Plans as low as $0 monthly premiums

Find the right Medicare plan for you

- 2024 Medicare Advantage Plan Facts for Plano

- Why Choose a Medicare Advantage Plan?

- Medicare Advantage Companies in Plano

- Top 5 Medicare Advantage Insurance Companies in Plano

- 2024 Plano Medicare Advantage Plans

- Top 9 Medicare Advantage Plans with the Highest Star Ratings in Plano

- Types of Medicare Advantage Plans Available in Plano

- When to Enroll in a Medicare Advantage Plan in Plano

- Medicare Doctors Near Me in Plano, Texas

- Frequently Asked Questions

While there are 182 Medicare Advantage plans in Texas, there are 69 plans available to you in Plano, Texas. Plano is located in Collin County. Connie Health gathered the plan cost and coverage information that matters most to you. Continue reading to discover the Medicare Advantage plan right for your health & budget and when to enroll.

2024 Medicare Advantage Plan Facts for Plano

- 43.05% of Medicare beneficiaries are enrolled in a Medicare Advantage plan in Plano.

- All Medicare beneficiaries in Plano have access to a $0 premium plan.

- There are 49 $0 premium Medicare Advantage plans available in Plano.

- For those that pay a premium, the average is $66.30 per month.

- The average out-of-pocket maximum is $NaN per year.

- The average prescription drug plan deductible (for plans that include Part D) is $351.72 per month.

- There are 26 plans available in Plano that Medicare rated four stars or higher.

- There are 4 Medicare Advantage plan types you can choose from, including: Local HMO, Local PPO, PFFS, Regional PPO.

Why Choose a Medicare Advantage Plan?

There are three primary reasons you may choose to enroll in a Medicare Advantage plan:

- Low or no-cost monthly premiums,

- Lower out-of-pocket costs, and

- Additional benefits such as comprehensive dental, vision, hearing, and more.

1. Low or no-cost monthly premiums

You have access to a Medicare Advantage plan as low as $0 monthly. If you don't qualify for a $0 premium plan, the average is $66.30 per month. This premium is low, especially compared to a Medicare Supplement plan or your Part B premiums.

2. Lower out-of-pocket costs

Original Medicare doesn't cap their out-of-pocket costs, so you could end up with unexpectedly high medical bills. With Original Medicare Part B, you must pay the premium, deductible, and 20% coinsurance for Medicare-approved services and procedures. The 20% can add up.

3. Additional benefits not available with Original Medicare

Want routine dental coverage? Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) don't offer comprehensive dental, vision, or hearing coverage. These services would be entirely out-of-pocket for you.

The good news? Medicare Advantage plans have low or no-cost premiums, an out-of-pocket maximum, offer additional benefits, and are regulated by the Centers for Medicare & Medicaid Services (CMS). With a Medicare Advantage plan, you could receive prescription drug coverage, routine dental, vision, hearing, transportation, reduced cost-sharing, a gym membership, and more.

Medicare Advantage Companies in Plano

13 insurance companies offer Medicare Advantage plans in Plano.

| Organization Name |

|---|

| Humana |

| Wellcare |

| UnitedHealthcare |

| Blue Cross and Blue Shield of NM, TX |

| Baylor Scott & White Health Plan |

| Care N' Care Insurance Company |

| Aetna Medicare |

| Wellpoint |

| Cigna Healthcare |

| Blue Cross and Blue Shield of OK, TX |

| Wellcare by Allwell |

| Molina Healthcare of Texas, Inc. |

| Blue Cross and Blue Shield of Texas |

Top 5 Medicare Advantage Insurance Companies in Plano

These 5 Medicare Advantage insurance companies enroll the largest amount of Medicare beneficiaries in Plano. They offer the most popular plans.

| # | Organization Name |

|---|---|

| 1 | Unitedhealthcare Benefits Of Texas, Inc. |

| 2 | Sierra Health And Life Insurance Company, Inc. |

| 3 | Humana Insurance Company |

| 4 | Cha Hmo, Inc. |

| 5 | Care Improvement Plus South Central Insurance Co. |

2024 Plano Medicare Advantage Plans

There are 69 Medicare Advantage plans to choose from in Plano. Below are the many available options. Click on any of the links to review additional plan details.

