Discover how to apply for Part A & B Original Medicare in Texas or private options like Part C, Part D, or Medicare Supplement.

Medicare is designed to provide and reduce the cost of healthcare services in the United States. It is a federal health insurance program.

There were approximately 4.5 million Texans enrolled in Medicare. You’re not alone. If you meet the eligibility criteria, you’ll join the ranks of the 15% of Texans who are Medicare beneficiaries.

In Texas, as in the rest of the country, you’re eligible for Medicare if you meet the following criteria:

If you’re a Texan and meet the criteria above, you can apply for Medicare. As of 2020, 87% of Medicare beneficiaries were eligible due to age, while 13% were eligible due to a Social Security Administration-approved disability.

Becoming eligible for Medicare is a significant milestone. Continue reading to learn about your Medicare options in Texas, plus how and when to apply.

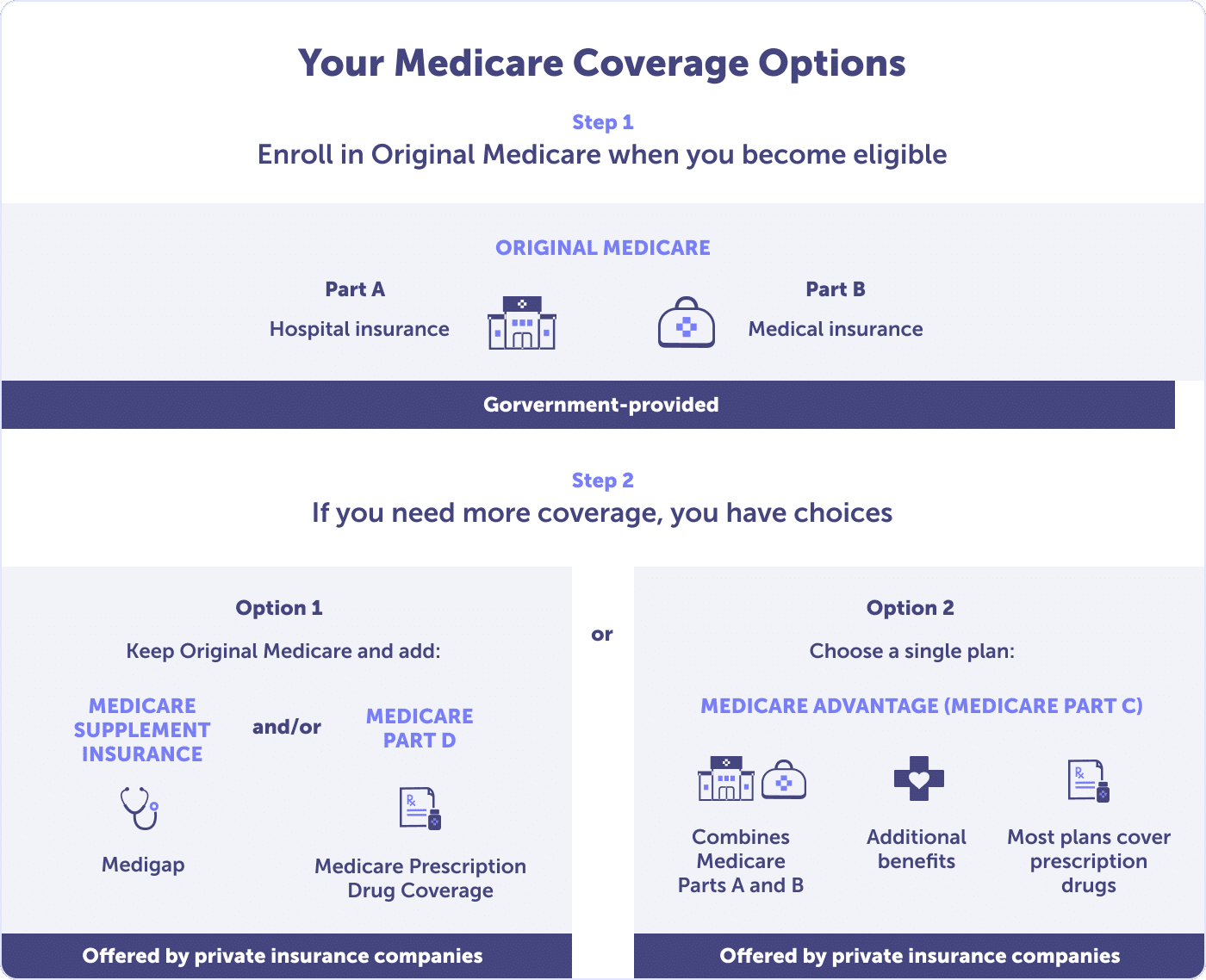

In Texas, you can access both public and private Medicare plan options. Your public option is called Original Medicare and includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Original Medicare doesn’t cover 100% of costs, and most people have a private health plan, like Medicare Part C or Medicare Supplement.

You also have the option of applying through a private health plan approved by the Centers for Medicare and Medicaid Services (CMS). Private options include Medicare Part C (Medicare Advantage or Medicare Advantage Prescription Drug plan), Medicare Part D (Prescription Drug Coverage), and Medicare Supplement (Medigap).

Medicare Part A (hospital insurance) is part of Original Medicare. It covers inpatient care, skilled nursing facility care, short-term nursing home care, hospice care, and home health care. If you choose to enroll in a Medicare Advantage (Medicare Part C) or other Medicare plan, there might be different rules. But your plan must provide at least the same coverage as Part A Original Medicare.

