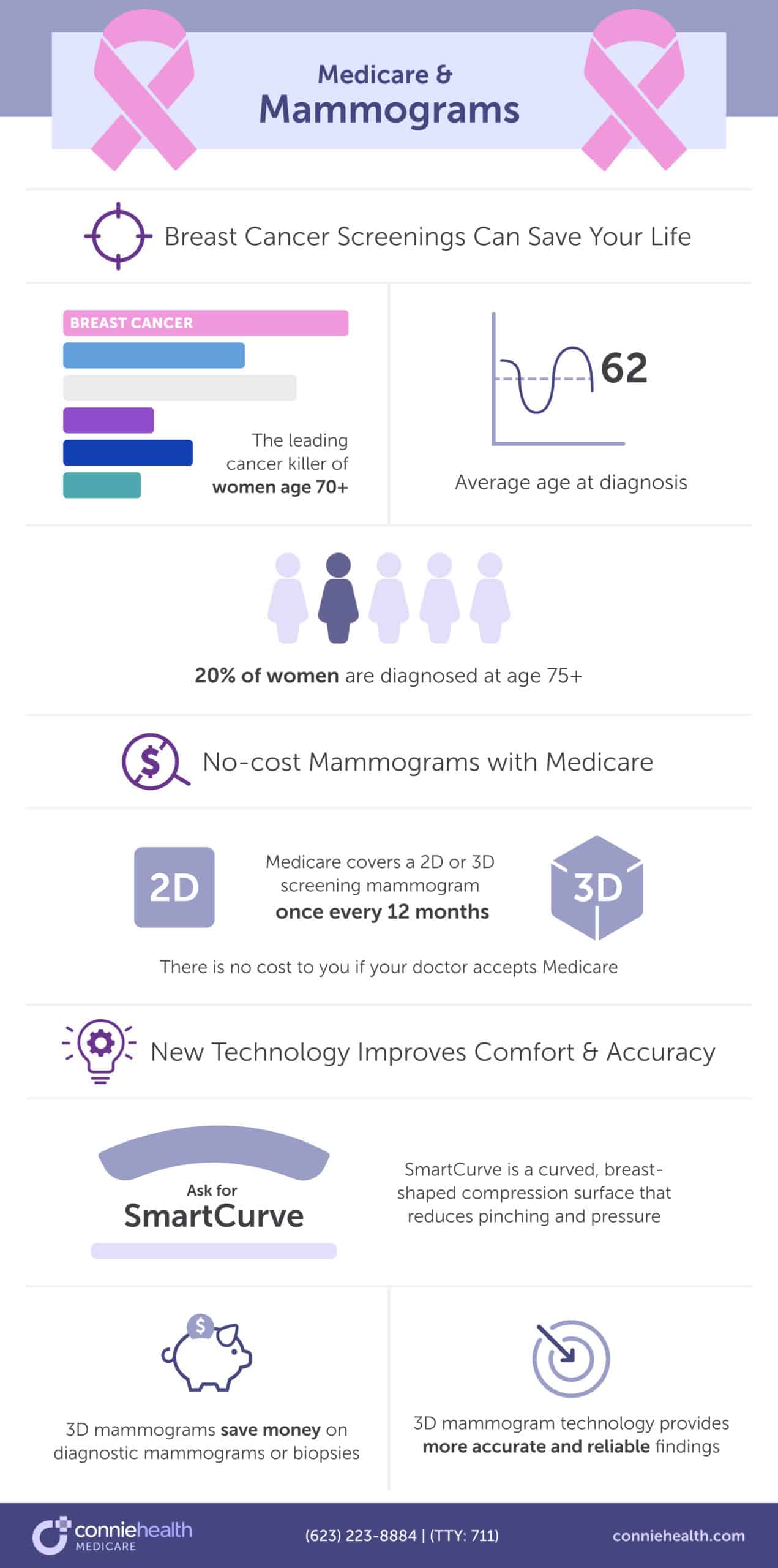

Nearly 20% of women are diagnosed with breast cancer over the age of 75. The average age of a breast cancer diagnosis is 62. This means that if you are reviewing Medicare plan options or enrolled in Medicare, you face the highest rate of breast cancer. Medicare recognizes this.

Agent tip:

“Nearly 20% of women are diagnosed with breast cancer over the age of 75. Because you can get a no-cost screening mammogram every 12 months – you shouldn’t delay.“

Included in Original Medicare Part B and Medicare Advantage plans, breast cancer screening mammograms are available once every 12 months if you’re a woman age 40 or older.

These types of mammograms are preventative, check for breast cancer, and are at no-cost to you as long as the mammogram provider accepts Medicare. You may be eligible for additional mammograms if you are high-risk. Your doctor will let you know if more frequent mammograms are medically necessary.