| Medicare Advantage Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|

| Humana Gold Plus H0028-043 (HMO) | Local HMO | $0.00 | $3,450.00 | $0.00 | 4 |

| Humana Gold Plus H0028-059 (HMO) | Local HMO | $26.00 | $3,450.00 | $0.00 | 4 |

| Wellcare Assist (HMO) | Local HMO | $22.40 | $3,450.00 | $535.00 | 3 |

| Wellcare No Premium (HMO) | Local HMO | $0.00 | $4,900.00 | $0.00 | 3 |

| Wellcare Giveback (HMO) | Local HMO | $0.00 | $8,850.00 | $545.00 | 3 |

| AARP SecureHorizons Medicare Advantage TX-0022 (HMO-POS) | Local HMO | $0.00 | $3,800.00 | $0.00 | 4.5 |

| AARP Medicare Advantage Patriot No Rx TX-MA02 (HMO-POS) | Local HMO | $0.00 | $5,400.00 | - | 4.5 |

| AARP SecureHorizons Medicare Advantage TX-0025 (HMO-POS) | Local HMO | $68.00 | $3,200.00 | $0.00 | 4.5 |

| AARP Medicare Advantage from UHC TX-0027 (HMO-POS) | Local HMO | $0.00 | $3,800.00 | $0.00 | 4.5 |

| AARP Medicare Advantage from UHC TX-0039 (HMO-POS) | Local HMO | $0.00 | $6,500.00 | $295.00 | 4.5 |

| AARP Medicare Advantage from UHC TX-0042 (HMO-POS) | Local HMO | $24.00 | $3,300.00 | $0.00 | 4.5 |

| AARP Medicare Advantage from UHC TX-0005 (PPO) | Local PPO | $0.00 | $6,300.00 | $260.00 | 3.5 |

| AARP Medicare Advantage Patriot No Rx TX-MA06 (PPO) | Local PPO | $0.00 | $6,900.00 | - | 3.5 |

| Blue Cross Medicare Advantage Choice Premier (PPO) | Local PPO | $88.00 | $6,355.00 | $295.00 | 3 |

| Blue Cross Medicare Advantage Choice Plus (PPO) | Local PPO | $0.00 | $7,950.00 | $545.00 | 3 |

| BSW SeniorCare Advantage (PPO) | Local PPO | $0.00 | $6,400.00 | $300.00 | 3.5 |

| Care N' Care Classic (HMO) | Local HMO | $0.00 | $3,900.00 | $0.00 | 3 |

| Southwestern Health Select (HMO) | Local HMO | $0.00 | $3,200.00 | $0.00 | 3 |

| Aetna Medicare Freedom Plan (PPO) | Local PPO | $0.00 | $6,350.00 | $150.00 | Plan too new to be measured |

| Aetna Medicare Eagle II (PPO) | Local PPO | $0.00 | $5,000.00 | - | Plan too new to be measured |

| Wellpoint Medicare Advantage 2 (HMO) | Local HMO | $0.00 | $8,300.00 | $0.00 | 3 |

| Aetna Medicare Value Plus (PPO) | Local PPO | $23.00 | $6,350.00 | $300.00 | 3.5 |

| Aetna Medicare Choice Plan (PPO) | Local PPO | $0.00 | $6,500.00 | $250.00 | 3.5 |

| Cigna Preferred Medicare (HMO) | Local HMO | $0.00 | $3,100.00 | $0.00 | 4 |

| Cigna Preferred Savings Medicare (HMO) | Local HMO | $0.00 | $6,700.00 | $0.00 | 4 |

| Aetna Medicare Prime Plan (HMO) | Local HMO | $0.00 | $3,850.00 | $150.00 | 4 |

| Blue Cross Medicare Advantage Classic (PPO) | Local PPO | $0.00 | $5,900.00 | $200.00 | 3 |

| Blue Cross Medicare Advantage Flex (PPO) | Local PPO | $238.00 | $0.00 | $545.00 | 3 |

