In Arizona, Medicare Supplement plans are one way to help protect you from the out-of-pocket costs associated with Original Medicare coverage (Parts A and B). Known as Medigap, this coverage option can be used alongside your Original Medicare for added protection but is not a stand-alone plan option.

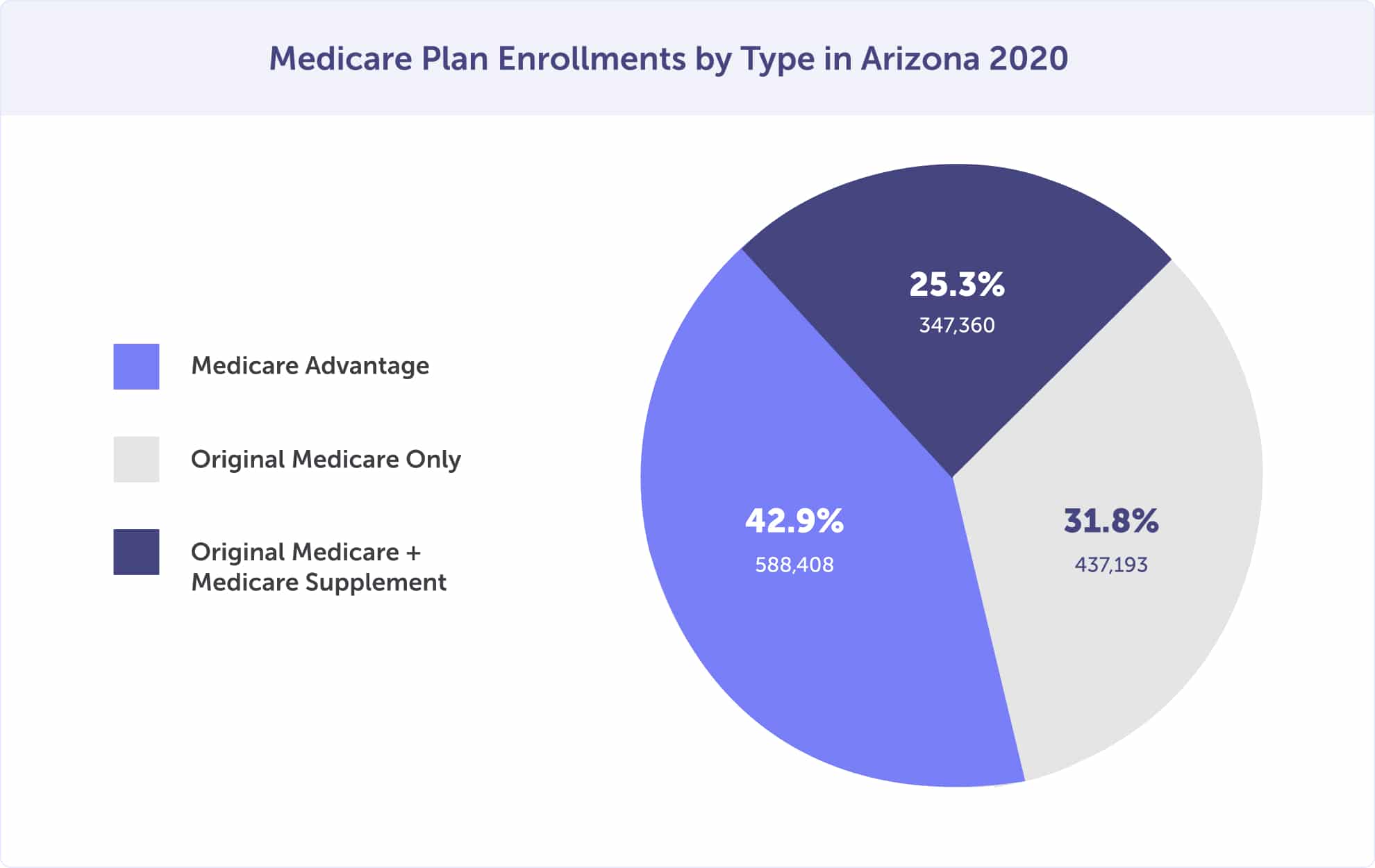

Arizonans are acutely aware of their healthcare needs and the financial risk of Original Medicare – more than 75% of Medicare beneficiaries in Arizona are enrolled in Medicare Supplement or Medicare Advantage coverage to help prevent steep out-of-pocket medical expenses and to reduce the cost of Medicare.