If your screening mammogram shows suspicious results, your doctor may request a diagnostic mammogram. These are available if medically necessary but are not preventative and often include an out-of-pocket cost.

Read more about the three types of breast cancer screenings and their costs.

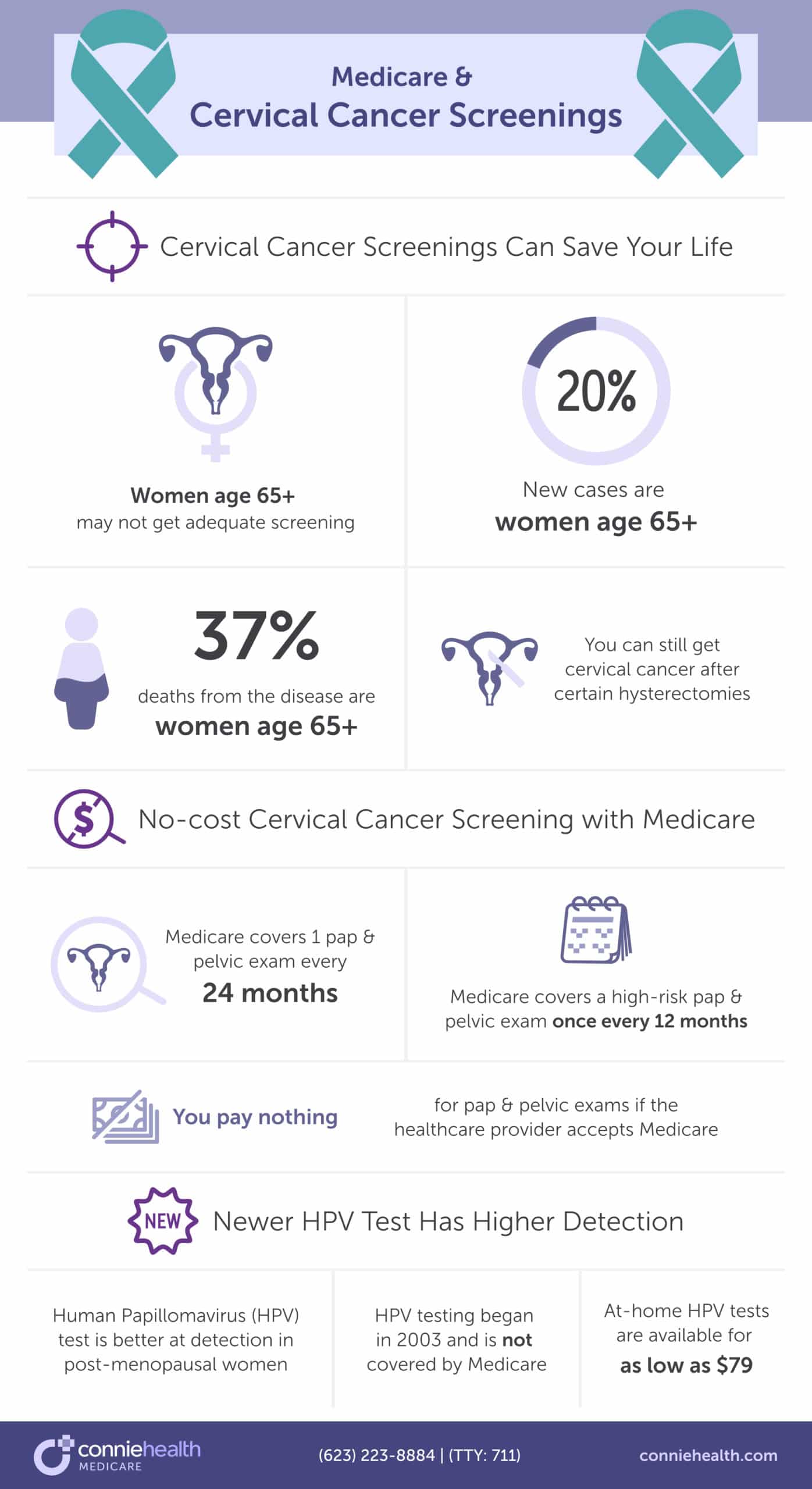

Did you know that if you’ve had a hysterectomy, you can still get cervical or vaginal cancer? And that an HPV test is better at detecting cervical or vaginal cancer in post-menopausal women? You must share this information with your female friends and family – it could save their lives.

Agent tip:

“An HPV test is better at detecting cervical or vaginal cancer in post-menopausal women, but Medicare doesn’t cover these tests after age 65. You may want to pay out-of-pocket because they are more precise.“

A recent University of California, Davis study found that women 65 and older may not get adequate screening. The study discovered that 20% of new cervical cancer diagnoses were in women 65 and older. Also, the majority of these women presented with late-stage cancer, likely because of a lack of screening and detection.