| Blue Cross Medicare Advantage Saver Plus (PPO) | Local PPO | $0.00 | $7,550.00 | $545.00 | 3 |

| Blue Cross Medicare Advantage Dental Premier (PPO) | Local PPO | $0.00 | $6,700.00 | $545.00 | 3 |

| Blue Cross Medicare Advantage Health Choice (PPO) | Local PPO | $0.00 | $6,900.00 | $545.00 | 3 |

| Blue Cross Medicare Advantage Protect (PPO) | Local PPO | $0.00 | $6,350.00 | - | 3 |

| HumanaChoice H5216-042 (PPO) | Local PPO | $65.00 | $6,700.00 | $200.00 | 4.5 |

| HumanaChoice H5216-043 (PPO) | Local PPO | $16.00 | $7,200.00 | $0.00 | 4.5 |

| Humana USAA Honor (PPO) | Local PPO | $0.00 | $5,400.00 | - | 4.5 |

| Humana USAA Honor (PPO) | Local PPO | $0.00 | $6,900.00 | - | 4.5 |

| Humana USAA Honor with Rx (PPO) | Local PPO | $0.00 | $6,900.00 | $480.00 | 4.5 |

| HumanaChoice H5216-352 (PPO) | Local PPO | $0.00 | $5,800.00 | $0.00 | 4.5 |

| Wellcare Patriot No Premium (HMO) | Local HMO | $0.00 | $3,450.00 | - | 3 |

| Wellcare Complement Assist (HMO) | Local HMO | $21.10 | $3,450.00 | $505.00 | 3 |

| Erickson Advantage Signature (HMO-POS) | Local HMO | $168.00 | $2,600.00 | $0.00 | 5 |

| Erickson Advantage Liberty no Rx (HMO-POS) | Local HMO | $0.00 | $7,300.00 | - | 5 |

| Erickson Advantage Freedom (HMO-POS) | Local HMO | $64.00 | $4,300.00 | $0.00 | 5 |

| Erickson Advantage Liberty (HMO-POS) | Local HMO | $0.00 | $7,300.00 | $0.00 | 5 |

| Care N' Care Choice Premium (PPO) | Local PPO | $195.00 | $3,500.00 | $0.00 | 3.5 |

| Care N' Care Choice Plus (PPO) | Local PPO | $50.00 | $3,900.00 | $0.00 | 3.5 |

| Care N' Care Choice (PPO) | Local PPO | $0.00 | $4,300.00 | $0.00 | 3.5 |

| Care N' Care Choice MA-Only (PPO) | Local PPO | $0.00 | $2,500.00 | - | 3.5 |

| Wellcare Mutual of Omaha No Premium Open (PPO) | Local PPO | $0.00 | $5,900.00 | $200.00 | 2.5 |

| Wellcare No Premium Rx Plus Open (PPO) | Local PPO | $0.00 | $6,000.00 | $300.00 | 2.5 |

| Wellcare Mutual of Omaha No Premium Secure Open (PPO) | Local PPO | $0.00 | $4,900.00 | $0.00 | 2.5 |

| Molina Medicare Choice Care (HMO) | Local HMO | $0.00 | $8,300.00 | $125.00 | 2.5 |

| Molina Medicare Choice Care Select (HMO) | Local HMO | $0.00 | $8,300.00 | $200.00 | 2.5 |

| Cigna True Choice Savings Medicare (PPO) | Local PPO | $0.00 | $6,100.00 | $0.00 | 3 |

| Cigna True Choice Courage Medicare (PPO) | Local PPO | $0.00 | $5,700.00 | - | 3 |

| Cigna True Choice Medicare (PPO) | Local PPO | $0.00 | $6,400.00 | $0.00 | 3 |

| BSW SeniorCare Advantage Select Rx (HMO-POS) | Local HMO | $0.00 | $5,000.00 | $0.00 | 4 |

| BSW SeniorCare Advantage Select (HMO-POS) | Local HMO | $0.00 | $5,550.00 | - | 4 |

| BSW SeniorCare Advantage Select Rx Assist (HMO-POS) | Local HMO | $28.40 | $5,000.00 | $545.00 | 4 |