According to The State of Medicare Supplement Coverage by AHIP, Arizona Medicare enrollees continue to prioritize their health care. In 2021, 25.1% (351,769) purchased a Medicare Supplement plan. In 2020, 25.3% (347,360) and 25.6% (340,158) acquired one in 2019. Plus, 50% of Arizonans are enrolled in a more comprehensive coverage option in 2023 – Medicare Advantage.

In 2021, 45.7% (640,844) of Medicare eligibles were enrolled in a Medicare Advantage plan, 25.1% (351,769) enrolled in Original Medicare and an Arizona Medicare Supplement Insurance plan, while the remaining 29.2% (409,736) were enrolled in Original Medicare without a plan to protect them for high out-of-pocket costs.

You are eligible for a Medicare Supplement plan in Arizona if you are enrolled in Medicare Part A and Medicare Part B and live in the plan’s service area.

Medicare Part A and B are great for basic medical expenses, but your out-of-pocket costs could quickly skyrocket if something more serious arises. After paying premiums and deductibles, you’ll still be responsible for 20% of the bill with coinsurance. But help is available – a Medicare Supplement plan can minimize or even cover those extra fees resulting from an extended hospital stay (over 60 days) or skilled nursing facility care over 20 days.

Medicare Supplement plan coverage varies by plan but can include:

Agent tip:

“Don’t miss the Medigap Open Enrollment Period. It’s is a 6-month window when you can enroll without prejudice to prexisting conditions, and when you can get the best policy rate.“

If you’re enrolled in Medicare insurance in Arizona, it’s essential to know that the Centers for Medicare & Medicaid Services (CMS) require you have creditable prescription drug coverage. If your existing plan doesn’t offer this type of protection – such as a Medicare Supplement policy – then adding a separate Part D plan could be the right option to keep yourself covered and compliant with CMS regulations.

Enrolling in a Medicare Part D standalone prescription drug plan simultaneously with your Medicare Supplement Plan can save you from costly penalties. The longer you wait to enroll, the higher the penalty gets, and it stays with you for life once added on. Ensure you have creditable prescription drug coverage to avoid unexpected fees.

Learn more about the types of Arizona Medicare plans.

Avoid lifetime enrollment penalties – Ensure you have creditable prescription drug coverage. Call (623) 223-8884 to speak with a local licensed agent.

Arizona Medicare Supplement plans can offer much-needed financial relief by reducing or eliminating costly out-of-pocket expenses that come with Original Medicare.

Medigap plans are sold by private insurance companies licensed by the Arizona Office of Insurance Regulation; these companies are authorized to sell Medigap plans. All plans must provide identical benefits – the costs, benefits, and customer service vary from carrier to carrier, and each company sets its rates.

There are 10 different types of Medigap Plans available in Arizona: A through G and K through N — every insurer must carry at least Plan A but may offer more than one plan if desired.

There are 10 Medicare Supplement plans, but there may be only a portion for you to choose from. That’s because plans that include coverage for the Part B deductible are no longer taking new enrollments for people who turned 65 on or after January 1, 2020. If you turned 65 before then, you still have the option to enroll in Plan C and Plan F.

The most popular Medicare Supplement plans in Arizona are:

Out of all the plans available for new enrollments in Arizona, Plan G stands out from the rest as it is closest to discontinued Plan F. No wonder this plan has become so popular, becoming second-highest in enrollment among Medicare Supplement plans.

Wondering if Plan G or N is the best plan for your health and budget? Use our online tool to review Medicare Supplement options, or call (623) 223-8884 to speak with a local licensed agent.