After age 65, Original Medicare Part B and Medicare Advantage plans cover pap tests and pelvic exams to check for cervical and vaginal cancers. As part of the pelvic exam, Medicare also covers a clinical breast exam to check for breast cancer.

Medicare Part B covers a pap test and pelvic exam once every 24 months or once every 12 months if you’re at high risk for cervical or vaginal cancer. Part B covers the HPV test, as part of the pap test, once every five years if you’re age 30-65 without HPV symptoms.

If the doctor or healthcare provider accepts Medicare assignment, you’ll pay nothing for the lab pap test, the lab HPV with the pap test, the pap test specimen collection, and a pelvic and breast exam.

Women over 65 do not have the HPV test covered by Medicare even though it detects cervical and vaginal cancer better in post-menopausal women. You may want to pay out-of-pocket for these preventative tests because of the high rate of late-stage diagnoses. You can spend as little as $79 for an at-home HPV test kit or up to $300 with a doctor’s visit.

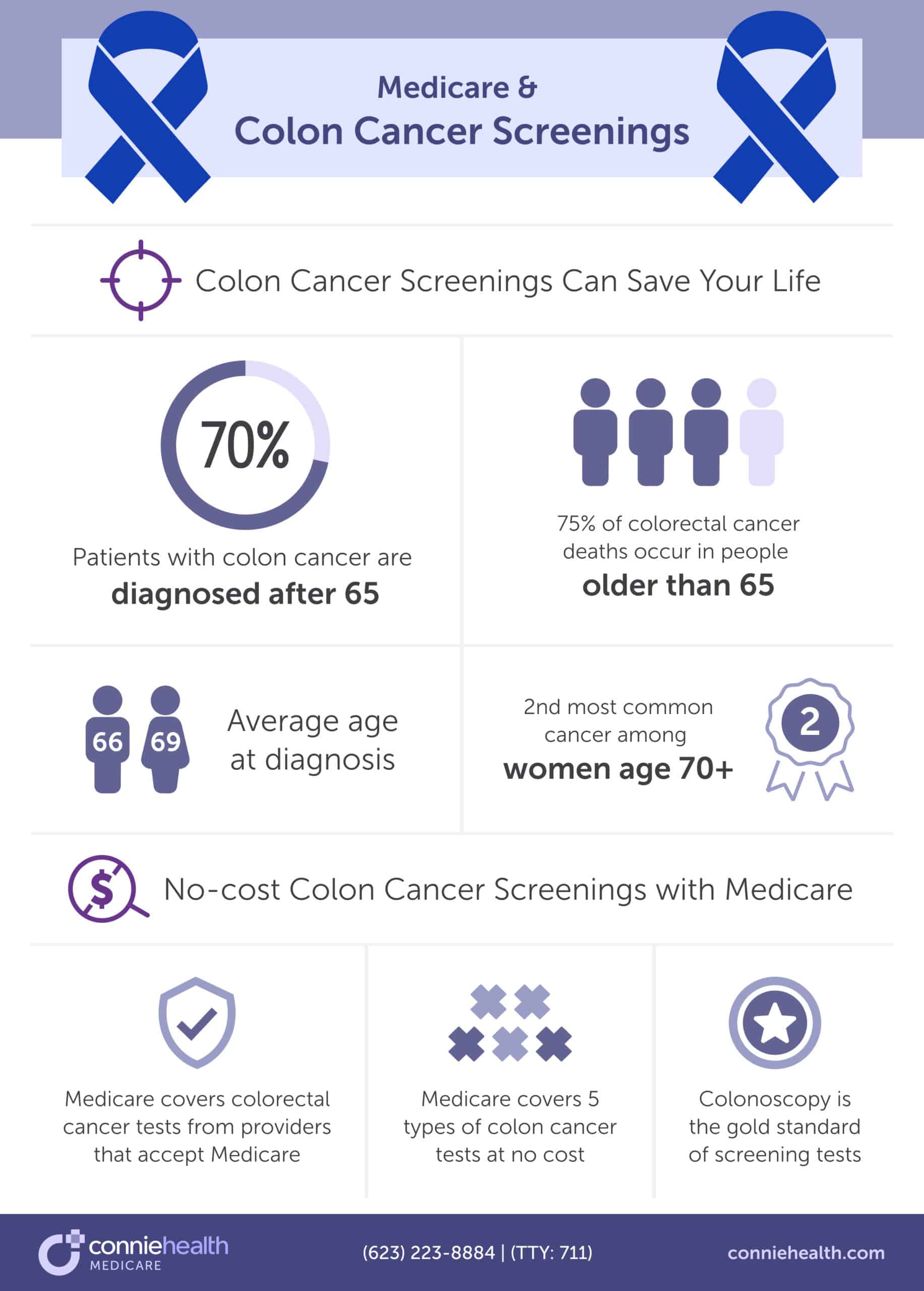

Among women 70 and older, colon cancer is the second most common cancer. And the fourth most common cancer among men 70 and older. That’s why you must get your colorectal cancer screening to help find and remove pre-cancerous growths.