Did you or your spouse earn 40 credits or work and pay FICA taxes for at least ten years? If you meet these criteria and meet the Medicare eligibility requirements, you’ll likely qualify for Medicare Part A, that’s premium-free. If not, you will probably pay a monthly or quarterly premium.

Read more about the inpatient, skilled nursing facility, short-term nursing home care, hospice, and home health care that Medicare Part A provides in What is Medicare Part A and What Does it Cover?

Medicare Part B (medical insurance) is part of Original Medicare. Medicare Part B covers your basic medical needs, such as doctor visits, lab tests, and medical equipment. Coverage includes orthopedic, cardiology, radiology, and any other specialist services. You can also get screenings for medical conditions, shots, and an annual wellness checkup without a copay, among other services.

If you are eligible to enroll in Medicare Part A, you can also enroll in Part B. However, Part B is not premium-free and doesn’t cover 100% of the costs. Instead, Part B covers 80% of costs, with the remaining 20% being your responsibility.

Your Medicare Part B costs include an annual deductible, cost-sharing, and a monthly or quarterly premium. Your monthly premium is based upon your income, so if your income fluctuates, or if you make above a certain threshold, your monthly premium may be higher.

Read more about what Medicare Part B covers in What is Medicare Part B and What Does it Cover? Curious about Part B’s costs? Read Cost of Medicare Part B Premium, Deductible & More.

Because you must pay a premium for Part B coverage, you can turn it down or delay enrollment. If you make a choice not to sign up for Medicare Part B and then decide to later on, your medical coverage could be delayed, and you may have to pay a higher monthly premium for as long as you have Medicare Part B.

Agent tip:

“If you make a choice not to sign up for Medicare Part B and then decide to later on, your medical coverage could be delayed, and you may pay a higher monthly premium for as long as you have Medicare Part B.“