| Humana Gold Choice H8145-084 (PFFS) | PFFS | $45.00 | - | $250.00 | 4 |

| Humana Gold Choice H8145-126 (PFFS) | PFFS | $15.00 | - | - | 4 |

| Aetna Medicare Value Plan (HMO) | Local HMO | $0.00 | $3,850.00 | $0.00 | 3 |

| Blue Cross Medicare Advantage Value (HMO) | Local HMO | $0.00 | $3,850.00 | $0.00 | 3 |

| Blue Cross Medicare Advantage Dental Value (HMO) | Local HMO | $0.00 | $3,850.00 | $545.00 | 3 |

| Blue Cross Medicare Advantage Saver (HMO) | Local HMO | $0.00 | $6,900.00 | $0.00 | 3 |

| HumanaChoice R4182-001 (Regional PPO) | Regional PPO | $0.00 | $5,100.00 | - | 3.5 |

| HumanaChoice R4182-003 (Regional PPO) | Regional PPO | $72.00 | $6,900.00 | $175.00 | 3.5 |

| HumanaChoice R4182-004 (Regional PPO) | Regional PPO | $49.00 | $6,900.00 | $275.00 | 3.5 |

| UHC Medicare Advantage TX-0030 (Regional PPO) | Regional PPO | $48.00 | $7,550.00 | $395.00 | 3.5 |

Top 26 Medicare Advantage Plans with the Highest Star Ratings in Plano

The Centers for Medicare and Medicaid Services (CMS) rates all Medicare Advantage plans on a scale of 1 to 5 stars. Plans with one star are considered “poor,” while those with five stars are considered “excellent.” Any plan that is four stars and higher is a “top-rated” plan. These are the plans with the highest star ratings in Plano.

| # | Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|---|

| 1 | Erickson Advantage Signature (HMO-POS) | Local HMO | $168.00 | $2,600.00 | $0.00 | 5 |

| 2 | Erickson Advantage Liberty no Rx (HMO-POS) | Local HMO | $0.00 | $7,300.00 | - | 5 |

| 3 | Erickson Advantage Freedom (HMO-POS) | Local HMO | $64.00 | $4,300.00 | $0.00 | 5 |

| 4 | Erickson Advantage Liberty (HMO-POS) | Local HMO | $0.00 | $7,300.00 | $0.00 | 5 |

| 5 | AARP SecureHorizons Medicare Advantage TX-0022 (HMO-POS) | Local HMO | $0.00 | $3,800.00 | $0.00 | 4.5 |

| 6 | AARP Medicare Advantage Patriot No Rx TX-MA02 (HMO-POS) | Local HMO | $0.00 | $5,400.00 | - | 4.5 |

| 7 | AARP SecureHorizons Medicare Advantage TX-0025 (HMO-POS) | Local HMO | $68.00 | $3,200.00 | $0.00 | 4.5 |

| 8 | AARP Medicare Advantage from UHC TX-0027 (HMO-POS) | Local HMO | $0.00 | $3,800.00 | $0.00 | 4.5 |

| 9 | AARP Medicare Advantage from UHC TX-0039 (HMO-POS) | Local HMO | $0.00 | $6,500.00 | $295.00 | 4.5 |

| 10 | AARP Medicare Advantage from UHC TX-0042 (HMO-POS) | Local HMO | $24.00 | $3,300.00 | $0.00 | 4.5 |

| 11 | HumanaChoice H5216-042 (PPO) | Local PPO | $65.00 | $6,700.00 | $200.00 | 4.5 |

| 12 | HumanaChoice H5216-043 (PPO) | Local PPO | $16.00 | $7,200.00 | $0.00 | 4.5 |

| 13 | Humana USAA Honor (PPO) | Local PPO | $0.00 | $5,400.00 | - | 4.5 |

| 14 | Humana USAA Honor (PPO) | Local PPO | $0.00 | $6,900.00 | - | 4.5 |

| 15 | Humana USAA Honor with Rx (PPO) | Local PPO | $0.00 | $6,900.00 | $480.00 | 4.5 |