Agent tip:

“Colon cancer is the second most common cancer for women over 70, and the fourth most common for men over 70. With six types of colon cancer screenings you can find the one that’s right for you.“

All people enrolled in Medicare, age 45 and older, have colorectal cancer screenings covered by Original Medicare Part B and Medicare Advantage plans. Medicare only covers tests done by doctors or health care providers that accept Medicare assignment. You may need to pay coinsurance, copayments, or deductibles for these services.

Medicare covers these types of tests at the following frequency. Consult with your doctor to learn which test is best for you.

Read more about the coverage of screening colonoscopies and Cologuard.

Visit Medicare’s Guide to Preventative Services to understand the frequency and cost of each screening and other colorectal cancer-related procedures.

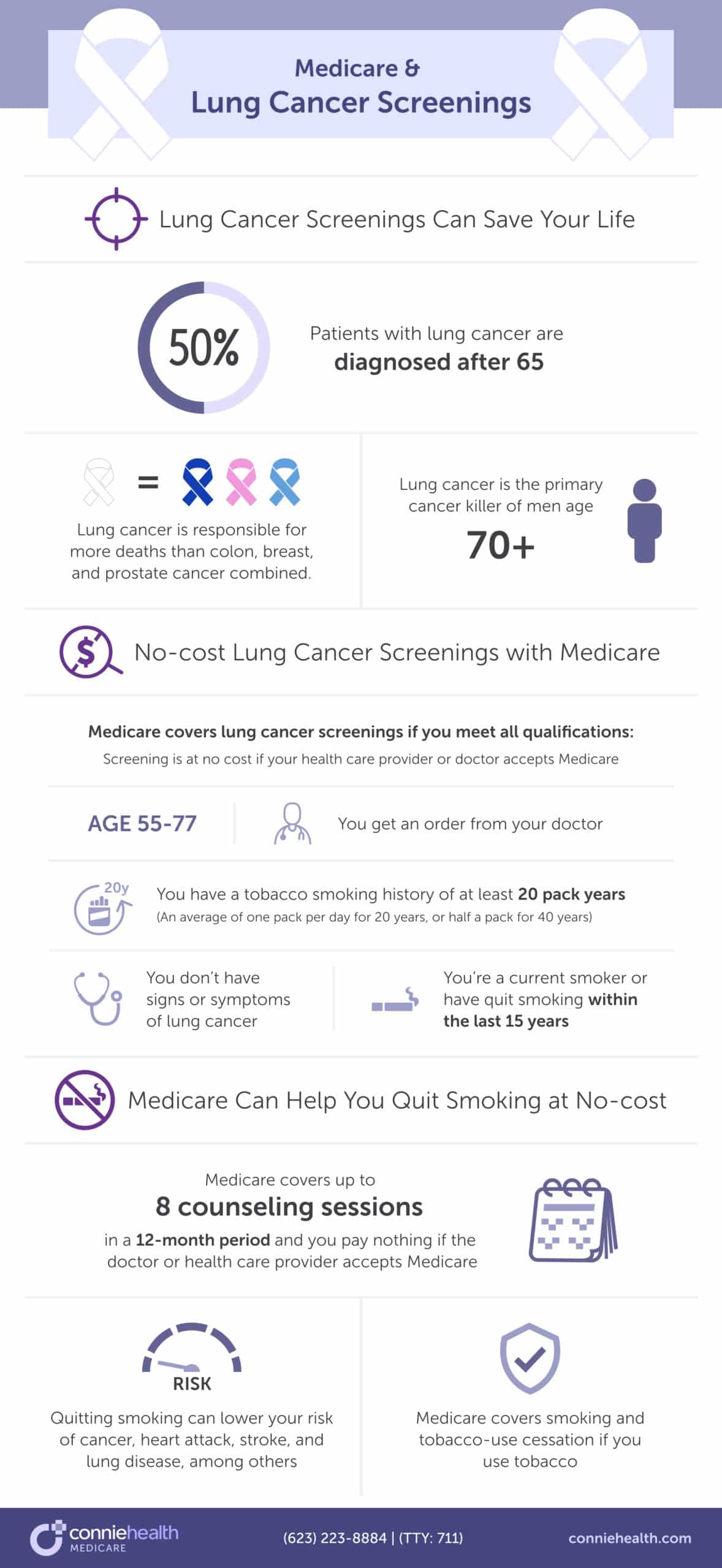

If you smoke and have been smoking for several years – or decades, you may be thinking, “Why does it matter if I stop now? Quitting smoking can lower your risk of cancers (especially lung cancer), heart attack, stroke, and lung disease, among others.