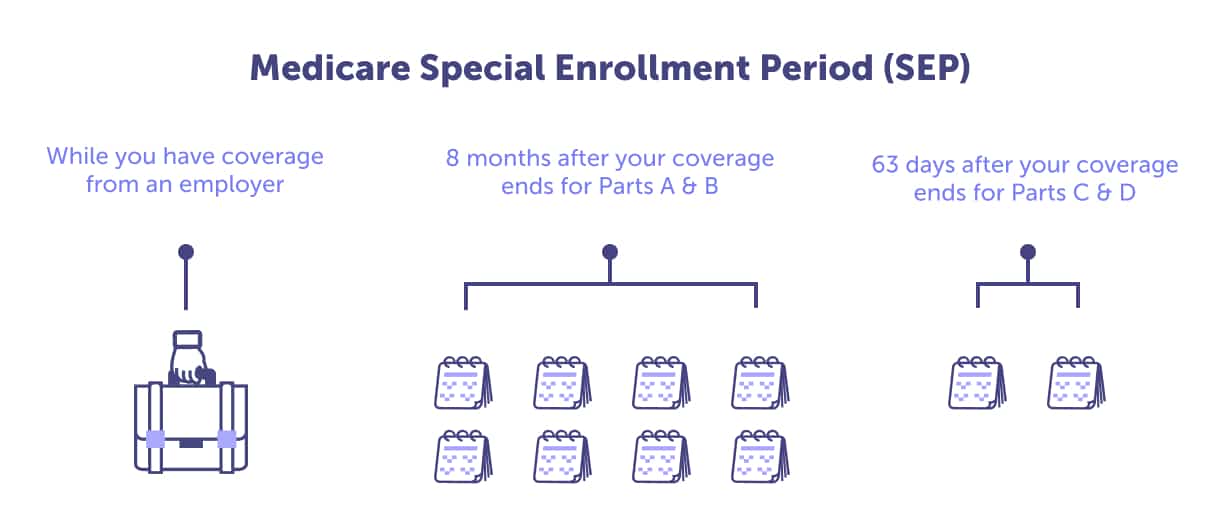

That premium could go up 10 percent for each 12-month period you were eligible for Part B and chose not to sign up—unless you qualify for a Special Enrollment Period (SEP).

Not sure whether enrolling in Medicare Part B is the right choice for you? Speak with a local licensed Medicare agent who can guide you through your Medicare journey. Call (623) 223-8884.

Are you 65 or turning 65? Your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after your birthday. You have a seven-month window to enroll in Medicare.

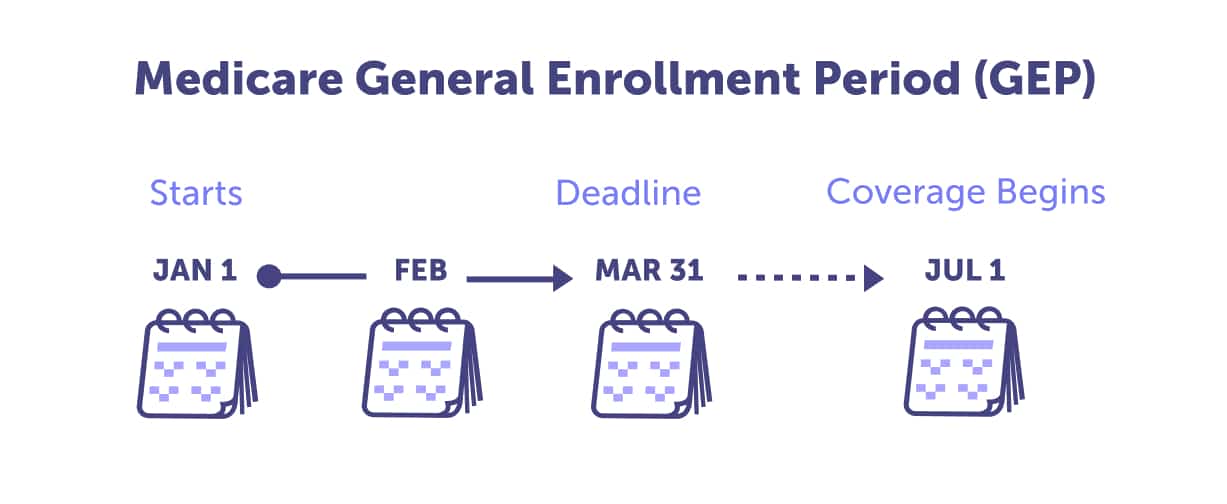

Should you not enroll in Medicare Part A & B during your Initial Enrollment Period, the two other chances you have is the General Enrollment Period from January 1st through March 31st. Your coverage would begin on July 1st of the year you enroll. Or a Special Enrollment Period, if you’re eligible.

Suppose you already receive Social Security or Railroad Retirement Board (RRB) benefits. In that case, you’ll be automatically enrolled in Medicare Part A & B starting the first day of the month you turn 65. If your birthday is on the first day of the month, Part A & B will begin on the first day of the prior month.

Do you have private health insurance through your or your spouse’s employer? You can choose to have that private insurance and Part A until you retire and receive Social Security benefits. If you aren’t receiving benefits from the Social Security Administration (SSA) or RRB at least four months before turning 65, you’ll need to sign up with Social Security Administration to get Medicare Part A and Part B.