Before deciding on an Arizona Medicare Supplement plan, it pays to weigh the monthly premiums against potential out-of-pocket costs. Remember that you might save immediately by choosing plans with lower upfront fees but incur higher expenses later.

Medigap Plan G is a popular choice amongst plans A through G.

Plan G offers benefits such as 100% coinsurance coverage for Part B (after the Part B deductible has been met) and more generous coverages than Original Medicare, including Part A hospice coinsurance and copayment paid at full rate, and three pints of blood per year. In addition to these core services, additional options like skilled nursing facility coinsurance help, Part A deductibles, excess costs related to Part B medical expenses that exceed the government’s limit, and out-of-country emergency care during travel abroad.

Plan N is the most popular amongst Medigap plans K through N. These plans don’t have uniform benefits like plans A – G. Each plan provides a unique level of coverage, and you should consult a local Medicare agent to discuss which plan option is best for your health and budget.

Arizona seniors seeking peace of mind may find it with a Medicare Supplement plan. These comprehensive options offer reliable coverage that won’t fluctuate in cost as you age, giving you the freedom to enjoy your golden years worry-free.

Monthly premiums vary depending on your chosen plan, gender, and whether or not you’re a smoker. Below is an example of the monthly premium cost for someone living in the 85001 zip code. Remember, Medicare is local to the county level. Your results may differ based on your zip code/county, your age, your sex, and whether you smoke.

In 2023, if you’re a 65-year-old non-smoking woman, you can expect to pay a monthly premium between $39 and $511. A woman who smokes can expect to pay between $43 and $562 monthly, depending on plan choice.

If you’re a 65-year-old non-smoking man in Arizona, you can expect to pay between $43 and $579 per month depending on your plan choice. A smoking man can expect to pay between $49 and $637 monthly.

Making a health plan choice can be dizzying. But, similarities exist between Medigap and Medicare Advantage plans. Ultimately it boils down to network flexibility versus overall cost — ensuring you’re aware of every detail before committing is key.

Medicare Supplement plans allow you to choose any carrier across Arizona that Medicare has approved. Conversely, a Medicare Advantage plan is more restrictive with its network but can provide added coverage in areas like dental care, hearing aid services, and vision needs.

Medicare Advantage plans offer an affordable option with average monthly premiums of $12.00; however, Medigap plans can range from a low of $39 to as high as $637 per month, depending on the plan type, gender, and other factors such as smoking status.

With 25% of Arizonans opting for Medigap coverage in 2021 and 50% choosing Medicare Advantage plans by 2023, Arizona seniors are increasingly turning to these options to help protect them from potential out-of-pocket costs associated with Original Medicare.

Not sure whether a Medicare Supplement plan in Arizona or a Medicare Advantage plan is right for you? Review plan options online or call (623) 223-8884 to speak with a local licensed agent to help you sort through your health care plan options.

Concerned about Original Medicare’s out-of-pocket expenses? You’re not alone.