Agent tip:

“Quitting smoking can lower your risk of cancer, heart attack, stroke, lung disease, and more. Medicare supports you quitting by covering no-cost tobacco-use cessation.“

Original Medicare Part B and Medicare Advantage plans cover smoking and tobacco-use cessation if you use tobacco. Medicare covers up to 8 counseling sessions in 12 months, and you pay nothing if the doctor or health care provider accepts Medicare assignment.

With lung cancer being the top killer of men over the age of 70, you must stop and encourage your friends and loved ones to do as well. It could save your – and their life.

Ask your doctor about Medicare-covered tobacco cessation programs where you live, or visit “Quitting Smoking” for more information about stopping tobacco use.

Lung cancer is prevalent amongst men and women over 70 years of age and is the #1 cancer among men of this age.

Agent tip:

“Lung cancer is the #1 cancer of men age 70 and older. Quitting smoking and getting your no-cost lung cancer screening is the best way to prevent and detect a lung cancer diagnosis.“

While you can get lung cancer from other sources, the U.S. Surgeon General advocates that if you smoke, you stop, even if you’re of Medicare-eligible age and have smoked for years – or decades. Quitting smoking and other forms of tobacco use lead to significant risk reduction of lung cancer and other diseases such as stroke, heart attack, and lung disease.

Medicare Part B and Medicare Advantage plans cover lung cancer screenings with low-dose computed tomography if you meet all the following conditions:

You are eligible for an annual low-dose computed tomography lung cancer screening if you meet all the criteria above. The lung cancer screening would be free if your health care provider or doctor accepts Medicare assignment.