| 16 | HumanaChoice H5216-352 (PPO) | Local PPO | $0.00 | $5,800.00 | $0.00 | 4.5 |

| 17 | Humana Gold Plus H0028-043 (HMO) | Local HMO | $0.00 | $3,450.00 | $0.00 | 4 |

| 18 | Humana Gold Plus H0028-059 (HMO) | Local HMO | $26.00 | $3,450.00 | $0.00 | 4 |

| 19 | Cigna Preferred Medicare (HMO) | Local HMO | $0.00 | $3,100.00 | $0.00 | 4 |

| 20 | Cigna Preferred Savings Medicare (HMO) | Local HMO | $0.00 | $6,700.00 | $0.00 | 4 |

| 21 | Aetna Medicare Prime Plan (HMO) | Local HMO | $0.00 | $3,850.00 | $150.00 | 4 |

| 22 | BSW SeniorCare Advantage Select Rx (HMO-POS) | Local HMO | $0.00 | $5,000.00 | $0.00 | 4 |

| 23 | BSW SeniorCare Advantage Select (HMO-POS) | Local HMO | $0.00 | $5,550.00 | - | 4 |

| 24 | BSW SeniorCare Advantage Select Rx Assist (HMO-POS) | Local HMO | $28.40 | $5,000.00 | $545.00 | 4 |