You will automatically receive Medicare Part A and Part B after receiving disability benefits from the Social Security Administration for 24 months or certain disability benefits from the Railroad Retirement Board for 24 months. You should receive your red, white, and blue Medicare card in the mail three months before your 25th month of disability (your 22nd month of disability).

You can choose whether to enroll in Medicare or not. You can enroll in Part A and Part B if you’re eligible for Medicare because of End-Stage Renal Disease (ESRD). You can choose whether or not to sign up for Part B. However, you’ll need Part A and Part B to cover certain services under Medicare, including dialysis and kidney transplant services.

If you have Amyotrophic Lateral Sclerosis (ALS), you’ll automatically get Medicare Part A and Part B the month your disability benefits begin. You’ll receive your red, white, and blue Medicare card the month that your disability benefits begin.

You can sign up for Medicare Part A and Part B through the Social Security Administration. However, we recommend that you speak with a local licensed agent to help guide you through your Medicare journey. Call (623) 223-8884 to have a trusted member of your community support you through the process.

Medicare Advantage (MA), also known as Medicare Part C, is an alternative to Original Medicare (Part A & B). Approximately 52% of Texans are on a Medicare Advantage plan. This is higher than the national average of 48%.

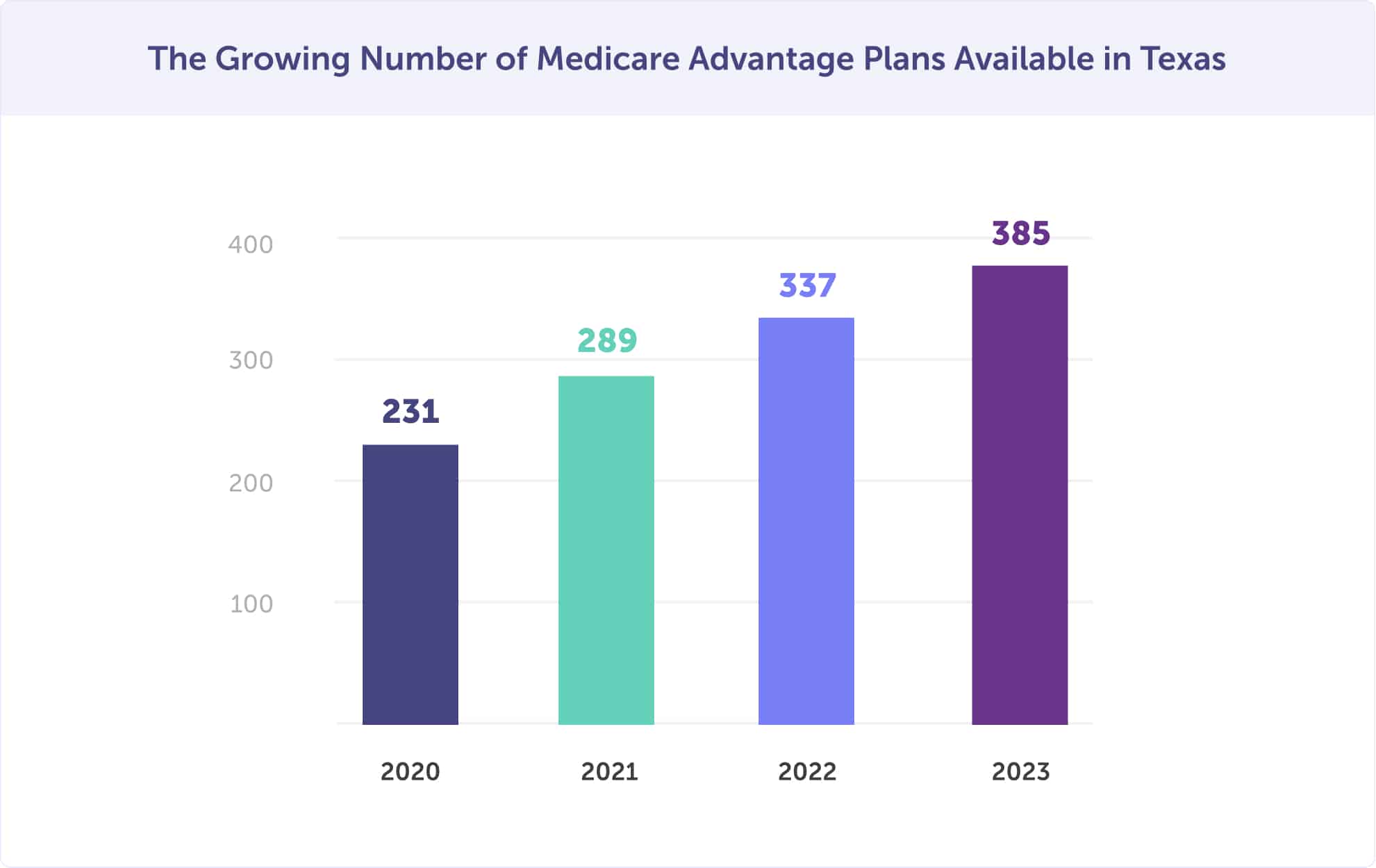

To qualify for an MA plan, you must enroll in Medicare Part A & B and live in the service area of the plan you wish to enroll in. MA plans are very local, down to the county level, and you have many options available. In Texas, in 2024, there are 385 Medicare Advantage plans available. That is up from 337 plans in 2022, 289 plans in 2021, and 231 plans in 2020.

Read more about the benefits, types of plans and costs of Medicare Advantage Plans in Texas.

The best time to enroll in a Medicare Advantage plan is during your Initial Enrollment Period (the seven-month window around when you turn 65). Should you miss your Initial Enrollment Period, you may be eligible to enroll in a Medicare Advantage plan during the General Enrollment Period or the Medicare Advantage Special Election Period (MA SEP). If an election was made during an enrollment period, you could make changes during the Medicare Advantage Open Enrollment Period.

Not sure when’s the right time to enroll in a Medicare Advantage plan? Speak with a local Medicare agent who can guide you through your options. Call (623) 223-8884 or find your plan online.