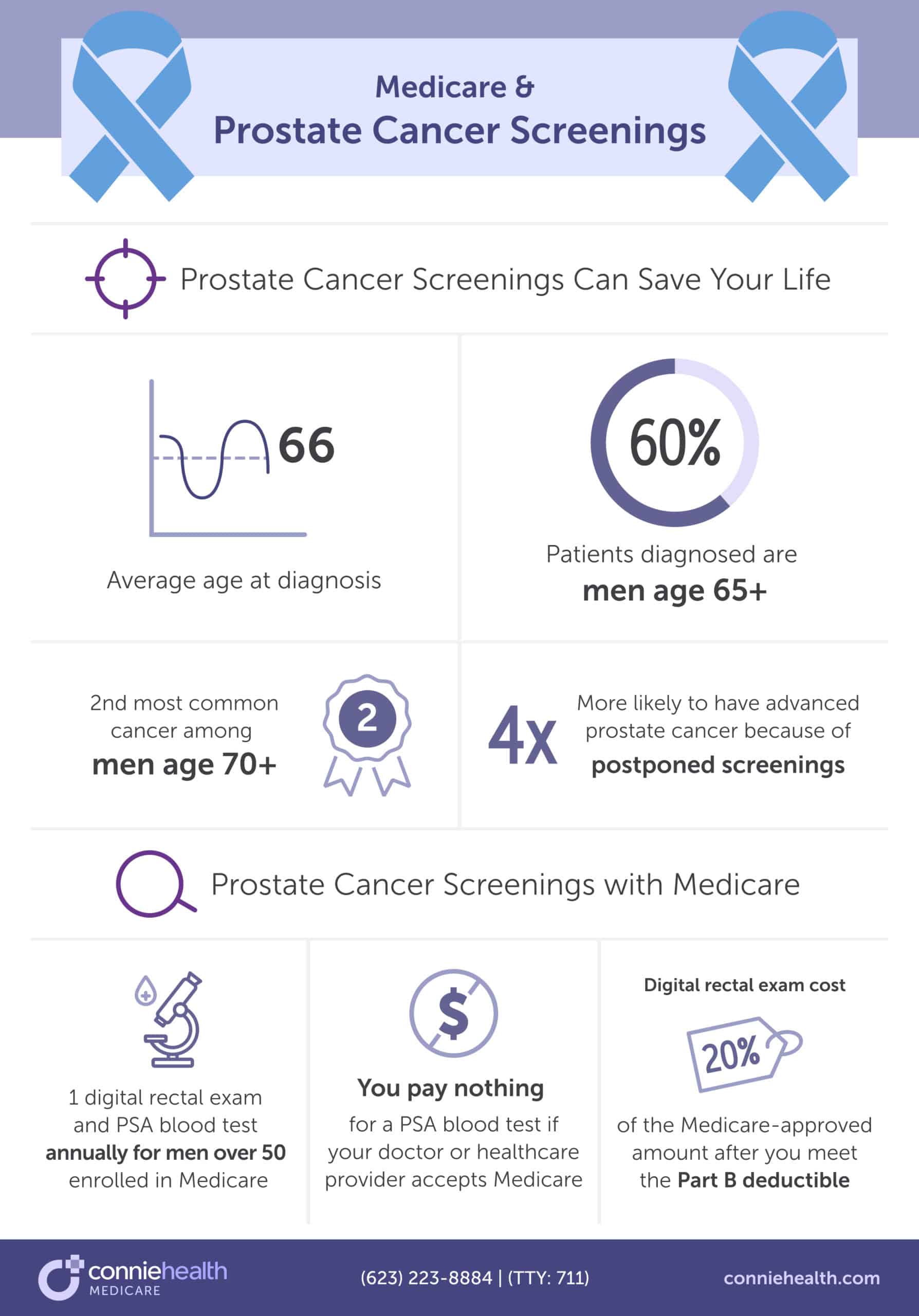

Prostate cancer is the second most common cancer for men aged 70 and older. And because people postpone prostate cancer screenings, men over 70 are four times more likely to have advanced prostate cancer. That is why screenings are so critical. Thankfully, Medicare covers prostate cancer screenings.

Agent tip:

“Because of postponed prostate cancer screenings, men over 70 are 4x more likely to have advanced prostate cancer. Medicare offers no-cost prostate cancer screenings every 12 months, so there’s no reason to delay your screening.“

Medicare Part B and Medicare Advantage plans cover prostate cancer screenings by testing the amount of Prostate Specific Antigen (PSA) in your blood or with a digital rectal exam. All men enrolled in Medicare over 50 can get a digital rectal exam and PSA blood test once every 12 months.

If your doctor or health care provider accepts Medicare assignment, you’ll pay nothing for the PSA blood test. For the digital rectal exam, you do have costs. After you meet the Part B deductible, you pay 20% of the Medicare-approved amount.

If you’re wondering which Medicare plans cover cancer treatment or how it’s covered, this section will help you. And if you’re wondering what the best plans are for cancer treatment, check the next section.

Now, let’s review how Medicare covers the three most common cancer treatments: surgery, chemotherapy, and radiation therapy.

Many types of surgery can be performed related to cancer. Some types include:

Original Medicare Part A covers inpatient hospital stays, including surgeries you get while an inpatient. Medicare Part B covers outpatient surgeries, breast prostheses, and surgically implanted breast prostheses after mastectomy surgery. And remember, anything that Original Medicare covers is covered by a Medicare Advantage plan.

But how much would a cancer-related surgery cost you out-of-pocket? That’s hard to know. You don’t understand your needed services until you speak with your healthcare provider. Medicare recommends that you take the following steps to estimate how much you may pay out-of-pocket:

Whether you have Original Medicare or a Medicare Advantage plan, review your “Medicare Summary Notice” or speak with your local licensed Connie Health agent to see if you’ve met your deductibles.

Review your Part A deductible if you expect to be admitted to the hospital, and check your Part B deductible for a doctor’s visit or other outpatient care.

Deductible amounts need to be paid before Medicare will start to pay. After Medicare starts to pay, you may still have copayments for the care you receive.

Three ways to help you manage out-of-pocket expenses are Medicare Supplement (Medigap) and Medicare Advantage plans, and cancer care insurance. If you’re concerned about out-of-pocket costs, consult your local licensed agent to discover when to change Medicare plans or get cancer care insurance.

Chemotherapy uses drugs to kill cancer cells that have spread to parts of the body that are far from the primary tumor. There are three reasons why chemotherapy might be suggested for you: cure, control, and palliation.

Original Medicare covers chemotherapy if you have cancer. Medicare Part A covers it if you’re an inpatient at a hospital. Medicare Part B covers chemotherapy if you’re a hospital outpatient or a patient in a doctor’s office or clinic.

If you receive chemotherapy as a hospital outpatient, you’ll pay a copayment. For chemotherapy in a doctor’s office or freestanding clinic, you pay 20% of the Medicare-approved amount after you meet the Part B deductible.

If you have Original Medicare with a Part D prescription drug plan, and Part B doesn’t cover a chemo drug, your drug plan may cover it. Review your Medicare Part D plan’s formulary (list of covered drugs) to ensure the chemo you need is on the formulary.

Medicare Advantage plans also cover chemotherapy but may have a different deductible and cost-sharing. You should review your “Summary of Benefits and Coverage” to know how much chemo may cost you out-of-pocket.