| 25 | Humana Gold Choice H8145-084 (PFFS) | PFFS | $45.00 | - | $250.00 | 4 |

| 26 | Humana Gold Choice H8145-126 (PFFS) | PFFS | $15.00 | - | - | 4 |

Find the right Medicare plan for you

Types of Medicare Advantage Plans Available in Plano

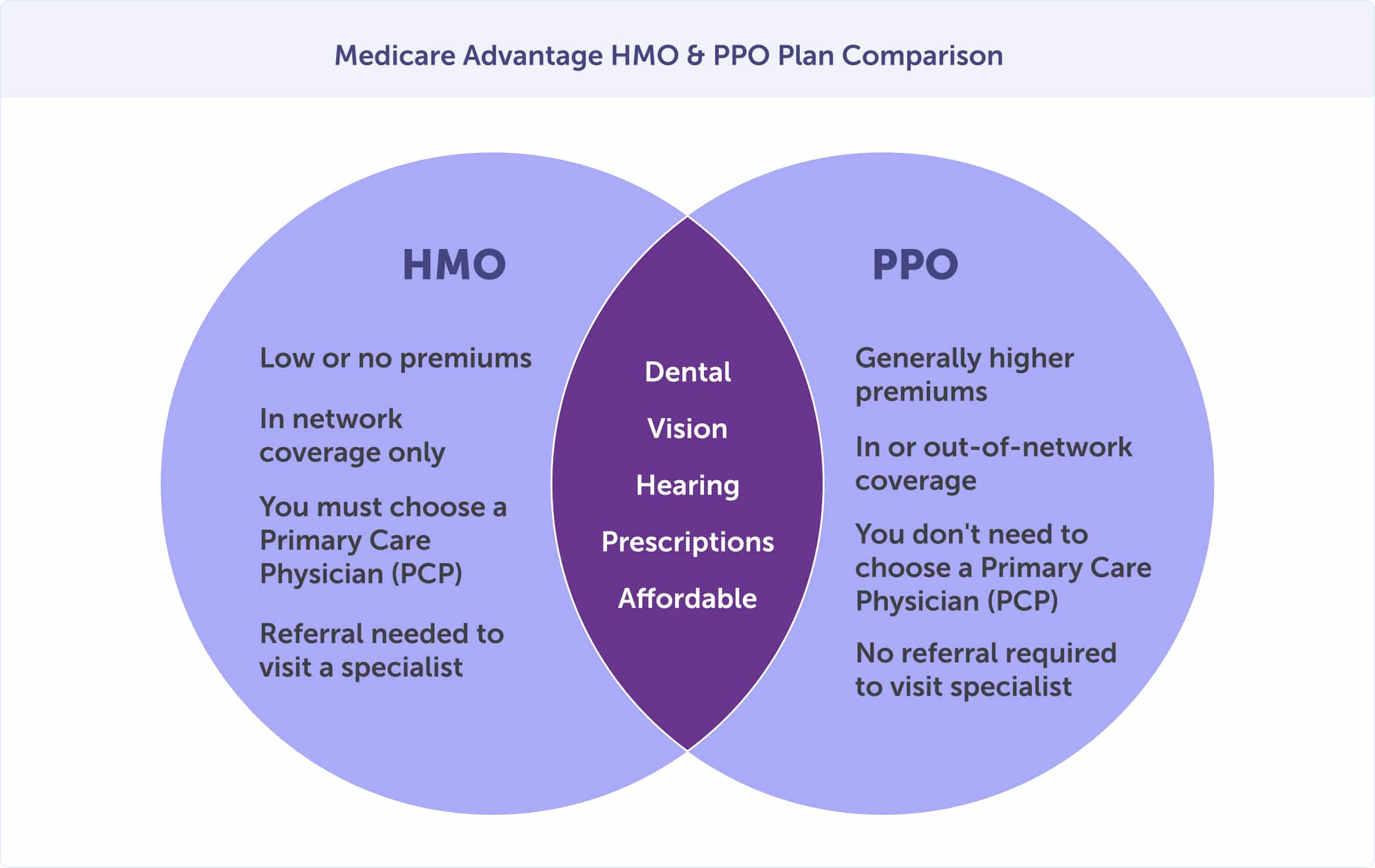

There 4 are Medicare Advantage plan types you can choose from in Plano. These include: Local HMO, Local PPO, PFFS, Regional PPO. Not sure which is the best plan for your health needs and budget? We'll walk you through the most popular plan types: Local HMO, Local PPO, PFFS, Regional PPO. At the end of this section, you'll understand the difference between these three most popular plan types.

Medicare Advantage HMO Plans

You have 32 Medicare Advantage HMO plans to choose from in Plano. An HMO, or Health Maintenance Organization, is a type of health plan that limits coverage to in-network care from doctors who work for or contract with the HMO. Typically, HMO plans won't cover out-of-network care except in an emergency.

Medicare Advantage PPO Plans

There are 35 Medicare Advantage PPO plans in Plano. A PPO, or Preferred Provider Organization, is a type of health plan where you pay less to use doctors in the plan's network. Unlike an HMO, you can see doctors and specialists and use a hospital outside the network without a referral for an additional cost.

Medicare Advantage Special Needs Plans (SNPs)

Special Needs Plans, or SNPs, are a type of Medicare Advantage plan. There are two types of Special Needs Plans that may be available to you: Chronic Special Needs Plans (C-SNP) and Dual Special Needs Plans (D-SNP).

Chronic Special Needs Plans (C-SNP) are limited to people with specific illnesses or characteristics. For example, you may qualify for a C-SNP if you have diabetes, End-Stage Renal Disease (ESRD), HIV/AIDS, dementia, chronic heart failure, or other qualifying illness. Medicare C-SNPs tailor benefits, provider choices, and drug formularies to meet the needs of the special needs groups they serve.

You may qualify for a Dual Special Needs Plan (D-SNP) if you are eligible for Medicare and Medicaid. With a D-SNP, the State of Texas may cover your Medicare costs, depending on your eligibility.

Veteran Benefits & Medicare

If you or your spouse are veterans, you likely have VA benefits. However, the U.S. Department of Veteran Affairs encourages you to sign up for Medicare as soon as you are eligible. Here are three reasons you should speak to a local licensed agent about how VA benefits and Medicare work together:

- Having Medicare means you're covered when you need care from a non-VA hospital or doctor, which also offers you greater health options.

- VA benefits and health care could change in the future, so you should enroll in every health care benefit that you are eligible for.

- If you lose VA benefits and aren't enrolled in Medicare, you could face Medicare Part B and Part D lifetime late enrollment penalties.