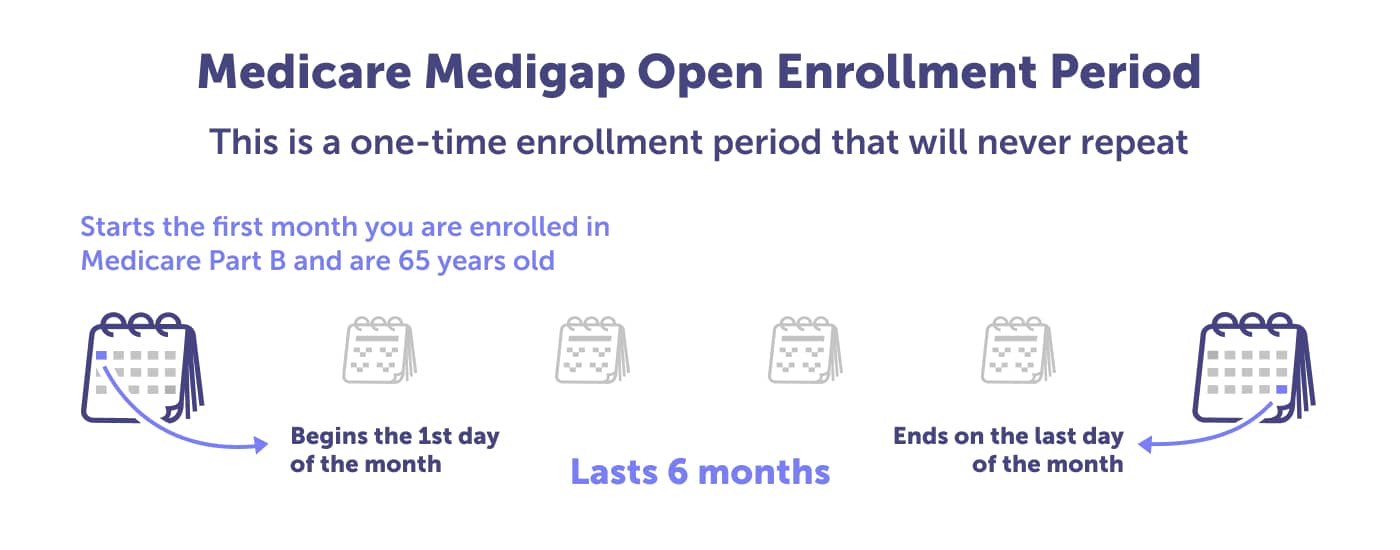

With unpredictable out-of-pocket costs associated with Original Medicare, many Arizonans are turning to a more stable option. During your Medigap Open Enrollment Period, you can enroll in a reliable and cost-effective Medicare Supplement plan – letting you take control of healthcare expenses now and into the future. Don’t miss this chance – secure affordable coverage while guaranteeing acceptance no matter your pre-existing medical status.

If you’re 65 and enrolled in Medicare Part B, taking advantage of your Medigap Open Enrollment Period is crucial. This window only happens once and is limited to six months – so don’t miss out. Make sure that any policy you choose will work for your health and budget; if not, buying a plan later may be possible but could cost more due to past and present medical conditions.

With the Medigap Open Enrollment Period, you have a critical window to apply for Medicare Supplement plans without concerns over pre-existing health conditions. This is why you must mark this critical window on your calendar.

It’s essential to keep up with your Medigap Open Enrollment Period. You must do so to avoid being rejected by insurance companies or charged more for a policy. Without meeting the requirements during the open enrollment period, insurers use medical underwriting to determine whether they should accept an application and how much it will cost – potentially making coverage much less accessible and affordable than if taken advantage of in time.

Some situations exclude you from insurance companies requiring underwriting.

Not sure which Medicare Supplement plan is best for your health and budget? Review your plan options online or call (623) 223-8884 to speak with a local licensed agent who can guide you through your options.

Sources

Guaranteed Issue Right.

How to compare Medigap policies.

MA State/County Penetration, December 2021.

MA State/County Penetration, December 2020.

MA State/County Penetration, December 2019.

Medicare Open Enrollment in Arizona, 2023.

Medicare Supplement Insurance Carriers as of October 2022.

Supplement Insurance (Medigap) plans in Arizona.

The State of Medicare Supplement Coverage, 2023.

The State of Medicare Supplement Coverage, 2022.

The State of Medicare Supplement Coverage, 2021.

When choosing a Medicare supplement plan in Arizona, there is no single “best” option—it depends on your individual needs and budget. Make sure to shop around and compare Medicare plans to find the one that offers you the most comprehensive coverage at an affordable price. Additionally, consider additional benefits such as discounts on prescriptions or vision care services that may save you money in the long run.

There are, however, Medicare Supplement plans that a majority of Arizona residents gravitate towards Medicare Supplement Plan G and Plan N. Most new enrollees choose one of these two Medigap plans in Arizona, and you may want to consider them as you evaluate your options.

Read more by Sammy Menton

I am an Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2009. I enjoy coaching youth and high school sports, watching sports, and spending time with family. I also like taking road trips and vacationing anywhere that has a beach.