Are you concerned about the costs of chemotherapy and other cancer treatments? You may consider choosing a Medicare Supplement plan paired with Original Medicare and a Part D prescription drug plan, a Medicare Advantage Prescription Drug plan, or a cancer care insurance plan. Speak with your local licensed agent to discover the right action plan for your unique situation.

Did you know that nearly 50% of people diagnosed with cancer undergo radiation therapy? It can be used alone or in combination with other cancer treatments. Unlike chemotherapy, radiation therapy is a localized treatment that aims to affect only the part of the body needing treatment. The goal is to do as little harm as possible to healthy cells surrounding the damaged cancer cells.

Original Medicare Part A covers radiation therapy for hospital inpatients, while Medicare Part B covers radiation therapy for outpatients or people in freestanding clinics. Medicare Advantage plans also cover radiation therapy.

If you’re a hospital inpatient, you will pay the Part A deductible and coinsurance, if applicable. If you receive radiation therapy as an outpatient or at a freestanding clinic, you must pay 20% of the Medicare-approved amount after you meet the Medicare Part B deductible.

Medicare Advantage plans cover radiation therapy and any other services that Medicare Part A and B cover but may have different deductibles and cost-sharing. Review your “Summary of Benefits and Coverage” to know how much radiation therapy may cost you.

If you’re concerned about the cost of radiation therapy, you may consider choosing a Medicare Supplement plan paired with Original Medicare, a Medicare Advantage plan, or a cancer care insurance plan. Call and speak with your local licensed Connie Health agent to discover whether one of these plans might suit you.

The type of cancer treatment you receive depends on the type and stage. Aside from surgery, chemotherapy, and radiation therapy, other cancer treatments include:

Some treatments are covered by Original Medicare Parts A, B, and D and Medicare Advantage plans. You should review your “Summary of Benefits of Coverage to determine the coverage of treatment and cost. You’ll most likely need to meet the deductible and pay a 20% coinsurance or more, plus copayments.

If you’re worried about affording treatment, you may want to consider a Medicare Supplement or Medicare Advantage plan. Or a cancer care insurance plan that will provide you with a lump sum to help with the costs – sometimes even after a cancer diagnosis. Speak with a local Connie Health agent to discover if one of these plans works for you.

Original Medicare does not have an out-of-pocket maximum, and with a cancer diagnosis, those costs add up quickly. With Original Medicare – alone – cancer patients can spend nearly 25% of their total annual household income on out-of-pocket medical expenses.

That’s why we advocate for supplemental coverage from a Medicare Supplement (Medigap) or Medicare Advantage plan, and cancer care insurance.

Original Medicare Parts A and B, plus Medicare Part D and a Medicare Supplement (Medigap) plan, often provide the most comprehensive coverage for cancer patients. That’s because the Medigap plan covers most out-of-pocket costs, and Original Medicare enables you to see any provider that accepts Medicare. You may also opt for cancer care insurance.

Agent tip:

“Medigap plans limit most out-of-pocket expenses and enable you to see any provider that accepts Medicare. This supplemental coverage, paired with Original Medicare and a Part D plan, is often the most comprehensive for cancer patients.“

If you’ve been diagnosed with cancer and you’re not in your Medigap Open Enrollment Period, you’ll likely be unable to enroll without a “Guaranteed Issue.” Call a Connie Health agent to see if you have a Guaranteed Issue Right.

The next best option is a Medicare Advantage Prescription Drug plan with or without cancer care insurance. A Medicare Advantage plan offers the same benefits as Original Medicare Parts A and B but with an out-of-pocket maximum.

Agent tip:

“Original Medicare does not have an out-of-pocket maximum. With a Medicare Advantage plan you get all the same coverage as Original Medicare, but with an out-of-pocket maximum and extra benefits.“

The downside is that you may have a more limited network of providers, and some of the top cancer hospitals, like the Mayo Clinic, don’t accept Medicare Advantage plans. When choosing a Medicare Advantage, ensure that your providers and hospital network are in-network. Call your local Connie Health agent to determine the best plan for your needs.

If you choose a Medicare Supplement or Medicare Advantage plan, you may also want to consider cancer care insurance. Even with a cancer diagnosis, you may qualify. These plans offer a lump sum payment upon a cancer diagnosis, helping you pay for your care and decreasing your financial worry.

Agent tip:

“Cancer care insurance provides a lump sum payment upon a cancer diagnosis. This is a plan that can be paired with a Medicare Supplement or Medicare Advantage plan, or with Original Medicare alone.“

A local Connie Health agent can help you walk through your options to enroll in Medicare for the first time or make a plan change. And we can help you decide whether cancer care insurance would help you. We’re here to support you throughout your Medicare journey.