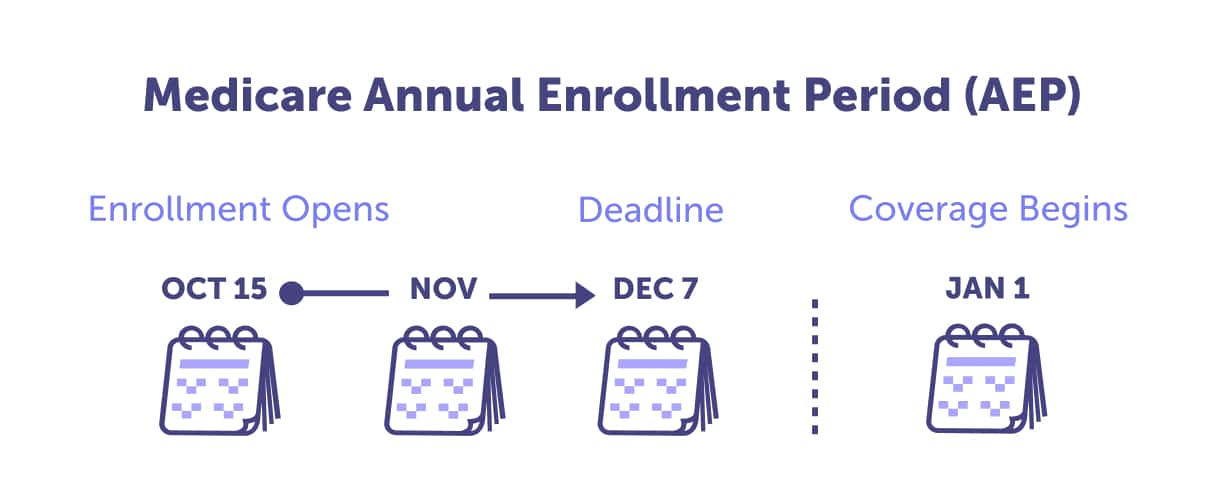

When to Enroll in a Medicare Advantage Plan in Plano

Knowing when to enroll or make plan changes can help you save money.

Enrolling in a Medicare Advantage plan for the first time, or are you interested in making a plan change? Skip to the section that applies to you - and mark the dates in your calendar.

Enroll for the First Time

If you're new to Medicare, the best time to enroll in a Medicare Advantage plan is during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period (January 1 - March 31) or Special Enrollment Period, but likely with penalties.

Make a Plan Change

The best time to make a plan change is during the Medicare Annual Enrollment Period (October 15 - December 7). During this time, anyone enrolled in Medicare can review their plan options for the coming year and ensure that their plan choice meets their health and budget needs.

If you need to make a plan change because you moved to a new service area or lost coverage, among other reasons, you could qualify for a Special Enrollment Period.

Whether you're enrolling for the first time or making a plan change, a Medicare Advantage plan could fit your health and budget needs. Medicare in Texas can be confusing, and you don't have to sift through your options alone.

Medicare Doctors Near Me in Plano, Texas

Struggling to find a trustworthy doctor who accepts your Medicare plan? It can be a daunting task but don't worry. With Connie Health, you can easily locate Medicare doctors near you.

No more endless phone calls or web searches. Our platform lets you enter your address and plan information (if you have it), and we'll do the rest. Let us help you eliminate the stress of finding a physician who accepts Medicare.

Why Connie Health

Local licensed insurance agents:

Independent agents, who live and work in your community, can help you access the best care for you in your area.

Compare all major insurance:

Our technology will help you find the plan that best fits your budget and health needs.

Our service is free:

You receive unbiased advice since our agents receive the same commission regardless of the insurance plan selected.

Ongoing support:

Once you have selected an insurance plan, your dedicated team will help you use your benefits and answer your questions.

Frequently Asked Questions

Let us help you eliminate the stress of finding a physician who accepts Medicare. Find your Medicare doctor today.

Medicare Advantage plans may be available in the following zip codes in Plano, Texas: 75023, 75024, 75025, 75026, 75074, 75075, 75086, 75093, 75094.

Sources

“Explore your Medicare coverage options.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“Monthly MA Enrollment by State/County/Contract.” CMS.gov.

“Prescription Drug Coverage - General Information.” CMS.gov.

“VA healthcare and other insurance.” U.S. Department of Veterans Affairs (VA.gov).

Last updated: July 19, 2024