Medicare Part D, also known as Medicare prescription drug coverage, is a federal program that offers Medicare beneficiaries prescription drug coverage whether you live in Texas or elsewhere. You must be enrolled in Medicare Part A and/or Part B and live in the Part D plan’s service area to qualify.

If you choose to enroll in Medicare Part A & B, you’ll likely need Medicare Part D coverage because it fills the requirement of having creditable coverage. However, if you enroll in a Medicare Advantage plan, you could have creditable coverage through a Medicare Advantage Prescription Drug (MA-PD) plan. You cannot have both a Medicare Advantage Prescription Drug plan and Medicare Part D.

Yes, you must have prescription drug coverage at all times. In fact, if your creditable coverage through your group health plan ends, you must enroll in Part D within 63 days of losing that coverage. Or you could incur a permanent late enrollment penalty when you do decide to enroll in Medicare Part D. And that penalty will be in place for the entire length of your Medicare coverage.

You may qualify for financial assistance for prescription drug costs through a program called Extra Help. The Social Security Administration (SSA) and the Centers for Medicare & Medicaid Services (CMS) work together to provide the benefit. In 2022, 28% of Texans with a stand-alone Medicare prescription drug plan receive Extra Help, also known as a low-income subsidy or LIS.

You must have limited income and resources to qualify for Extra Help. For example, in 2023, your monthly income must be less than $1,823 if single and $2,465 if married. And you should have resources less than $16,660 if single and $33,240 if married.

If you meet these guidelines, you’ll have low or no deductible, low or no premiums, no coverage gap, and will pay much less for your prescriptions. To see if you qualify for Extra Help, contact Connie Health. One of our local agents can help you apply. Call (623) 223-8884.

Suppose you’re enrolling in Medicare Part D for the first time. In that case, you’ll typically do it during your Medicare Part D Initial Enrollment Period, which is usually the same as your Medicare Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period (SEP), if you qualify.

You may qualify for a Special Enrollment Period to enroll in Part D if you had creditable coverage, have job-based drug coverage through you or your spouse’s employer, or are eligible for Extra Help.

A local licensed Connie Health agent can help you determine if you qualify for Extra Help, and can even help you with the application process. Call (623) 223-8884 today.

Medicare Supplement plans, also known as Medigap plans, are used with Original Medicare and are not stand-alone plans. Because Original Medicare does not have a cap on out-of-pocket costs, these plans can assist you in paying for some or all of the expenses you would otherwise have to pay for under Part A & B Original Medicare.