Did you know February 4th is World Cancer Day? It’s a global uniting initiative to raise worldwide awareness, improve education, and reimagine a world where millions of preventable cancer deaths are saved and life-saving cancer treatment and care are equitable for all. Connie Health supports the efforts of World Cancer Day and actively works to advance cancer prevention awareness.

We hope that you’ll share this information with others so that we can increase cancer screenings, decrease the occurrence of cancer, and increase survival rates.

Yes. Original Medicare covers common cancer treatments such as chemotherapy, radiation therapy, and surgery.

Medicare Part A covers chemotherapy if you’re an inpatient, while Medicare Part B covers chemotherapy if you’re an outpatient or a patient in a doctor’s office or clinic. Sometimes, Medicare Part B doesn’t cover a chemo drug. Then, your Medicare Part D prescription drug plan may cover the drug, but you should review your Part D plan’s formulary. Medicare Advantage plans cover any services provided by Original Medicare.

As a hospital outpatient, chemotherapy requires a copayment. In a doctor’s office or freestanding clinic, you pay 20% of the Medicare-approved amount after the Part B deductible. If you have a Medicare Advantage plan, you should review the “Summary of Benefits and Coverage” to understand the out-of-pocket costs of chemotherapy.

Radiation therapy is another standard cancer treatment. Original Medicare Part A covers radiation therapy as an inpatient, and Part B covers outpatients and coverage at freestanding clinics. Medicare Advantage plans also cover radiation therapy. Inpatients will pay the Part A deductible and coinsurance, if applicable. As an outpatient or at a freestanding clinic, you pay 20% of the Medicare-approved amount after the Part B deductible.

Another standard cancer treatment is surgery. Again, Medicare Part A covers inpatient stays. Medicare Part B covers outpatient surgeries. Medicare Advantage plans offer the same coverage. It’s hard to predict out-of-pocket costs for surgery, but you should expect to pay Part A and Part B deductibles depending on whether you’re an inpatient or outpatient. And with Part B, there is a 20% coinsurance of the Medicare-approved amount.

Yes, Medicare Advantage and Medicare Advantage Prescription Drug plans cover cancer treatment.

The great thing about Medicare Advantage plans is that they cover the same cancer treatments as Original Medicare Part A and Part B but with an out-of-pocket maximum. Whether you’re receiving cancer treatments such as surgery, chemotherapy, radiation therapy, or others, whatever Original Medicare covers, Medicare Advantage plans cover.

Yes, Original Medicare and Medicare Advantage plans cover cancer treatment after age 76. You must pay any required deductibles, copayments, and coinsurance for treatment.

Unlike cancer treatment, there are some preventative or cancer screenings that are not covered after specific ages. If you wanted to get these screenings after the cut-off age you would have to pay out-of-pocket.

Yes, Original Medicare pays for cancer treatment. However, it doesn’t pay for the entire cost of cancer treatment, which could include surgery, chemotherapy, and radiation therapy, among other cancer treatments.

With Original Medicare Parts A, you must pay the Part A annual deductible, plus service copayments. With Part B, you must pay the yearly deductible plus 20% coinsurance of the Medicare-approved amount. Remember that with Original Medicare, there is no out-of-pocket maximum so that coinsurance costs could rise quickly.

Medicare Advantage plans cover the same services and cancer treatments as Original Medicare but with an out-of-pocket maximum.

Yes, Medicare Part D prescription drug plans and Medicare Advantage Prescription Drug plans cover cancer drugs, some chemotherapy treatments, and prescription medications. However, you should check your plan’s formulary (list of approved drugs) to ensure coverage and its tier, which can impact your costs.

Original Medicare does not cover wigs for cancer patients because they are not deemed medically necessary during or after cancer treatment. If you have a Medicare Advantage plan, you should check your “Summary of Benefits and Coverage” because many private insurers cover wigs as a prostheses or durable medical equipment (DME) for people undergoing cancer treatment.

If you have Original Medicare, you can see any provider that accepts Medicare. And a Medicare Supplement (Medigap) plan can help you cap out-of-pocket costs for cancer treatment. However, if you are past your Medigap Open Enrollment Period, it could be challenging to switch to or enroll in a Medigap plan if you have a cancer diagnosis.

A Medicare Advantage plan offers the same cancer treatment coverage as Original Medicare but with an out-of-pocket maximum. This can help you limit your costs, compared to having Original Medicare only. Private Medicare Advantage insurers often offer extra benefits and greater coverage than Original Medicare. However, the network of providers accepting Medicare Advantage plans may be smaller, limiting the doctors you can see for cancer treatment.

Read more by Renee van Staveren

Since 2009, I've been writing about complicated, technical issues, with the goal of making topics like Medicare and healthcare easier to understand. I've been writing about Medicare since 2021 and healthcare since 2019. I am an AmeriCorps alumni. I enjoy gardening, reading, and DIYing.