Many Medicare enrollees have some sort of supplemental coverage. In fact, in Texas, according to AHIP analysis, there were 918,619 Texas Medicare beneficiaries (36% of fee-for-service enrolled) with Medicare Supplement coverage in 2022.

Read more about the ten types of Medicare Supplement plans available in Texas, plus additional details about eligibility and enrollment in Medicare Supplement Plans in Texas.

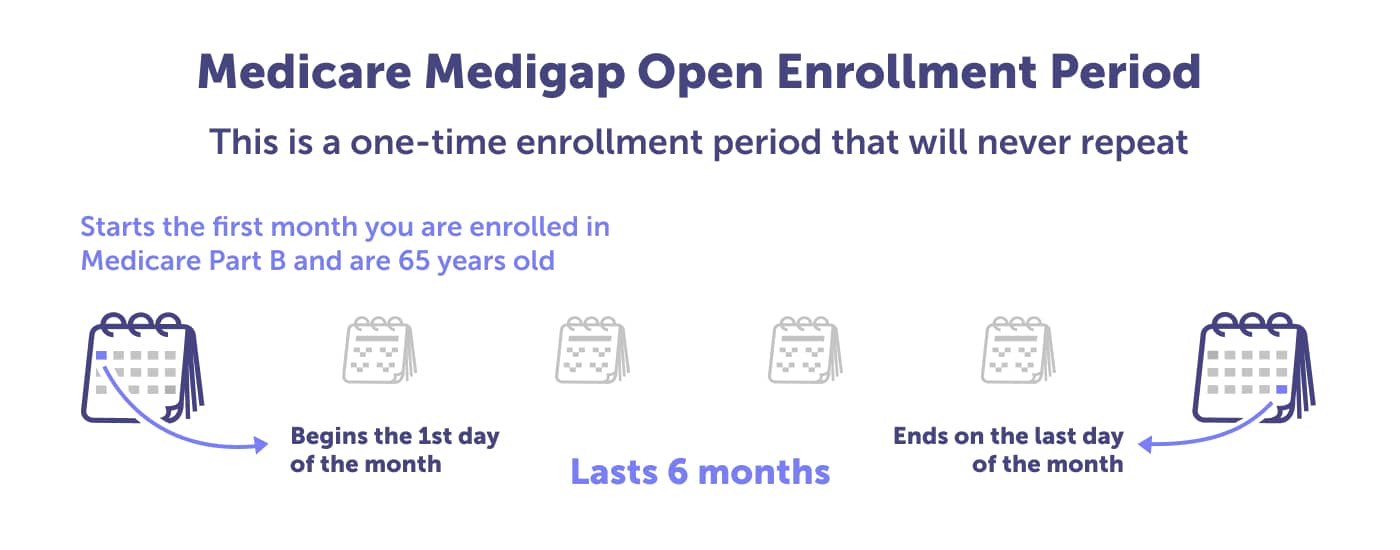

The best time to enroll in a Medicare Supplement plan in Texas is during your Medigap Open Enrollment Period. That occurs the first month you are enrolled in Medicare Part B, and you’re older than 65.

The Medigap Open Enrollment Period lasts six months, and the period only happens once. It cannot be changed or repeated. Should you miss this period, you might be able to purchase a Medigap policy, but it will likely cost more due to past or present health problems.

Your Medigap Open Enrollment Period is the best time to enroll because insurance carriers must sell you any plan that they offer regardless of your pre-existing medical conditions. After this period, most carriers apply the pre-existing clause to newly issued plans. And there’s no guarantee that an insurance company will sell a plan to you—unless you meet specific medical underwriting requirements or situations.

Want help enrolling in a Medicare Supplement plan in Texas? Speak with a local Medicare agent who can guide you through your Medigap options. Call (623) 223-8884 or find your Medigap plan online.

Application for Enrollment in Medicare – Part B (Medical Insurance).

Extra Help with Medicare Prescription Drug Plan Costs.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

Medicare Open Enrollment in Texas, 2022.

Medicare Open Enrollment in Texas, 2023.

The State of Medicare Supplement Coverage.

Last updated: February 10, 2023

Read more by Sid Martinez

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2011. When not working, you can find me exploring new places in the Lone Star State, or watching movies and TV shows.